Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help

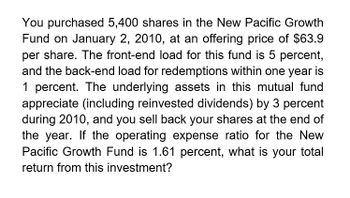

Transcribed Image Text:You purchased 5,400 shares in the New Pacific Growth

Fund on January 2, 2010, at an offering price of $63.9

per share. The front-end load for this fund is 5 percent,

and the back-end load for redemptions within one year is

1 percent. The underlying assets in this mutual fund

appreciate (including reinvested dividends) by 3 percent

during 2010, and you sell back your shares at the end of

the year. If the operating expense ratio for the New

Pacific Growth Fund is 1.61 percent, what is your total

return from this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You purchased 500 shares of The New Century Fund at NAV of $23.56 last year. The fund distributed $4.35 in dividends at the end of the year and the current NAV is $21.78. What is the adjusted closing price of your purchase? Please show how to solve in excelarrow_forwardOver a four-year period, Matt Ewing purchased shares in the ClearBridge Large-Cap Value Fund. Use the following information: Year Investment Amount Price per Share 2018 $ 3,100 $ 29 per share 2019 3,100 37 per share 2020 3,100 34 per share 2021 3,100 36 per share At the end of four years, what is the total amount invested? At the end of four years, what is the total number of mutual fund shares purchased? At the end of four years, what is the average cost for each mutual fund share?arrow_forwardPlease correct sir, thanksarrow_forward

- The Investments Fund sells Class A shares with a front-end load of 4.5% and Class B shares with 12b-1 fees of 1% annually as well as back-end load fees that start at 5% and fall by 1% for each full year the investor holds the portfolo (untill the fifth year). Assume that you have $1,000 to invest and the portfolio rate of return net of operating expenses is 15% annually. a-1. If you invest in each fund and sell after 4 years, how much will you receive from each sale? (Round your answers to 2 decimal places.) Amounts Class A Class B a-2. ass B shares better for you? Class A O Class B b-1. If you invest in each fund and sell after 15 years, how much will you receive from each sale? (Round your answers to 2 decimal places.) Amounts Class A Class B b-2. Are Class A or Class B shares the better choice for you? O Class A O Class Barrow_forwardCompute the total and annual returns on the following investment. Nine years after purchasing shares in a mutual fund for $7000 , the shares are sold for $11,400 .arrow_forwardThe Investments Fund sells Class A shares with a front-end load of 5% and Class B shares with 12b-1 fees of 1% annually as well as back-end load fees that start at 5% and fall by 1% (percentage point) for each full year the investor holds the portfolio (until the fifth year). Assume that you have $1,000 to invest and the portfolio rate of return net of operating expenses is 12% annually. a. If you invest in each fund and sell after 4 years, how much will you receive from each sale? b. If you invest in each fund and sell after 10 years, how much will you receive from each sale?arrow_forward

- The Investments Fund sells Class A shares with a front-end load of 6% and Class B shares with 12b-1 fees of 5% annually as well as back-end load fees that start at 5% and fall by 1% for each full year the investor holds the portfolio (until the fifth year). Assume the portfolio rate of return net of operating expenses is 10% annually. If you plan to sell the fund after four years, are Class A or Class B shares the better choice for you? What if you plan to sell after 15 years?arrow_forwardThe Investments Fund sells Class A shares with a front-end load of 5% and Class B shares with 12b-1 fees of 0.5% annually as well as back-end load fees that start at 5% and fall by 1% (percentage point) for each full year the investor holds the portfolio (until the fifth year). Assume that you have $1,000 to invest and the portfolio rate of return net of operating expenses is 13% annually.a. If you invest in each fund and sell after 4 years, are Class A or Class B shares the better choice for you? Class A Class B b. If you invest in each fund and sell after 12 years, are Class A or Class B shares the better choice for you? Class A Class Barrow_forwardYou are given the following information concerning a noncallable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent Term to maturity: 12 years Sinking fund: 3 percent of outstanding bonds retired annually; the balance at maturity If you buy the bond today at its face amount and interest rates rise to 12 percent after five years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. $ If you hold the bond 12 years, what do you receive at maturity? -Principal or All coupon payments? What is the bond's current yield as of right now? Round your answer to the nearest whole number. % Given your price in a, what is the yield at maturity? Round your answer to the nearest whole number. % What proportion of the total debt issue is retired by the…arrow_forward

- The Investments Fund sells Class A shares with a front-end load of 6% and Class B shares with 12b-1 fees of .5% annually as well as back-end load fees that start at 5% and fall by 1% for each full year the investor holds the portfolio (until the fifth year). Assume the portfolio rate of return net of operating expenses is 10% annually. If you plan to sell the fund after 4 years, are Class A or Class B shares the better choice for you? What if you plan to sell after 15 years?arrow_forwardThe Investments Fund sells Class A shares with a front-end load of 6% and Class C shares with 12b-1 fees of 0.75% annually as well as back-end load fees that start at 5% and fall by 1% for each full year the investor holds the portfolio (until the fifth year). Assume that you have $1,000 to invest and the portfolio rate of return net of operating expenses is 12% annually. Required: a-1. If you invest in each fund and sell after 4 years, how much will you receive from each sale? a-2. Are Class A or Class C shares the better choice for you? b-1. If you invest in each fund and sell after 14 years, how much will you receive from each sale? b-2. Are Class A or Class C shares the better choice for you? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2arrow_forwardJudah invests $7 million in a hedge fund with a 2/20 fee structure. The fund has a total of $93 million of assets under management and the return in the first year is 22%. Assume that management fees are paid at the beginning of each year and performance fees are paid at the end of each year in which they are applicable. What is the amount of the performance fee that Mr. Dowdy will pay in the first year? O $276,300 O $273,840 O $1,369,200 O $283,900 O $300,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning