Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help

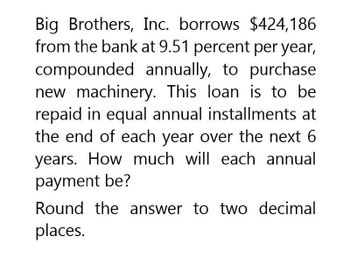

Transcribed Image Text:Big Brothers, Inc. borrows $424,186

from the bank at 9.51 percent per year,

compounded annually, to purchase

new machinery. This loan is to be

repaid in equal annual installments at

the end of each year over the next 6

years. How much will each annual

payment be?

Round the answer to two decimal

places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Big Brothers Inc. borrows $244,621 from the bank at 19.9 percent per year, compounded annually, to purchase new machinery. This loan is to be repaid in equal annual installments at the end of each year over the next 3 years. How much will each annual payment be? Round to two decimal places.arrow_forwardOlfert Inc. is repaying a loan of $52500.00 by making payments of $4700.00 at the end of every six months. If interest is 7.5% compounded semi-annually, the outstanding balance after the first, second, third payment will be respectively: O 49268.75, 47565.08 and 43995.14 O 49768.75, 45015.08 and 42105.48 49768.75, 46935.08 and 43995.14 O48425.12, 45238.21 and 42355.23 Mrs. Robinson madearrow_forwardWhat is the amount of each payment if Plascote Industries borrows $32,600, at an annual interest of 6.35 percent compounded monthly for 5 years and the first monthly payment is due today?arrow_forward

- JPY Inc borrowed $705,000 for 30 years at a rate of 4.68% APR compounded monthly, with first payment due one-month from today. What is the equal monthly payment on this loan? A) 3697.98 B) 3673.85 C) 3647.93 D) 3620.19arrow_forwardIdaho International Inc. borrows $86,600 from a bank at 3.08% compounded semi-annually for 7 years and 10 months. a) How much will the accumulated value of the loan be at the end of the term? $ b) How much interest will be charged on the loan? $arrow_forwardVan Buren Resources Inc. is considering borrowing $100,000 for 202 days from its bank. Van Buren will pay $3,000 of interest at maturity, and it will repay the $100,000 of principal at maturity. Assume that there are 365 days per year. Calculate the loan’s annual percentage rate. Round your answer to two decimal places. %arrow_forward

- A loan of $2766 borrowed today is to be repaid in three equal installments due in two years, three years, and six years, respectively. What is the size of the equal installments if money is worth 7.7% compounded annually? The payments are each $ ☐ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardAn amount of $15,000 is borrowed from the bank at an annual interest rate of 12%. Solve, a. Calculate the equal end-of-year payments required to completely pay off the loan in four years. b. Calculate the repayment amounts if the loan ($15,000) will be repaid in two equal installments of $7,500 each, paid at the end of second and fourth years respectively. Interest will be paid each year.arrow_forwardAn amount of $13,000 is borrowed from the bank at an annual interest rate of 14%. a. Calculate the equal end-of-year payments required to completely pay off the loan in 4 years. b. Calculate the repayment amounts if the loan ($13,000) will be repaid in two equal installments of $6,500 each, paid at the end of second and fourth years respectively. Interest will be paid each year.arrow_forward

- a. Set up an amortization schedule for a $19,000 loan to be repaid in equal installments atthe end of each of the next 3 years. The interest rate is 8% compounded annually.b. What percentage of the payment represents interest and what percentage representsprincipal for each of the 3 years? Why do these percentages change over time?arrow_forwardA company borrows $126,500 from a bank. The interest rate on the loan is 10 percent compounded semiannualy. The company agrees to repay the loan in equal semiannualy installments over the next 10 years. The first payment is to be made six months from now. (Use factor table in Appendix B for calculation) Required 1: What is the amount of each semiannual payment? $ Required 2: In the first payment, what is the amount of principal cancelled? $ Required 3: In the second payment, what is the amount of interest paid? $ Required 4: In the last payment, what is the amount of the last payment to cancel the loan? $ Required 5: Assume the debt contract has the option to make one extraordinary payment of up to 25% of the principal. If the company decides to exercise the right and make the extra payment together with the 18th payment, how much it must pay in dollars at the 18th payment to pay off the loan? $ Required 6: What is the amount reported in the annual audited balance sheet for…arrow_forwardYou have taken a loan of $92,000.00 for 35 years at a 4.9% annual interest rate, with interest compounded quarterly. Fill in the amortization table below to show how the payments will be applied to interest and principal: (Round all answers to 2 decimal places. Please note the order of the headings in the table - make sure you put the answers in the appropriate columns as layed out below.) Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ LA tA +A LA $ Balance $92,000.00 tA LAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT