FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer

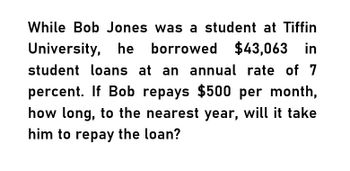

Transcribed Image Text:While Bob Jones was a student at Tiffin

University, he borrowed $43,063 in

student loans at an annual rate of 7

percent. If Bob repays $500 per month,

how long, to the nearest year, will it take

him to repay the loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- While Mary Corens was a student at the University of Tennessee, she borrowed $14,000 in student loans at an annual interest rate of 11%. If Mary repays $1,800 per year, then how long (to the nearest year) will it take her to repay the loan? Do not round intermediate calculations. Round your answer to the nearest whole number. year(s)arrow_forwardWhile Mary Corens was a student at the University of Tennessee, she borrowed $11,000 in student loans at an annual interest rate of 9%. If Mary repays $1,300 per year, then how long (to the nearest year) will it take her to repay the loan? Do not round intermediate calculations. Round your answer to the nearest whole number. How many year(s)?arrow_forwardYour cousin's student loan totaled $45,000 when he graduated. After making payments for the last 2.5 years (30 payments) in the amount of $595 per month, how much does your cousin still owe if the interest rate on student loans has been 6.29% per year?arrow_forward

- Jeffrey Wei received a 6 year non-subsidized student loan of $30,000 at an annual interest rate of 5.9%. what are Jeffrey's monthly loan payments for this loan after he graduates in four years? (Round your answers to the nearest cent)arrow_forwardTom borrowed $300,000 for his son Remy's law school tuition at the University of Missisippi. Tom received a rate of 3.75 for five years. Using 360 days in a year. what is the maturity value of the loan?arrow_forwardPlease help me answer the following time value of money question. Edison borrowed $10,000 from the Niederriter Loan Company. He has to pay off the loan in 36 monthly payments of $500. What interest rate is he being charged?arrow_forward

- Sandy Kupchack just graduated from State University with a bachelor's degree in history. During her four years at the university, Sandy accumulated $10,750 in student loans. She asks for your help in determining the amount of the quarterly loan payment. She tells you that the loan must be paid back in five years and that the annual interest rate is 8%. Payments begin in three months. (EV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: Determine Sandy's quarterly loan payment. (Round your final answers to nearest whole dollar amount.) Table or calculator function Present value: Quarterly paymentarrow_forwardDerrick recently graduated. He owes $17,525 in student loans with APR of 4.6% compounded monthly. He is expected to pay off his loan in 15 years. Round answer to two decimal points a. Under the current terms of his loan what is Derricks minimum payment? b. What is the total amount Derrick will pay when the loan is complete? c. How much will Derrick pay in interest? d. Derrick wants to pay more than the required monthly amount for his loan. Assuming the same conditions of the original student loan what would Derrick new monthly payment would be if he pay off loan in 10 years e. What is the total amount Derrick will pay if they pay off the loan in 10 years? f. With the 10 year loan how much will Derrick pay in interest?arrow_forwardSandy Kupchack just graduated from State University with a bachelor’s degree in history. During her four years at the university, Sandy accumulated $11,500 in student loans. She asks for your help in determining the amount of the quarterly loan payment. She tells you that the loan must be paid back in five years and that the annual interest rate is 8%. Payments begin in three months. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)arrow_forward

- Jeffery Wei received a 6-year non-subsidized student loan of $31,000 at an annual interest rate of 5.9%. What are Jeffery's monthly loan payments for this loan after he graduates in 4 years? (Round your answer to the nearest cent.)arrow_forwardVictor received an 8-year subsidized student loan of $23,000 at an annual interest rate of 4.25 %. If Victor qualifies for an income - adjusted repayment plan of $500 per month, how long (in months) will it take him to repay the loan? (Round your answer up to the nearest month.)arrow_forwardNikularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education