Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

tutor solve thiis prob

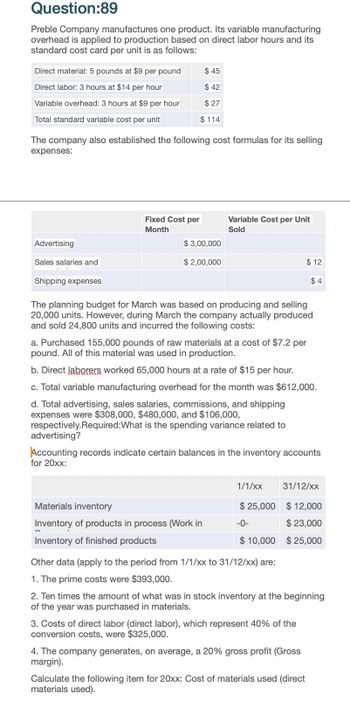

Transcribed Image Text:Question:89

Preble Company manufactures one product. Its variable manufacturing

overhead is applied to production based on direct labor hours and its

standard cost card per unit is as follows:

Direct material: 5 pounds at $9 per pound

$ 45

Direct labor: 3 hours at $14 per hour

$ 42

Variable overhead: 3 hours at $9 per hour

$ 27

Total standard variable cost per unit

$ 114

The company also established the following cost formulas for its selling

expenses:

Advertising

Sales salaries and

Shipping expenses

Fixed Cost per

Month

Variable Cost per Unit

Sold

$ 3,00,000

$ 2,00,000

$ 12

$4

The planning budget for March was based on producing and selling

20,000 units. However, during March the company actually produced

and sold 24,800 units and incurred the following costs:

a. Purchased 155,000 pounds of raw materials at a cost of $7.2 per

pound. All of this material was used in production.

b. Direct laborers worked 65,000 hours at a rate of $15 per hour.

c. Total variable manufacturing overhead for the month was $612,000.

d. Total advertising, sales salaries, commissions, and shipping

expenses were $308,000, $480,000, and $106,000,

respectively.Required:What is the spending variance related to

advertising?

Accounting records indicate certain balances in the inventory accounts

for 20xx:

1/1/xx

31/12/xx

Materials inventory

$ 25,000 $12,000

Inventory of products in process (Work in

-0-

$23,000

$10,000 $25,000

Inventory of finished products

Other data (apply to the period from 1/1/xx to 31/12/xx) are:

1. The prime costs were $393,000.

2. Ten times the amount of what was in stock inventory at the beginning

of the year was purchased in materials.

3. Costs of direct labor (direct labor), which represent 40% of the

conversion costs, were $325,000.

4. The company generates, on average, a 20% gross profit (Gross

margin).

Calculate the following item for 20xx: Cost of materials used (direct

materials used).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forwardRex Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: What is the activity rate for each cost pool?arrow_forward

- Rose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardBaxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Using the costs data from Rose Company, answer the following questions: A. If 15,000 units are produced, what is the variable cost per unit? B. If 28,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs? D. If 29,000 units are produced, what are the total variable costs? E. If 17,000 units are produced, what are the total manufacturing overhead costs incurred? F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? G. If 30,000 units are produced, what are the per unit manufacturing overhead costs incurred? H. If 15,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardGrainger Company produces only one product and sells that product for $100 per unit. Cost information for the product is: Selling expenses are $4 per unit and are all variable. Administrative expenses of $20,000 are all fixed. Grainger produced 5,000 units; sold 4,000; and had no beginning inventory. A. Compute net income under absorption costing variable costing B. Reconcile the difference between the income under absorption and variable costing.arrow_forward

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardPreble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 32.00 12.00 $84.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Variable Cost per Unit Sold Fixed Cost per Month Advertising Sales salaries and commissions Shipping expenses $4240,000 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production., b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was…arrow_forward券 Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 32.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Variable Cost per Unit Sold Fixed Cost Advertising Sales salaries and commissions per Month $ 270,000 Shipping expenses 0000 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was…arrow_forward

- Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: $40.00 Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 12.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Variable Cost, per Unit Sold Fixed Cost per Month $ 270,000 $ 240,000 Advertising $19.00 Shipping expenses The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $1700 per hour c. Total variable manufacturing overhead for the month was $390,600. d. Total…arrow_forwardneed answer of all questionarrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub