FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

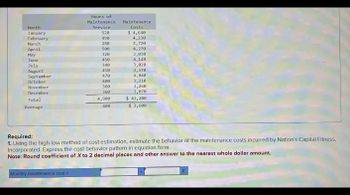

Transcribed Image Text:Month

January

February

Hours of

Maintenance

Service

Maintenance

Costs

4,230

520

$ 4,640

490

March

April

May

280

2,720

500

4,270

320

3,030

June

450

4,140

July

348

3,020

August

410

3,570

September

470

4,040

October

400

3,210

November

360

3,260

December

360

3,070

Total

Average

4,900

$ 43,200

408

$ 3,600

Required:

1. Using the high-low method of cost estimation, estimate the behavior of the maintenance costs incurred by Nation's Capital Fitness.

Incorporated. Express the cost behavior pattern in equation form.

Note: Round coefficient of X to 2 decimal places and other answer to the nearest whole dollar amount.

Monthly maintenance cost =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Question AR and Chave partenhp caplcot bcs 00 S00 and Stas 0, ly the income sharng A sR n ws. Add wi e parrh nd apeed that part pays S9500 A perh t The flnces t's and Cs Captal cc aer As wal wodd be OARSEND00C 0 OaR SS00, C 00arrow_forwardSubject:arrow_forward0271 20161 122oint and wong liw vitorioss of 10 2016 621 570111507780002 Question 50 vd mwob 250g abnod to oulay jud asiduob loota to oulsy od viqinda WOT ST6 201611291910 e vibrd, col vimonces adt milt once and T: E renso2 You are given the following information for two assets Uno and Dos: u yo qu909 DOGO TO SLolato sulsv onT reda ai Expected rate of return Variance of return srüster2 (1) 0.0595 0.0384 0.0153 ort ano 0.0153 29:01 ano Asset Uno W bas Wydb Dos rifesw 0.2315 VISM 1 odtwob stiW bus x to noitonuts as zonesse sondt orlt to ross tot visvitsogasn 26 At a market risk premium of 3.5% and a risk-free rate of 2%, determine which asset is considered riskier by analyzing their systematic and unsystematic risks. mvilu a visM szoqquz W bas W. W to noitonuts as vilitu botooqxo a'vM to noia201qxs si nwob in W v bas xto esuley sri bait sidizzoq zi sim ooit-lain odi is gaibasl bas gniwonod goimwezA viilitu botoqxo a'vieM eximixem lliw jedi MOTarrow_forward

- Armo n d ng genty le veed js en the of det prfeiorel r h Ovetatwetee sa.co0.rect pt later hu tm be00. and dretarolessona er cot was prected to be s000. Durng he yea, Amo ured ectuaoveteed com ofs212.000, ectuadrect proleona laer hun of TRS00, and actual dect laber cafanoon y en, overtead Che O ueveearrow_forwardASiithial 10) eymarta) o px s yous i odcoon, you wh o o axcumiiod $140008 s v O PAS Todots ) s o yob 1 b Wil 0oy Y3 scnconpoune o, o 15 Y W-flmmmmmflmnmhmmmmbmmmmn“ (Round 19 the nerest cont) .arrow_forwardideal farenitura couipment discorded onjene 15, 2013, that Rad a cost d lo, o00 $ and was jaukuadžed the dieporal f De equiprent"arrow_forward

- 0271 20161 122joint and wong liwymorioso 16 2016 621 570111507780002 Question 50 vd mwob 250g abnod to oulay jud asiduob loota to oulev od viqinda WOT ST6 201611291910 e vibrd, cob vrnonces adt tilt once and T: omienso2 You are given the following information for two assets Uno and Dos: s do qu90 EDUCO LO SHOolato suisv onT reda ai Expected rate of return Variance of return ng srü star2 0.0595 0.0384 0.0153 ort ano 0.0153 29:01 ano od Asset Uno W bas Wydb Dos riflesw 0.2315 VISM 1 wob stiW 26 bus x to noitonuts as zonense sonds ont to oss tot visvisogasn At a market risk premium of 3.5% and a risk-free rate of 2%, determine which asset is considered riskier by analyzing their systematic and unsystematic risks. viilu a visM szoqque W bas W. W to noitomut sasviliu botoogzo a'veM to noi201qxs sdi awob in W v bus xto esulav sri bail sidizeoq zi sim ooit-lain sdi is gribael bas gniwonod gniezA viilitu bolooqxo a' viEM eximixem liw jedi (1) MOTarrow_forwardOn July 1, 2021, Markwell Company acquired equipment. Markwell paid $167,500 in cash on July 1, 2021, and signed a $670,000 noninterest- bearing note for the remaining balance which is due on July 1, 2022. An interest rate of 5% reflects the time value of money for this type of loan agreement. (PV of $1, PVA of $1) (Use appropriate factor(s) from the tables provided.) For what amount will Markwell record the purchase of equipment? Multiple Choice $705,595 $797,977. $837.500. { Prev 15 of 15 Nextarrow_forwardCh. 17 - Financial Statement Anal x Bb 2193516 + i learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com/5f7ce11c673e5/2193516?X-Blackboard-Expiration=1648004400000&X-Blackboard-Signature=vwLhZZb3V30b7J84... 2 * O w WordCounter - Co... y! Yahoo A Regions Bank | Che.. Welcome, Justin – B. * eBooks, Textbooks... O Jefferson State Co... Electronics, Cars, Fa... C Home | Chegg.com 2193516 1 / 1 100% + | December 31, 2014 and 2013 Dec. 31, 2014 Dec. 31, 2013 Assets bloe Current assets: Cash. Marketable securities $ 500,000 $ 400,000 1,000,000 1,010,000 Accounts receivable (net)... 740,000 510,000 Inventories 1,190,000 950,000 000. Prepaid expenses. 250,000 229,000 Total current assets. $3,690,000 $3,089,000 Long-term investments... 2,350,000 2,300,000 1 Property, plant, and equipment (net) Total assets 3,740,000 3,366,000 $9,780,000 $8,755,000 Liabilities Current liabilities $ 900,000 $ 880,000 Long-term liabilities: $ 200,000 Mortgage note payable, 8%, due 2019. Bonds payable, 10%,…arrow_forward

- mni.0arrow_forwardcdn.ctudent.se.amuasunetdba i AC T101 FEX 2021 2 Male If equity is 250,000SR and liabilities are 180,000SR then assets equal: 27-34 e1Bce33 70,000 400,000 95%018 b. 95abe18 C. 100,000 95abe18ce 33 d. 430,000 95abe18ce33 95a 95abe18ce33 95abe18ce33 95abe18ce33 95abe18ce33 F1 MacBook Pro F3 000 F4 F5 4 F6 50 F7 6 & DII **** F8 7 V F9 8 9 LL %23arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education