Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

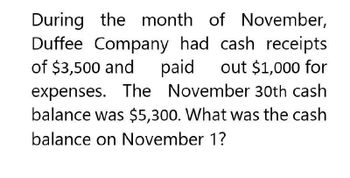

Transcribed Image Text:During the month of November,

Duffee Company had cash receipts

of $3,500 and paid out $1,000 for

expenses. The November 30th cash

balance was $5,300. What was the cash

balance on November 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Garden Gate, Inc. reported the following data in its August 31 annual report. Cash and cash equivalents $ 485,625 Cash flow from operations (630,000) Required: a. What is the company's "cash burn" per month? per month b. What is the company's ratio of cash to monthly cash expenses? Round your answer to one decimal place. monthsarrow_forwardGregg Corp. reported revenue of $1,450,000 in its cash basis income statement for the year ended Dec. 31, Year 7. Additional information was as follows: Accounts receivable, Jan 1, Year 7 $400,000 Accounts receivable, Dec 31, Year 7 $530,000 Under the accrual basis, Gregg would report revenue of O $1,580,000 O $1,035,000 $1,335,000 O $1,505,000arrow_forwardDuring the year, Tempo Inc. has monthly cash expenses of $144,468. On December 31, its cash balance is $1,829,210. The ratio of cash to monthly cash expenses (rounded to one decimal place) is Oa. 13.7 months Ob. 12.7 months Oc. 6.4 months Od. 7.9 monthsarrow_forward

- What is it's accounts receivable balance on these general accounting question?arrow_forwardBailey Co earns $27,792 of revenue on account and in $6,256 cash revenue transactions in Year 1. Cash collections of receivables amount to $7,152 in Year 1 with the remainder being collected in Year 2. Based on this information alone the company’s financial statements would show Total Revenue in Year 1 of $_arrow_forwardYork Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forward

- What is the company's cash cycle for this accounting question?arrow_forwardThe balance in Accounts Receivable at the beginning of the year was $520,000. The balance in Accounts Receivable at the end of the year was $780,000. Customer accounts of $420,000 were written off. The company collected $4,060,000 from credit customers and $1,010,000 from cash customers. What are credit sales for the year? A) $4,740,000 B) $4,480,000 C) $4,060,000 D) $4,220,000arrow_forwardWhat must have been the credit sales for April on these financial accounting question?arrow_forward

- Bucknell, Inc. uses the calendar year as its fiscal year. Determine the total net cash flow recorded at the end of the fiscal year. Month Receipts, $1000 Disbursements, $1000 Jan 300 500 Feb 950 500 Mar 200 400 Apr 120 400 May 600 500 June 900 600 July 800 300 Aug 900 300 Sept 900 200 Oct 500 400 Nov 400 400 Dec 1800 700arrow_forwardIn 2021, Lmao company reported cash basis income of P 7,800,000. Tracing back its records, accounts receivable and accounts payable on December 31, 2021 were P5,200,000 and P 1,950,000 respectively. During the year, the accounts receivable increased by 200% while accounts payable decreased by 50%. How much were net income using accrual method?arrow_forwardThe accounts receivable balance is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning