Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Q4. Prepare the

Please find informations details attached and please consider Additional information below.

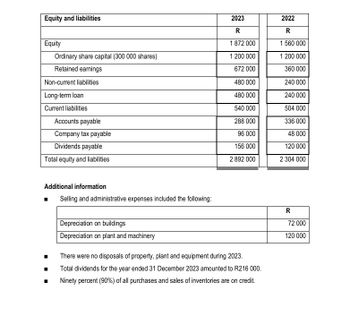

Transcribed Image Text:Equity and liabilities

2023

2022

R

R

Equity

1 872 000

1 560 000

Ordinary share capital (300 000 shares)

1 200 000

1 200 000

Retained earnings

672 000

360 000

Non-current liabilities

480 000

240 000

Long-term loan

Current liabilities

Accounts payable

Company tax payable

Dividends payable

Total equity and liabilities

480 000

240 000

540 000

504 000

288 000

336 000

96 000

48 000

156 000

120 000

2 892 000

2 304 000

Additional information

Selling and administrative expenses included the following:

Depreciation on buildings

Depreciation on plant and machinery

There were no disposals of property, plant and equipment during 2023.

Total dividends for the year ended 31 December 2023 amounted to R216 000.

Ninety percent (90%) of all purchases and sales of inventories are on credit.

R

72 000

120 000

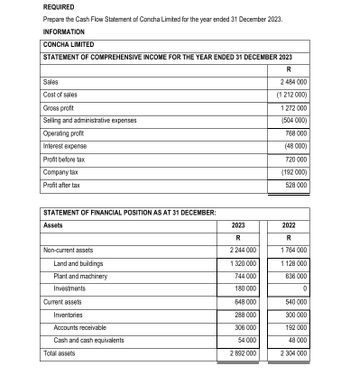

Transcribed Image Text:REQUIRED

Prepare the Cash Flow Statement of Concha Limited for the year ended 31 December 2023.

INFORMATION

CONCHA LIMITED

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2023

R

Sales

Cost of sales

Gross profit

Selling and administrative expenses

Operating profit

Interest expense

Profit before tax

Company tax

Profit after tax

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER:

2 484 000

(1 212 000)

1 272 000

(504 000)

768 000

(48 000)

720 000

(192 000)

528 000

Assets

2023

R

2022

R

Non-current assets

Land and buildings

Plant and machinery

Investments

2 244 000

1 764 000

1 320 000

1 128 000

744 000

636 000

180 000

0

Current assets

648 000

540 000

Inventories

288 000

300 000

Accounts receivable

306 000

192 000

Cash and cash equivalents

54 000

48 000

Total assets

2 892 000

2 304 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- QUESTION REQUIRED Use the information provided below to prepare the Cash Flow Statement of Jonah Ltd for the year ended 31 December 2022. (Some of the figures have already been entered in the answer book.) INFORMATION The Statement of Comprehensive Income of Jonah Ltd for the year ended 31 December 2022 and Statement of Financial Position as at 31 December 2021 and 2022 are as follows: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 Sales Cost of sales Gross profit Other operating income Gross income Distribution expenses Administrative expenses Earnings before interest and tax Interest income Interest expense Esmings before tax Company tax Earnings after interest and tax STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: ASSETS Non-current assets Land and buildings Plant and machinery Current assets Inventories Accounts receivable Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Retained earnings Non-current liabilities Long-term borrowings…arrow_forwardUse the information provided below to prepare the pro forma statement of comprehensive income for the year ended 31 December 2023. (Note the statement must reflect the gross profit,operating profit, profit before tax and profit after taxarrow_forwardHarlan Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements for 2025 are provided below. Cash COMPARATIVE BALANCE SHEETS Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Accounts payable Income taxes payable Bonds payable Common stock Retained earnings 12/31/25 $608000 (320000) $408000 360000 384000 288000 $1440000 $176000 352000 360000 216000 336000 $1440000 INCOME STATEMENT For the Year Ended December 31, 2025 12/31/24 $960000 (304000) $192000 216000 480000 656000 $1544000 $96000 392000 600000 216000 240000 $1544000arrow_forward

- Bonita Industries has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Bonita Industries for 2022 and 2021 are provided below. Cash Accounts receivable Inventory Property, plant and equipment Less accumulated depreciation Accounts payable Income taxes payable Bonds payable Common stock Retained earnings BALANCE SHEETS $608000 (320000 ) 12/31/22 $408000 360000 382000 288000 $1438000 $ 177000 353000 360000 230000 318000 $1438000 $958000 (306000) 12/31/21 $ 194000 216000 479000 652000 $1541000 $96000 391000 600000 216000 238000 $1541000arrow_forwardCash Flow Income Statement Revenue COGS Gross Profit Common Size BISON INC. Dividends Add to R/E Depreciation Expense Expenses EBIT Interest EBT Tax Net Income 2021 2021 Common Size 120,566 68,990 51,576 4,654 17,855 33,721 2,400 31,321 6,577.41 24,743.59 4,948.718 19,794.872 Balance Sheet Cash Accounts Receivable Inventory CURRENT ASSETS Fixed Assets: Gross Accum. Depreciation Net TOTAL ASSETS Liabilities Accounts Payable Salary Payable CURRENT LIABILITIES Long-Term Debt Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Equity INDUSTRY AVERAGES 35.01% 2.95% 15.26% 53.22% 75.01% -28.23% 46.78% 100.00% 5.26% 4.68% 9.94% 18.42% 28.36% 22.41% 49.23% 71.64% 100.00% Income Statement Revenue COGS Gross Profit Depreciation Expense Expenses EBIT Interest EBT Tax Net Income 100.00% 40.01% 59.99% 10.58% 11.45% 37.96% 5.87% 32.09% 6.04% 26.05%arrow_forwardPrepare the Pro-Forma Statement of Financial Position for the year ending 31 December 2023 INFORMATIONSibiya ProjectsStatement of Comprehensive Income for the year ended 31 December 2022 RSales 10 000 000Cost of sales (5 750 000)Gross profit 4 250 000Variable, selling and administrative costs (1 500 000)Fixed selling and administrative costs (500 000)Net profit 2 250 000 Statement of Financial Position for the year ended 31 December 2022ASSETS RNon-current assets 800 000Property, plant and equipment 800 000 Current assets 3 400 000Inventories 1 600 000Accounts receivable 600 000Cash 1 200 000TOTAL ASSETS 4 200 000 EQUITY AND LIABILITIESEquity 3 760 000 Current liabilities 440 000Accounts payable 440 000TOTAL ASSETS AND LIABILITIES 4 200 000 Additional informationA. The sales budget for 2023 is as follows:First Quarter Second Quarter Third Quarter Fourth QuarterR2 625 000 R2 750 000 R2 875 000 R2 750 000 B. 90% of sales is collected in the quarter of the sale and 10% in the quarter…arrow_forward

- The trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Gain on debt securities Loss on projected benefit obligation Cost of goods sold Selling expense Goodwill impairment loss Interest expense General and administrative expense Debits $ 160,000 6,100,000 600,000 500,000 30,000 500,000 Credits $ 8,200,000 60,000 120,000 140,000 The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been recorded. The effective tax rate is 25%. Required: Prepare a 2024 single, continuous statement of comprehensive income for Kroeger Incorporated. Use a multiple-step income statement format. Note: Round earnings per share answer to 3 decimal places.arrow_forwardThe following are the financial statement JNC Ltd. for the year ended 31 March 2020: JNC Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 JNC Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities: Loan 85 25…arrow_forwardComparitive balance sheet of Hillard Co. as of Dec 31, 2020 and 2021 is as under: Assets 2020 2021 Liabilities Cash Accounts Receivable Inventory Fixed Assets Investments Sales Cost of Goods Sold Gross profit 16,425 12,300 Salaries expenses Depreciation expense Income tax expense Admin. Expenses Net profit 16,100 163,000 13,500 221,325 28,025 10,600 Income statement for the year 2021 is as under: 18,400 206,300 9,200 272,525 829,400 614,450 214,950 12,900 11,600 1,150 164,400 24,900 Accounts Payable Salaries Payable Income tax payable Loans Payable Retained earnings Please prepare the cash flow statement using the indirect method. 2020 26,900 2,400 1,600 106,250 84,175 221,325 2021 33,450 3,100 2,050 113,250 120,675 272,525arrow_forward

- accarrow_forwardSales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forwardKORBIN COMPANY Comparative Income Statements For Years Ended December 31 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities KORBIN COMPANY Comparative Balance Sheets Common stock Other paid-in capital Retained earnings 2021 2020 2019 $ 483,981 $ 370,769 $257,300 291,357 234,326 164,672 192,624 136,443 92,628 68,725 51,166 33,964 43,558 32,628 21,356 112,283 83,794 55,320 80,341 37,308 14,943 7,574 $ 65,398 $ 41,856 $ 29,734 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses December 31 2021 Total expenses Income before taxes Income tax expense Net income $ 57,843 0 14.19 52,649 10,793 $ 20,253 $ 19 708 66,000 48,000 8,250 8,250 5,333 39,574 65,490 41,423 Total liabilities and equity $ 163,630 $ 135,926 $ 112,615 % $ 38,714 900 105,787 96,312 $ 163,630…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning