Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting mcq type Question

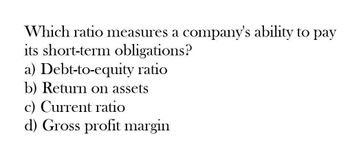

Transcribed Image Text:Which ratio measures a company's ability to pay

its short-term obligations?

a) Debt-to-equity ratio

b) Return on assets

c) Current ratio

d) Gross profit margin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following ratios is used to measure a firms profitability? a. Liabilities Ă· Equity c. Sales Ă· Assets b. Assets Ă· Equity d. Net Income Ă· Net Salesarrow_forwardCalculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?arrow_forwardProvide answerarrow_forward

- Which financial ratio measures a company's ability to pay its short-term obligations? a) Debt-to-equity ratio b) Current ratio c) Return on investment d) Gross profit marginarrow_forwardWhich of the following ratios best measures the profitability of a company? a) Return on equity b) Gross margin c) Current ratio d) Net operating asset turnoverarrow_forwardA ratio that measures a company’s profitability is thea. leverage ratio.b. gross margin percentage.c. current ratio.d. times-interest-earned ratio.arrow_forward

- Which of the following financial measures are used to determine a company's credit rating? a)A company's current ratio, quick ratio, inventory turnover ratio, and default risk ratio b) Its ratio of annual interest payments to net profits, current ratio, working capital ratio, debt-equity ratio, and percentage return on capital employed c) Its loans outstanding as a percentage of total revenues, default risk ratio, inventory turnover ratio, and long-term debt-to-equity ratio d) Its total debt-equity ratio, current ratio, working capital ratio, and ratio of prior-year cash flow from operations to prior-year interest payments e) The percentage by which prior-year cash flow from operations covers a company's prior-year interest payments, the company's debt-asset ratio, its dividend payout ratio, and its default risk ratioarrow_forwardWhich of the following ratios is used to analyze a company's liquidity? a. Inventory turnover ratio b. Earnings per share c. Return on assets ratio d. Asset turnover ratioarrow_forwardWhat financial metric measures a company's ability to cover its short-term obligations with its most liquid assets and is calculated by excluding inventory from the current assets? A. Quick ratio B. Current ratio C. Inventory turnover ratio D. Return on assets ratioarrow_forward

- Total debt-to-assets ratio, debt-to-equity ratio and Long-term debt-to-capital ratio are examples of what type or category of ratios? a. Activity O b. Profitability O c. Liquidity O d. Leveragearrow_forwardThe current ratio: a. Is used to help assess a company's ability to pay its debts in the near future. b. Measures the effect of operating income on profit. c. Is used to measure the relationship between assets and long-term debt. d. Is used to measure a company's collection period.arrow_forwardDefine each of the following terms: a. Liquid asset b. Liquidity ratios: current ratio; quick ratio c. Asset management ratios: inventory turnover ratio d. Debt management ratios: total debt to total capital; times-interest-earned (TIE) ratio e. Profitability ratios: profit margin; return on total assets (ROA); return on common equity (ROE); return on invested capital (ROIC); basic earning power (BEP) ratio f. Market value ratios: price/earnings (P/E) ratio; market/book (M/B) ratio; enterprise value/EBITDA ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,