Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

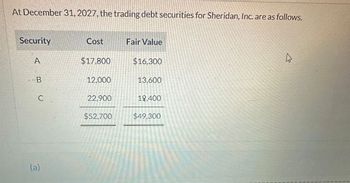

Transcribed Image Text:At December 31, 2027, the trading debt securities for Sheridan, Inc. are as follows.

Security

Cost

Fair Value

A

$17,800

$16,300

B

12,000

13,600

C

22,900

19,400

$52,700

$49,300

(a)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please send answer as the chartarrow_forwardBased on the numbers attatched, I need to show the balance sheet presentation at Deceber 31, 2022 after adjustment to fair value.arrow_forwardpresentation. EH.6 (LO 3), AP At December 31, 2022, the trading debt securities for Gwynn, Inc. are as follows. Fair Value Instructions Security A B C Total Cost $18,100 12,500 23,000 $53,600 $16,000 14,800 18,000 $48,800 a. Prepare the adjusting entry at December 31, 2022, to report the securities at fair value. b. Show the balance sheet and income statement presentation at December 31, 2022, after adjustment to fair value. Prepare adjusting entry to record fair value, and indicate statement presentation.arrow_forward

- EH.6 (LO 3), AP At December 31, 2022, the trading debt securities for Gwynn, Inc. are as follows. Security A B C Total Cost $18,100 12,500 23,000 $53,600 Fair Value $16,000 14,800 18,000 $48,800 Instructions a. Prepare the adjusting entry at December 31, 2022, to report the securities at fair value. b. Show the balance sheet and income statement presentation at December 31, 2022, after adjustment to fair value.arrow_forwardAt December 31, 2025, Cullumber Corporation has the following account balances: Bonds payable, due January 1, 2034 Discount on bonds payable Interest payable $1,400,000 76,000 71,000 Show how the above accounts should be presented on the December 31, 2025, balance sheet, including the proper classific CULLUMBER CORPORATION Balance Sheet (Partial) LAarrow_forwardAt December 31, 2021, the trading debt securities for Carla Vista, Inc. are as follows: Fair Value Debt Security Cost 12/31/21 X-tra $110000 $114000 Yeti 167000 164000 Zeta 50000 48000 Carla Vista should report the following amount related to the securities transactions in its 2021 income statement O $1000 realized loss. O $1000 unrealized loss. O $4000 gain. ○ $5000 unrealized loss.arrow_forward

- The following information is also available: 1. Current assets include cash P3,800, accounts receivables P18,500, note receivables (maturity date is on July 1, 2023) P10,000 and land P12,000. 2. Long term investments include a P4,600 investment in fair value though other comprehensive income securities that is expected to be sold in 2022 and a P9,000 investment in AllDay company bonds that are expected to be held until their December 31, 2029 maturity date. 3. Property and equipment include buildings costing P63,400, inventories costing P30,500 and equipment costing P29,600. 4. Intangible assets include patents that cost P8,200 and on which P2,300 amortization have accumulated, and treasury shares that costs P1,800. 5. Other assets include prepaid insurance (which expires on November 30, 2022) P2,900, sinking fund for bond retirement P7,000 and trademarks that cost P5,200 and on which P1,500 amortization has accumulated. 6. Current liabilities include accounts payable P19,400, bonds…arrow_forwardAt December 31, 2022, available-for-sale debt securities for Pharoah, Inc. are as follows. The securities are considered to be a long-term investment. Security (a) A B C Total Cost $16,985 12,930 21,760 $51,675 Fair Value $16.030 15,179 18,160 $49,369 Prepare the adjusting entry at December 31, 2022, to report the securities at fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Dec. 31 Debit Creditarrow_forwardMetlock Corporation has the following trading portfolio of debt investments as of December 31, 2020. Security Cost A $16,340 B 18,920 C (a) 29,240 $64,500 (b) Fair Value $12,900 On January 22, 2021, Metlock Corporation sold security C for $27,520. List of Accounts 23,220 Prepare the adjusting entry for Metlock Corporation on December 31, 2020, to report the portfolio at fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) Save for Later 24,940 $61,060 eTextbook and Media Date Account Titles and Explanation Dec. 31 METLOCK CORPORATION Balance Sheet (Partial) METLOCK CORPORATION Income Statement (Partial) Debit Indicate the balance sheet and income statement presentation of the fair value data for Metlock Corporation at December 31, 2020. $ Credit Attempts: unlimited Submit Answerarrow_forward

- Cost and fair value data for the trading debt securities of Ivanhoe Company at December 31, 2022, are $64,220 and $63,810, respectively. (a1) Show the financial statement presentation of the trading securities. Ivanhoe Company (Partial) Balance Sheet Aarrow_forwardBased on the information below, I have to prepare the adjusting entry at December 31, 2022 to report the securities at fair value. Thank you in advance!arrow_forwardEH.7 (LO 3), AP Writing At December 31, 2022, available-for-sale debt securities for Gwynn, Inc. are as follows. The securities are considered to be a long-term investment. Instructions Security A B C Total Cost $18,100 12,500 23,000 $53,600 Fair Value $16,000 14,800 18,000 $48,800 a. Prepare the adjusting entry at December 31, 2022, to report the securities at fair value. b. Show the statement presentation at December 31, 2022, after adjustment to fair value. c. Pam Jenks, a member of the board of directors, does not understand the reporting of the unrealized gains or losses on trading debt securities and available-for-sale debt securities. Write a letter to Ms. Jenks explaining the reporting and the purposes it serves.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning