Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Answer want

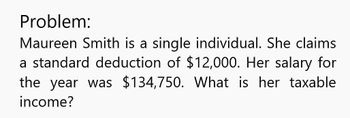

Transcribed Image Text:Problem:

Maureen Smith is a single individual. She claims

a standard deduction of $12,000. Her salary for

the year was $134,750. What is her taxable

income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sally McKrachen is a single young professional with a gross income of $51,000. Sally has no adjustments to gross income, but she does have itemized deductions totaling $4,275. If personal exemptions for the year are $3,700 each and the standard deduction is $5,800, what is Sally's taxable income? a. $ 37,225 b. $43,028 c. $47,300 d. $ 41,500arrow_forwardIf Marissa's yearly salary was $65,900 and she received taxable benefits in the amount of $1127.99 per year what amount would go into Box 26 on her T4?arrow_forward3. Fess receives wages totaling $75,700 and has net earnings from self-employment amounting to $61,300. In determining her taxable self-employment income for the OASDI tax, how much of her net self-employment earnings must Fess count?arrow_forward

- 2) Using the same information above, "David and Dana file a joint return. David earned $35,000 during the year before losing his job. Dana received Social Security benefits of $4,800" What is the taxable portion of the Social Security benefits if David earned $46,000? Begin by computing the provisional income.arrow_forwarduire anv were- Your Taxpayer, age 16, is claimed as a dependent by his mother. In 2019, he has dividend income of $1,300 and earns $500 from a part-time job. What is his taxable income for 2019? a. r00 b. Suppose he earned $1,100 (not $500) from the part-time job. What is his taxable income for 2019? 950 atoturfes)arrow_forwardMaureen Smith is a single individual. She claims a standard deduction of $12,400. Her salary for the year was $73,850. Assume the following tax table is applicable. Single Individuals If Your Taxable Income is Up to $9,875 $9,875-$40,125 $40,125-$85,525 $85,525-$163,300 $163,300-$207,350 You Pay This Amount on the Base of the Bracket O a $9,309.00 Ob $12,037.00 O c $4,617.50 Od $7.176.50 e $13.519.00 $0.00 987.50 4,617.50 14,605.50 33,271.50 47,367.50 156,235.00 $207 350-$518,400 Over $518,400 What is her federal tax liability? Plus This Percentage on the Excess over the Base 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20,4 22.8 30,1 37.0arrow_forward

- Coby has $61,000 of salary and $11,300 of itemized deductions. Chelsea has $87,000 of salary and $15,200 of itemized deductions. They are married and under age 65. Read the requirements2. Requirement a. Compute their taxable incomes if they file separately and Chelsea claims itemized deductions on her return. First, compute the taxable income for Coby. (1) (2) Taxable income Now compute the taxable income for Chelsea. (3) (4) Taxable income Requirement b. Compute their taxable income if they file jointly. Assume their total itemized deductions equals the sum of their separate itemized deductions. (5) (6) Taxable income 1: Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses $24,400 Heads of households $18,350 Unmarried individuals (other than surviving…arrow_forwardpare.0arrow_forwardSuni, age 21, is a full-time student at the University and is a dependent of her parents. She had earned income of $2,000 from a part-time job. In addition, she had $950 interest from a savings account. She had total itemized deductions of $200 in the current year. What is Suni's taxable income this year? Question 3 options: a. $550. b. $950. c. $2,000 d. $2,950.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you