Concept explainers

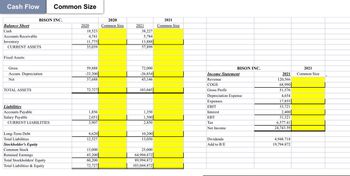

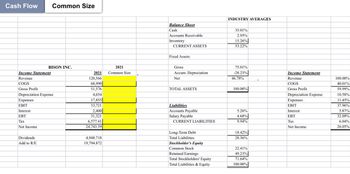

The Statement of Financial Position -

The statement of financial position is the position of the assets as on the balance sheet date.

We will get use following formula -

For Accounts Receivable (Current Year Amount X 100% / Total Assets)

The Statement of Comprehensive Income -

The statement of comprehensive income is the profit earned and loss incurred in the period end.

If we evaluate the financial analysis of the statement of comprehensive income then we have to use the following formula -

Total Sales will be considered as 100% and other Income Statement items will compare the other Sales items with them.

We will get use following formula -

For Cost of goods sold (Cost of goods sold X 100% / Sales)

Step by stepSolved in 2 steps

how were the percentages found

how were the percentages found

- Assets Cash Accounts Receivable Prepaids Inventory Property, Plant & Equipment Less: Accumulated Depreciation Total Assets Liabilities A wompany Balance Sheet December 31, Year 2 Accounts Payable Accrued Liabilities Notes Payable (Long-Term Debt) Total Liabilities Stockholders Equity Common Stock ($10 par) Paid in Capital In Excess of Part Retained Earnings Treasury Stock Total Stockholders Equity Total Liabilities and Stockholders Equity Year 2 Year 1 Change 40,000 $20,000 140,000 (10,000) $ 60,000 $ 130,000 35,000 43,000 (8,000) 183,000 120,000 63,000 340,000 310,000 30,000 (75,000) (50,000) (25,000) $673,000 $ 603,000 $70,000 $110,600 $ 111,000 $ (400) 34,000 32,000 2,000 50,000 50,000 100,000 $244,600 $ 193,000 $51,600 $ 75,000 $ 75,000 $ 220,000 220,000 143,400 10,000 115,000 28,400 10,000 $428,400 $ 410,000 $18,400 $673,000 $ 603,000 $70,000 28 What is the cash flow from operating activities using the indirect method of the statement of cash flows? O $71,400 O $53,000 O $63,000 O…arrow_forwardssarrow_forwardSunland Co. reports the following information: Net cash provided by operating activities Average current liabilities Average long-term liabilities Dividends paid Capital expenditures Purchase of treasury stock Payments of debt Sunland's free cash flow is $192000. $292000. $62000. O $16000. $422000 314000 214000 130000 230000 23000 72000arrow_forward

- solve yellow blanks thank you!arrow_forwardComparative statement of financial position of Alpha Sdn Bhd as at 31 December 2023 Cash at bank Accounts receivable fless: provision for doubtful Inventories Plant and equipment (NBV) Investment in government securities Total assets Ordinary shares 180 million 10% Preference shares. Retained earnings Accounts payable Tax payable Deferred taxation 10% Debentures Sales Less: Cost of sales Gross profit Operating expenses Operating profit Investment income Profit before tax Taxation Profit after tax Interim dividend paid Profit attributable to members Additional information: I. II. III. Required: b. 2023 BM million a. Prepare the cash flow statement for Alp Show the reconciliation of profit before # # # # 84.00 585.50 33.60 509.20 1.094.70 # Income statement for the year ended 31 December 2023 105.00 815.00 205.90 15.00 37.80 21.00 RM million 860.00 560.00 300.00 224.40 75.60 9.00 84.60 18.80 65.80 34.30 31.50 RM 279.70 258.70 1,094.70 802.20 50.40 219.00 134.40 (26 marks) (14 marks)…arrow_forwardSTATEMENT OF CASH FLOW EXAMPLE Kerby Company has prepared the following Balance Sheets for 2023 and 2022. Cash 12/31/23 $ 56 12/31/22 $ 40 Accounts receivable 41 42 Fixed assets 579 465 Accumulated depreciation (170) (140) $506 $407 Accounts payable Mortgage payable Preferred stock $ 74 $ 60 20 181 Additional Paid-In Capital - preferred 70 Common stock Retained earnings 100 61 ២៩៩៩88 100 100 $506 $407 1. On 8/1/23, Kerby sold a fixed asset with a cost of $91 and book value of $66 for $67. 2. Retained Earnings was adjusted by dividends and net income only. 3. Net Income in 2023 was $80. a. Net Cash Provided by Operations is $ b. Net Cash Used by Investments is $ c. Net Cash Provided by Financing is $arrow_forward

- Cash Accounts receivable (net) Other current assets Investments Property, plant, and equipment (net) Current liabilities Long-term debt Common stock, $10 par Retained earnings Blue Corporation Balance Sheets December 31 Net income 2025 $31,000 $21,000 51,000 95,000 60,000 500,000 $86,000 150,000 370,000 $737,000 $612,000 $81,000 325,000 176,000 $737,000 Blue Corporation Income Statements For the Years Ended December 31 Sales revenue Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses (including income taxes) 2024 46,000 100.000 2025 75,000 90,000 315,000 $745,000 41,000 704,000 430,000 2023 $19,000 49,000 126,000 114,000 $612,000 $545,000 69,000 2024 50,000 358,000 $545,000 $71,000 55,000 305,000 $605,000 31,000 574,000 355,000 219,000 151,000 274,000 181,000 $93,000 $68,000arrow_forwardStatement of financial position balances as at 31 December 20X8 and 20X9 are provided below for Laurel Inc. As at 31 December Assets Cash Short-term investments Accounts receivable Inventories Long-term investments Equipment Accumulated depreciation . Patent, net Total assets Liabilities and Shareholders' Equity Accounts payable Short-term bank debt Common shares Retained earnings Total liabilities and shareholders' equity $ Operating activities: 20X9 Laurel Inc. Statement of Cash Flows For the year ended 31 December 20X9 258,500 333,500 547,000 723,500 208,500 1,717,000 (467,000) 93,500 20X8 103,000 533,500 643,500 317,000 1,017,000 (458,500) 117,000 $ 3,414,500 $ 2,272,500 $ 823,500 $ 357,000 Laurel Inc. additional information: .Net earnings for 20x9 were $720,500. Equipment with an original cost of $417,000 and a NBV of $158,500 was sold for $158,500 during the year. Long-term investments were sold for $143,500 during the year. . • Short-term investments acquired are treasury bills…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Quiz Question Please tell me what statement or statments End-of-period Retained Earnings Balance is on: Options: Income Statement Balance Sheet Statement of Cash Flows Statement of Retained Earningsarrow_forwardperience p....pptm ^ Type here to search w X # 3 E Coronado Company's condensed financial statements provide the following information. C Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Current liabilities ACC341-2022-Ho....xlsx $ 4 Bonds payable R F % 5 O CORONADO COMPANY BALANCE SHEET T At O+ 6 V B ▶ music 2.jpeg n H & 7 Dec. 31, 2020 $52,100 197,700 80,800 442,700 3,000 $776,300 849,900 $1,626,200 237,700 401,800 U 20 8 J Dec. 31, 2019 $60,200 O 80,800 39,600 N M 360,200 $547,700 849,900 $1,397,600 6,900 155,700 ( 401,800 9 W K F11 ) O 0 888 P Home End C Rair Insearrow_forwardCurrent assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Current liabilities Accounts payable Salaries payable Income tax payable Total current liabilities (a1) a. $8,600 Current ratio 12,900 b. Quick ratio 145,000 5,200 $171,700 $53,300 3,600 1,000 $57,900 2024 $30,100 10,300 :1 105,000 $152,300 :1 6,900 $40,400 5,000 1,000 $46,400 $27,100 7,700 100,000 During 2024, credit sales and cost of goods sold were $138,040 and $82,500, respectively. The 2023 and 2022 credit sales were $151,200 and $151,840, respectively, and the cost of goods sold for the same periods were $79,950 and $82,325, respectively. The accounts receivable and inventory balances at the end of 2021 were $6,900 and $85,000, respectively. 5,600 $140,400 Using the above data, calculate the following ratios: (Round receivables turnover ratio and average collection period to 1 decimal place, e.g. 15.2, days to sell inventory to 0 decimal places, e.g. 152 and all other answers to 2 decimal…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education