Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Select the accurate answer to this accounting MCQ

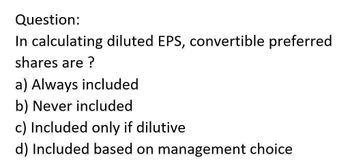

Transcribed Image Text:Question:

In calculating diluted EPS, convertible preferred

shares are ?

a) Always included

b) Never included

c) Included only if dilutive

d) Included based on management choice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following is an acceptable accounting approach for distributions under the equity method? cumulative investment approach net accumulated benefit approach nature of distribution approach net unrealized appreciation approacharrow_forwardIn the price equation, incentives are subtracted from the list price and are added to it to determine the final price. Multiple Choice equity adjustments. О allowances. extra fees. discounts. quotas.arrow_forwardBriefly discuss dividend relevance and dividend irrelevance. Theory M&M = argumentsarrow_forward

- 10, b=Briefly discuss clientele theory and signaling theory of dividend policyarrow_forward3) Which three of the following factors are most likely to lead to a stable dividend policy? A) Clientele preferencesB) Dividends as a residual; the availability of positive NPV projectsC) Mechanisms highlighted by agency theoryD) Signallingarrow_forward1. Explain the concept of control and its relationship to ownership percentage 2. which criteria do you prefer to use to classify equity investments ( quantitative, qualitative, or a combination of both)? Explain your answer (you may wish to highlight the advantages and disadvantages of each one)arrow_forward

- Which of the following is NOT a profitability ratio? Select one:a. Return on Equityb. Net Profit Marginc. Return on Assetsd. Average Collection Periodarrow_forwardwhat is the effect of purchase supples on accout on current ratio?arrow_forwardWhich of the following is the definition of return on common equity?A. Net income / Average common equityB. Operating income / Average common equityC. Comprehensive income / Average common equityD. None of the abovearrow_forward

- In cost accounting stocks are valued at cost or market value whichever less is. Select One : a) True b) Falsearrow_forwardAn underpriced stock provides an expected return which is _______________ the appropriate required return based on the relevant asset pricing model. Group of answer choices less than equal to greater than greater than or equal toarrow_forwardExplain the relationship between return on equity (ROE), return on asset (ROA), and leverage effect. Please define these terms before discussion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT