Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

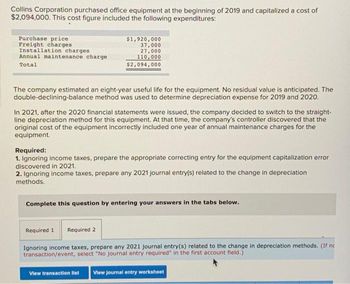

Transcribed Image Text:Collins Corporation purchased office equipment at the beginning of 2019 and capitalized a cost of

$2,094,000. This cost figure included the following expenditures:

Purchase price

Freight charges

Installation charges.

Annual maintenance charge

Total

$1,920,000

37,000

27,000

110,000

$2,094,000

The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The

double-declining-balance method was used to determine depreciation expense for 2019 and 2020.

In 2021, after the 2020 financial statements were issued, the company decided to switch to the straight-

line depreciation method for this equipment. At that time, the company's controller discovered that the

original cost of the equipment incorrectly included one year of annual maintenance charges for the

equipment.

Required:

1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error

discovered in 2021.

2. Ignoring income taxes, prepare any 2021 journal entry(s) related to the change in depreciation

methods.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Ignoring income taxes, prepare any 2021 journal entry(s) related to the change in depreciation methods. (If ne

transaction/event, select "No journal entry required" in the first account field.)

View transaction list View Journal entry worksheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.arrow_forwardHunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.arrow_forwardKam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.arrow_forward

- Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?arrow_forwardDepreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?arrow_forwardOn July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000arrow_forward

- Cost of Asset and Depreciation Method Heist Company purchased a machine on January 2, 2019, and uses the 150%-declining-balance depreciation method. The machine has an expected life of 10 years and an expected residual value of 5,000. The following costs relate to the acquisition and use of the machine during the first year of its operations: Required: 1. Compute the depreciation expense for 2019 and 2020. 2. Next Level What is the effect on the financial statements if the company used the straight-line method instead of the 150%-declining-balance method?arrow_forwardAt the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.arrow_forwardReferring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forward

- Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000arrow_forwardAlbany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forwardDuring 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College