FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Why is it wrong?

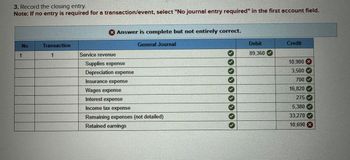

Transcribed Image Text:3. Record the closing entry.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

× Answer is complete but not entirely correct.

No

Transaction

1

1

Service revenue

Supplies expense

Depreciation expense

Insurance expense

General Journal

Wages expense

Interest expense

Income tax expense

Remaining expenses (not detailed)

Retained earnings

Debit

Credit

89,360

10,900 ×

3,500

700

16,820

275

5,380

33,270

10,690 x

![[The following information applies to the questions displayed below.]

Tunstall, Incorporated, a small service company, keeps its records without the help of an accountant. After much effort, an

outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on

December 31:

Cash

Accounts receivable

Supplies

Prepaid insurance

Service trucks

Accumulated depreciation

Other assets

Tunstall, Incorporated

Unadjusted Trial Balance

At December 31

Debit

Credit

47,900

10,900

600

700

17,600

7,800

9,260

2,210

Accounts payable

Wages payable

Income taxes payable

Notes payable (3 years; 10% interest due each September 30)

Common stock (5,700 shares outstanding)

11,000

2,046

Additional paid-in capital

18,414

Retained earnings

5,600

Service revenue

89,360

Wages expense

16,200

Remaining expenses (not detailed; excludes income tax)

33,270

Income tax expense

Totals

136,430

136,430

Data not yet recorded at December 31 included:

a. The supplies count on December 31 reflected $210 in remaining supplies on hand to be used in the next year.

b. Insurance expired during the current year, $700.

c. Depreciation expense for the current year, $3,500.

d. Wages earned by employees not yet paid on December 31, $620.

e. Three months of interest expense (for the note payable borrowed on October 1 of the current year) was incurred in

the current year.

f. Income tax expense, $5,380.](https://content.bartleby.com/qna-images/question/10b5500b-af9e-44d2-8ab3-e2516e4dde77/3e7f7e37-6c3d-473a-99de-d145b5eee724/tzeeiyo_thumbnail.jpeg)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Tunstall, Incorporated, a small service company, keeps its records without the help of an accountant. After much effort, an

outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on

December 31:

Cash

Accounts receivable

Supplies

Prepaid insurance

Service trucks

Accumulated depreciation

Other assets

Tunstall, Incorporated

Unadjusted Trial Balance

At December 31

Debit

Credit

47,900

10,900

600

700

17,600

7,800

9,260

2,210

Accounts payable

Wages payable

Income taxes payable

Notes payable (3 years; 10% interest due each September 30)

Common stock (5,700 shares outstanding)

11,000

2,046

Additional paid-in capital

18,414

Retained earnings

5,600

Service revenue

89,360

Wages expense

16,200

Remaining expenses (not detailed; excludes income tax)

33,270

Income tax expense

Totals

136,430

136,430

Data not yet recorded at December 31 included:

a. The supplies count on December 31 reflected $210 in remaining supplies on hand to be used in the next year.

b. Insurance expired during the current year, $700.

c. Depreciation expense for the current year, $3,500.

d. Wages earned by employees not yet paid on December 31, $620.

e. Three months of interest expense (for the note payable borrowed on October 1 of the current year) was incurred in

the current year.

f. Income tax expense, $5,380.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Please to do the Journal and the balance sheet and the allowance for uncollectablearrow_forwardarkman Sporting Goods is preparing its annual report for its fiscal year. The company's controller has asked for your help in determining how best to disclose information about the following items: Required: Indicate whether each item should be disclosed (A) in the summary of significant accounting policies note, (B) in a separate disclosure note, or (C) on the face of the balance sheet. 1. A related-party transaction.2. Depreciation method.3. Allowance for uncollectible accounts.4. Composition of investments.5. Composition of long-term debt.6. Inventory costing method.7. Number of shares of common stock authorized, issued, and outstanding.8. Employee benefit plans.arrow_forwardAdjusting and Correcting Entries Upon inspecting the books and records for Wernli Company for the year ended December 31, 2013, you find the following data: (a) A receivable of $640 from Hatch Realty is determined to be uncollectible. The company maintains an allowance for bad debts for such losses. (b) A creditor, E. F. Bowcutt Co., has just been awarded damages of $3,500 as a result of breach of contract by Wernli Company during the current year. Nothing appears on the books in connection with this matter. (c) A fire destroyed part of a branch office. Furniture and fixtures that cost $12,300 and had a book value of $8,200 at the time of the fire were completely destroyed. The insurance company has agreed to pay $7,000 under the provisions of the fire insurance policy. (d) Advances of $950 to salespersons have been previously recorded as sales salaries expense. (e) Machinery at the end of the year shows a balance of $19,960. It is discovered that additions to this account during the…arrow_forward

- Please give me answer general accounting questionarrow_forwardThe chief accountant for Dickinson Corporation provides you with the following list of accounts receivable written off in the current year. Date Customer Amount March 31 E. L. Masters Company $7,800 June 30 Stephen Crane Associates 6,700 September 30 Amy Lowell"s Dress Shop 7,000 December 31 R. Frost, Inc. 9,830 Dickinson follows the policy of debiting Bad Debt Expense as accounts are written off. The chief accountant maintains that this procedure is appropriate for financial statement purposes because the Internal Revenue Service will not accept other methods for recognizing bad debts. All of Dickinson’s sales are on a 30-day credit basis. Sales for the current year total $2,200,000. The balance in Accounts Receivable at year-end is $77,000 and an analysis of customer risk and charge-off experience indicates that 12% of receivables will be uncollectible (assume a zero balance in the allowance). Instructions a. Do you agree or disagree with…arrow_forwardBlackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Accounts should be $19,950. The account had an unadjusted credit balance of $11,000 at that time. Required: Prepare journal entries for each of the following. (If no entry is required for a transaction/event, select in the first account field.) a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $1,100 was determined to be uncollectible and was written off. View transaction list Journal entry worksheet 1 2 Record the end-of-period adjustment for bad debts under the aging of accounts receivable method. Note: Enter debits before credits. Transaction General Journal Debit Credit View general journal Record entry Clear entryarrow_forward

- CAN SOMEONE HELP ME FILL OUT THIS CHART ? (b) Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in (a).Assume the current balance in Allowance for Doubtful Accounts is a $8,500 debit. (c) Of the above accounts, $4,700 is determined to be specifically uncollectible.Prepare the journal entry to write off the uncollectible account. (d) The company collects $4,700 subsequently on a specific account that had previously been determined to be uncollectible in (c).Prepare the journal entries necessary to restore the account and record the cash collection.arrow_forwardSteering Corporation reported the following selected information in its general ledger at December 31: All sales were on account. Some accounts receivable were collected. One account was written off; there were no subsequent recoveries. At the end of the year, uncollectible accounts were estimated to total $1,980. Using your knowledge of receivables transactions, determine the missing amounts. (Hint: You may not be able to solve the below items in alphabetical order. In addition, you may find it helpful to reconstruct the journal entries.) Beg. bal. End, bal. (a) U (f) Accounts Receivable 17,800 Allowance for Doubtful Accounts Beg. bal. 900 Unadj. bal. End. bal. Sales Bad Debts Expense (b) (d) (e) 54,900 1,800 900 77,200arrow_forwardDuring the second year of operations, Rabbit Company found itself in financial difficulties. The entitydecided to use the accounts receivable as a means of obtaining cash to continue operation.On July 1, 2022, the entity sold P1,500,000 of accounts receivable for cash proceeds of P1,400,000. Noallowance for doubtful accounts was associated with these accounts.On December 15, 2022, the entity assigned the remainder of its accounts receivable, P5,000,000 as ofthat date, as collateral on a P2,500,000, 12% annual interest rate loan from Finance Company. The entityreceived P2,500,000 less a 2% finance charge.None of the assigned accounts have been collected by the end of the year. It is estimated that 10% ofaccounts receivable would be uncollectible.The entity revealed the following data on December 31, 2022. Accounts Receivable, excluding factored and assigned ACCOUNTS 1,000,000 Accounts receivable -assigned 5,000,000 Accounts receivable – factored 1,500,000 Allowance for doubtful…arrow_forward

- Required: (a) Prepare journal entries to record the impairment loss of receivable in 2021 under Statement of Financial Position approach. (b) Prepare partial Statement of Financial Positions to show the accounts receivables at 31 December 2021.arrow_forwardPlease provide answer this following requirements on these general accounting questionarrow_forwardOkay, I have everything else in the journal entry except for the last one. I'm attaching a picture of what I've got so you don't have to worry about explaining all of that. Here's the original (complete) problem: Weldon Corporation’s fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2018: Mar. 17 Accounts receivable of $1,700 were written off as uncollectible. The company uses the allowance method. 30 Loaned an officer of the company $20,000 and received a note requiring principal and interest at 7% to be paid on March 30, 2019. May 30 Discounted the $20,000 note at a local bank. The bank’s discount rate is 8%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $12,000. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education