FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please help solving this problem, thank you

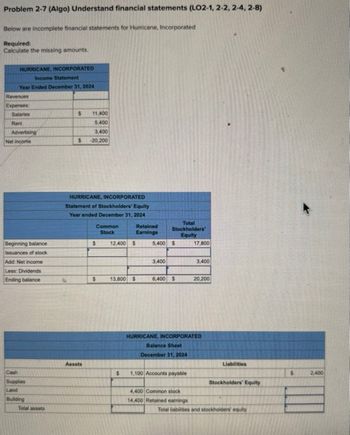

Transcribed Image Text:Problem 2-7 (Algo) Understand financial statements (LO2-1, 2-2, 2-4, 2-8)

Below are incomplete financial statements for Hurricane, Incorporated

Required:

Calculate the missing amounts.

HURRICANE, INCORPORATED

Income Statement

Year Ended December 31, 2024

Revenues

Expenses

Salaries

$

11,400

Rent

5,400

Advertising

3,400

Net income

$

-20.200

HURRICANE, INCORPORATED

Statement of Stockholders' Equity

Year ended December 31, 2024

Common

Retained

Total

Stockholders'

Stock

Earnings

Equity

Beginning balance

$

12,400 $

5,400 $

17,800

Issuances of stock

Add: Net income

Less: Dividends

Ending balance

Cash

Supplies

Land

Building

Total assets

3,400

3,400

$

13,800 $

6,400 $

20,200

HURRICANE, INCORPORATED

Balance Sheet

December 31, 2024

Assets

Liabilities

$

1,100 Accounts payable

$

2,400

Stockholders' Equity

4,400 Common stock

14,400 Retained earnings

Total liabilities and stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- attached in ss below thanks for hlp appareicated it apizaepigjwr hwhp 5whjipw5hw ihw 5arrow_forwardTypes of accounts answer choices: Asset Equity Expense Liability Revenue Normal balance answer choices: Credit Debt Increase (Dr. or Cr.) Credit Debtarrow_forwardworkjam (ulta) - Question 2 of 10 The following data are taken from the financial statements of JB Chris, Inc. The average number of shares of common stock outstanding for the year was 5,200. The following data are in are provided: Current ratio $20,800 23,400 54,600 148,200 26,000 Net sales connect Other current liabilities Total assets Salaries and wages payable Total stockholders' equity MYOCC 21 zoom :1 $382,200 14,300 3,900 174,720 quizlet google docs 312,000 Compute the following: (Round Earnings per share to 2 decimal places, e.g. 52.51 and all other answers to 1 decimal place, e.g. 525.1.) google slides 0.25/1 =arrow_forward

- Assume the following information (numbers in millions). Note: You can copy this table directly into Excel. Data Item EBIT ($) 2022 2023 13831 8891 -1082 Interest Expense ($) 113 Operating Assets ($) 34985 36920 Operating Liabilities 25,365 25703 ($) Net Fixed Assets ($) 41421 57002 Debt ($) 6942 10548 Tax Rate (%) 8.3% -50.1% What is free cash flow to equity in 2023? IMPORTANT! It will be very easy to goof up this problem given the negative interest expense and negative tax rate. Remember, if you subtract a negative this turns it into a positive. Hint: It will be so amazingly useful to remember the FCFE extra credit problem. To help, please note that the answer ranges between 1.300 and 2,100.arrow_forwardgageNOWv2 | Online teachir X * CengageNOWv2 | Online teachin x om/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogre.. eBook Show Me How Long-Term Solvency Analysis The following information was taken from Acme Company's balance sheet: Fixed assets (net) $1,092,000 Long-term liabilities 280,000 Total liabilities 196,000 Total stockholders' equity 980,000 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. If required, round your answers to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity Previous Next Check My Work 11:17 A 67°F Sunny A O E O G 40) 12/3/20 delete ome prt se 84l 144 4+ 6 backscace %Darrow_forwardA-E is either going to be: Account Accounts receivable Asset Classified balance sheet Creditors Equality Ledger Payable Threearrow_forward

- * CengageNOWv2 | Online teachin X * CengageNOWv2 | Online teachin X now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogre... еBook Show Me How Changes in Current Operating Assets and Liabilities-Indirect Method Victor Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $23,400 $22,600 Inventory 78,800 79,500 Accounts payable 20,700 20,400 Dividends payable 18,000 17,000 Adjust net income of $77,900 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. Check My Work 70°F Sunnyarrow_forwardAlpesharrow_forwardWhat are two kinds of paid-in capital accounts?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education