FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Eexamine the following

attached in ss beelow

thanks for help

l4py2

y25yp

2y

2

Transcribed Image Text:e the following selected financial information for The Deal Corporation and Simple Stores, Inc., as of the end of their fiscal years ending in 2021:

ck the icon to view the financial information.)

e requirements.

plef

pla

al

al

era

ere

wer

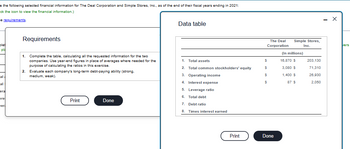

Requirements

1. Complete the table, calculating all the requested information for the two

companies. Use year-end figures in place of averages where needed for the

purpose of calculating the ratios in this exercise.

2. Evaluate each company's long-term debt-paying ability (strong.

medium, weak).

Print

Done

Data table

1. Total assets

2.

Total common stockholders' equity

3. Operating income

4. Interest expense

5.

Leverage ratio

6.

Total debt

7.

Debt ratio

8. Times interest earned

Print

The Deal

Corporation

$

S

$

S

Done

Simple Stores,

Inc.

(In millions)

16,870 $

3,080 $

1,400 $

87 $

203,130

71,310

26,930

2,050

- X

vers

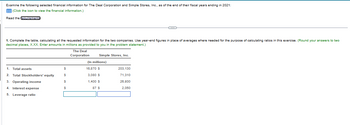

Transcribed Image Text:Examine the following selected financial information for The Deal Corporation and Simple Stores, Inc., as of the end of their fiscal years ending in 2021:

(Click the icon to view the financial information.)

Read the requirements

1. Complete the table, calculating all the requested information for the two companies. Use year-end figures in place of averages where needed for the purpose of calculating ratios in this exercise. (Round your answers to two

decimal places, X.XX. Enter amounts in millions as provided to you in the problem statement.)

1. Total assets

2. Total Stockholders' equity

3. Operating income

4. Interest expense

5. Leverage ratio

$

$

$

$

The Deal

Corporation

Simple Stores, Inc.

(In millions)

16,870 $

3,080 $

1,400 $

87 $

203,130

71,310

26,930

2,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fill in the missing amounts from the following T accounts.arrow_forwardgle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (229) - abigailof X MGmail x iConnect - Home x Question 5 Mid-Term x Connect Getting to K wiL47988 xapp ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 5 Part 4 of 4 Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,660 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Ask Land Office equipment Accounts payable Owner investments $ 12,040 Cash withdrawals by owner 13,720 Consulting revenue 2,990 Rent expense 45,940 Salaries expense 17,710 Telephone expense 8,230 Miscellaneous expenses. 83,660 $ 1,760 13,720 3,210 6,690 870 680 Mc Graw Hill 一口 Help Save & E Also assume the following: a.…arrow_forwardu Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forward

- Question 3arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help G ox (270) - abigailo x MACC101 Principles of A X (4726) IFRS vs. GAAP x M Question 15 - Chapter X WiConnect-Home 1545 x M Qu ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... pter 6 Homework i 15 Saved Help Part 3 of 4 10.34 points Required information Problem 6-2AA (Algo) Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Activities Beginning inventory Purchase Units Acquired at Cost 110 units $45 per unit 410 units @$50 per unit 140 units @$55 per unit 220 units @$57 per unit 430 units @$80 per unit Totals 880 units eBook Ask Print Date March 1 March 5 March 9 March 18 March 25 March 29 Sales Purchase Purchase Sales References 180 units @ $90 per unit…arrow_forwardHelp Save & Exit ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252... 3-RA1 - Princi x M Question 2 - CV 12.5 - Conne x + Fube Maps Translate News 2.5 i 2 Required information Saved t2 of 3 ts Knowledge Check 01 J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two partners decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts according to the sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000; accounts payable, $80,000; J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for $110,000 cash. On January 16, the partnership settled its liabilities. On January 31, the remaining cash was distributed to the partners. Prepare the January 15 journal entry for the partnership to…arrow_forward

- AutoSave a Ch13Homework_Question5 OFF Home Insert Draw Page Layout Formulas Data Review View Tell me A Share Comments A^ A KA Insert v Liberation Sans 12 22 Wrap Text v Custom Delete v В I U A $ v % 9 .00 Conditional Format Cell Find & Select Analyze Data Paste Merge & Center v Sort & Sensitivity 00 Formatting as Table Styles Format v Filter С32 fx K L 0 P A В C D E G H J M N R S U V W X Formula: Divide; Cell Referencing 1 2 3 Using Excel to Perform Vertical Analysis PROBLEM Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to this work area. 4 5 Data from the comparative balance sheets of Rollaird Company is 6 presented here. 7 December 31, December 31, Using these data from the comparative balance sheets of Rollaird Company, perform vertical analysis. 8. 9. 2022 2021 Accounts receivable (net) $ 460,000 $ 780,000 400,000 650,000 10 11 Inventory December 31, 2022 December 31, 2021 12 Total assets…arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help C Netflix MInbox (228 X MACC101 Pr X Accounting X Accounting X M Question 1 X M Question 1 xb Answered: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 9 Homework 13 30.12 points Saved Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 eBook Ask Print References February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight…arrow_forwardBookmarks Profiles Tab Window Help C (4726) IFRS v x Accounting10 x Accounting10 × M Question 3-1 WiConn le Chrome File Edit View History Inbox (228) X ACC101 Princ X C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 7 Homework Saved 3 Part 2 of 2 15.96 points eBook Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). March 1 March 2 March 3 (a) March 3 (b) March 6 March 9 March 10 March 12 Purchased $31,000 of merchandise from Van Industries, terms 2/15, n/30. Sold merchandise on credit to Min Cho, Invoice Number 854, for $12,400 (cost is $6,200). Purchased $930 of office supplies on credit from Gabel Company, terms n/30. Sold merchandise on credit to Linda Witt, Invoice Number 855, for $6,200 (cost is $3,100). Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. Purchased $15,500 of office equipment on…arrow_forward

- 同 Mail - Edjouline X Bb Content- ACG2 X CengageNOWv X (58) YouTube + Microsoft Office X PowerPoint from Towards a A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%=Dassignments&takeAssignmentSessionLocator=assignment-take&inpro. of mail YouTube Maps eBook Show Me How apter Nine Determine Due Date and Interest on Notes .09-03.BLANKSHEET Determine the due date and the amount of interest due at maturity on the following notes: L09-04.BLANKSHEET Date of Note Face Amount Interest Rate Term of Note 09-03.ALGO January 10* $40,000 90 days a. b. March 19 180 days 000 8. 09-04.ALGO June 5 30 days 000'06 d. September 8 90 days 90-60 3. 000'9E e. November 20 60 days 9-11 4. 000' *Assume that February has 28 days. 9-12 Assume 360-days in a year when computing the interest. -19 Note Due Date Interest > -20 (2) (b) 9-22 -24 (p) (a) 890- 8/12 items Check My Work ( Previous Next LE V O 10: Narrow_forwarde Chrome File Edit View History Gbjs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Siç x Window Help M Question 5- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 3 Homework Saved 。 Help Save LO 5 9.25 points eBook Hint Ask Print References Exercise 3-8 (Algo) Adjusting and paying accrued expenses LO P3 a. On April 1, the company hired an attorney for April for a flat fee of $2,000. Payment for April legal services was made by the company on May 12. b. As of April 30, $2,102 of interest expense has accrued on a note payable. The full interest payment of $6,307 on the note is due on May 20. c. Total weekly salaries expense for all employees is $11,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above…arrow_forwardano X M Gmail .wiley.com/was/ui/v2/assessment-player/index.html?launchld=96bacef2-13fb-44ea-b6d0-66f66b100cbd#/question/3 O search WP SCS0984 Midterm Hudovernik m Hudovernik $2 W YouTube 13 3 Maps W NWP Assessment Player Ul Appli X X View Policies E Question 4 of 11 Index of /software New Tab requires an understanding of the company's operations and the inter-relationship of accounts. is only required for accounts that do not have a normal balance. is optional when financial statements are prepared. is straight-forward because the accounts that need adjustment will be out of balance. 55 % f6 D T https://checkout.wileyplus.com/cx Immigration and Ci... 6 f7 Y Ps W & 7 hp f8 7 D U f9 * 8 + 00 f10 9 9 2 ☆ f11 .../5 > [P→ Attempts: 1 of 1 used O = : M f12 Activate W Go to Settings -1°C Mostly clear A 30arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education