Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:workjam (ulta)

-

Question 2 of 10 <

2/assessment-player/index.html?launchid=4131ffcd-b4b1-4c03-9899-2873266f84cf#/question/1

Cash

school b bartleby WP Wiley

Accounts payable

Accounts receivable

Your answer is partially correct.

Gross profit

Net income

1.

>

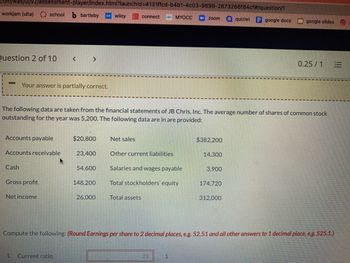

The following data are taken from the financial statements of JB Chris, Inc. The average number of shares of common stock

outstanding for the year was 5,200. The following data are in are provided:

Current ratio

$20,800

23,400

54,600

148,200

26,000

Net sales

connect

Other current liabilities

Total assets

Salaries and wages payable

Total stockholders' equity

MYOCC

21

zoom

:1

$382,200

14,300

3,900

174,720

quizlet google docs

312,000

Compute the following: (Round Earnings per share to 2 decimal places, e.g. 52.51 and all other answers to 1 decimal place, e.g. 525.1.)

google slides

0.25/1 =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 61 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,350,500 $2,822,200 Net income 748,800 578,100 Dividends: On preferred stock (9,800) (9,800) On common stock (40,000) (40,000) Retained earnings, December 31 $4,049,500 $3,350,500 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $4,270,500 $3,934,620 Cost of merchandise sold 1,608,920 1,480,210 Gross profit $2,661,580 $2,454,410 Selling expenses $844,790 $1,058,190 Administrative expenses 719,640 621,470 Total operating expenses $1,564,430 $1,679,660 Income from operations $1,097,150 $774,750 Other revenue and…arrow_forwardRatio the liabilities to stockholders equity and times interest earned. following data were taken from the financial statement of Hunter Inc.for December 31st of two recent years: Current year accounts payable $434,000. Current maturity. 290,000 Serial bonds payable, 10% 1,190,000 Common stock,$1 par value 70,000 Paid- in capital in excess of par 700,000 Retained earnings 2,420,000 Previous year $127,000 290,000 1,480,000 90,000 700,000 1,920,000 The income before income tax expense was $518,000 and $453,000 for the camera in previous years respectively. A. Determine the ratio of liabilities to stockholders Equity at the end of each year. Round to one decimal place. Current year Previous year B. Determine the times interest earned ratio for both years. Round to one decimal place. Current year Previous year C. The ratio of liabilities to stockholders Equity has _______and the number of times bond interest charges were earned has_______ from…arrow_forwardSelected financial data for DC Menswear is provided as follows: ($ in millions except share data) Sales $14,826 Net income $1,190 Stockholders’ equity, beginning $3,800 Stockholders’ equity, ending $4,200 Average shares outstanding (in millions) $620 Dividends per share $1.20 Stock price, ending $23.13 Required: Calculate the following ratios for DC Menswear. (Enter "Net income" and "Average stockholders' equity" answers in millions (i.e., 5,000,000 should be entered as 5). Round your answers to 2 decimal places.) DC Menswear Return on Equity ÷ = Return on equity Dividend Yield Dividend yield Price-Earnings Ratio Price-Earnings Ratioarrow_forward

- A company reports the following: Net income $163,510 $12,110 Preferred dividends Shares of common stock outstanding 20,000 Market price per share of common stock $169.95 Determine the company's price-earnings ratio. Round your answer to two decimal places.arrow_forwardThe following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $174,000 $157,000 $140,000 Notes payable (8% interest) 60,000 60,000 60,000 Common stock 24,000 24,000 24,000 Preferred 6% stock, $100 par 12,000 12,000 12,000 (no change during year) Retained earnings 70,170 47,100 36,000 The 20Y7 net income was $23,790, and the 20Y6 net income was $11,820. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders’ equity for the years 20Y6 and 20Y7. When required, round to one decimal place. 20Y7 20Y6 Return on total assets fill in the blank 1 % fill in the blank 2 % Return on stockholders’ equity fill in the blank 3 % fill…arrow_forwardAssume that the stockholders' equity section on the balance sheet of Mangum's, a popular department store, is shown below. During the year, the company reported net income of $241,125,000 and declared and paid dividends of $11,909,000. Stockholders' Equity: Common stock, Class A-116,610,308 and 116,535,495 shares issued; ? and ? shares outstanding Common stock, Class B (convertible)-4,170,929 shares issued and outstanding Additional paid-in capital Retained earnings Less treasury stock, at cost, Class A- 47,176,748 and 45,340,148 shares $ Current Year 1,166,000 42,000 769,055,000 2,607,727,000 (1,891,581,000) $ Last Year 1,165,000 42,000 796,987,000 ? (941,560,000) Required: 1. What is the par value of Magnum's Class A common stock? 2. How many shares of Class A Common Stock were outstanding at the end of last year and the end of the current year? 3. What amount was reported in the Retained Earnings account at the end of last year? 4. How is the dollar amount in the treasury stock…arrow_forward

- How many shares of common stock are outstanding at year-end(Refer to the Balance Sheet). (one sentence answer)arrow_forwardA company reported the following: Net income $423,790 Preferred dividends $31,390 Shares of common stock outstanding 36,000 Market price per share of common stock $184.43 Calculate the company's price-earnings ratio. Round your answer to two decimal places.fill in the blank 1arrow_forwardThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,112,575 $2,638,225 Net income 700,800 540,300 Dividends: On preferred stock (11,200) (11,200) On common stock (54,750) (54,750) Retained earnings, December 31 $3,747,425 $3,112,575 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,863,160 $3,559,340 Cost of merchandise sold 1,516,210 1,394,910 Gross profit $2,346,950 $2,164,430 Selling expenses $731,580 $918,970 Administrative expenses 623,190 539,710 Total operating expenses $1,354,770 $1,458,680 Income from operations $992,180 $705,750 Other revenue and expense:…arrow_forward

- Hahaharrow_forwardPrepare the journal entry to record Zende Company's issuance of 79,000 shares of $8 par value common stock assuming the shares sell for: a. $8 cash per share. b. $9 cash per share. View transaction list Journal entry worksheetarrow_forwarddont give answer in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education