Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please solve these general accounting question not use

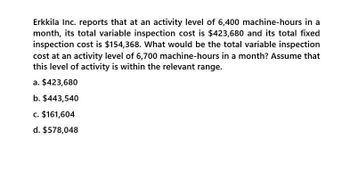

Transcribed Image Text:Erkkila Inc. reports that at an activity level of 6,400 machine-hours in a

month, its total variable inspection cost is $423,680 and its total fixed

inspection cost is $154,368. What would be the total variable inspection

cost at an activity level of 6,700 machine-hours in a month? Assume that

this level of activity is within the relevant range.

a. $423,680

b. $443,540

c. $161,604

d. $578,048

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Determine the fixed cost component using the High low method.arrow_forwardOnline At an activity level of 8,000 machine-hours in a month, a company's total variable maintenance cost is $390,000 and its total fixed maintenance cost is $368,000 What would be the average fixed maintenance cost per unit at an activity level of 9,000 machine-hours in a month? Assume that this level of activity is within the relevant rangearrow_forwardWhat are the estimated direct labor costs?arrow_forward

- Provide correct solution for this questionarrow_forwardPlease give me answerarrow_forwardAssume that the inspection activity has an expected cost of 120,000. Expected direct labor hours are 3,000, and expected number of inspections is 600. The best activity rate for inspection is as follows: a. 40 per inspection b. 40 per hour c. 200 per inspection d. 200 per hourarrow_forward

- The expected costs for the Maintenance Department of Stazler, Inc., for the coming year include: Fixed costs (salaries, tools): 64,900 per year Variable costs (supplies): 1.35 per maintenance hour Estimated usage by: Actual usage by: Required: 1. Calculate a single charging rate for the Maintenance Department. 2. Use this rate to assign the costs of the Maintenance Department to the user departments based on actual usage. Calculate the total amount charged for maintenance for the year. 3. What if the Assembly Department used 4,000 maintenance hours in the year? How much would have been charged out to the three departments?arrow_forwardI want to answer this questionarrow_forwardWhat are the estimated direct labour costs ?arrow_forward

- Markowis Corp. has collected the following data concerning its maintenance costs for the past 6 months.July August September October November DecemberUnits Produced18,000 32,000 36,000 22,000 40,000 38,000Total Cost$36,000 48,000 55,000 38,000 74,500 62,000Compute the variable- and fixed-cost elements using the high-low method.arrow_forwardThe manager of Trusty Car Inspection reviewed the monthly operating costs for the past year. The costs ranged from $4,300 for 1,300 inspections to $3,900 for 900 inspections. Requirements 1. Use the high-low method to calculate the variable cost per inspection. 2. Calculate the total fixed costs. 3. Write the equation and calculate the operating costs for 1,000 inspections. 4. Draw a graph illustrating the total cost under this plan. Label the axes, and show the costs at 900, 1,000, and 1,300 inspections.arrow_forwardVinubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning