Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

General accounting

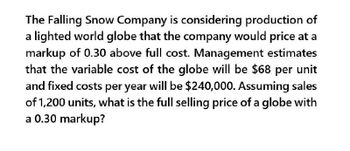

Transcribed Image Text:The Falling Snow Company is considering production of

a lighted world globe that the company would price at a

markup of 0.30 above full cost. Management estimates

that the variable cost of the globe will be $68 per unit

and fixed costs per year will be $240,000. Assuming sales

of 1,200 units, what is the full selling price of a globe with

a 0.30 markup?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Falling Snow Company is considering production of a lighted world globe that the company would price at a markup of 0.30 above full cost. Management estimates that the variable cost of the globe will be $62 per unit and fixed costs per year will be $240,000. Assuming sales of 1,200 units, what is the full selling price of a globe with a 0.30 markup? Round to two decimal places.arrow_forwardGrove Audio is considering the introduction of a new model of wireless speakers with the following price and cost characteristics. Sales price $ 438.00 per unit Variable costs 198.00 per unit Fixed costs 680,000 per year Assume that the projected number of units sold for the year is 4,150. Consider requirements (b), (c), and (d) independently of each other. Required: What will the operating profit be? What is the impact on operating profit if the sales price decreases by 20 percent? Increases by 10 percent? What is the impact on operating profit if variable costs per unit decrease by 10 percent? Increase by 20 percent? Suppose that fixed costs for the year are 20 percent lower than projected, and variable costs per unit are 10 percent higher than projected. What impact will these cost changes have on operating profit for the year? Will profit go up? Down? By how much? omplete this question by entering your answers in the tabs below. Required A Required B…arrow_forwardGrove Audio is considering the introduction of a new model of wireless speakers with the following price and cost characteristics. Sales price $ 450.00 per unit Variable costs 210.00 per unit Fixed costs 764,000 per year Assume that the projected number of units sold for the year is 4,750. Consider requirements (b), (c), and (d) independently of each other. What will the operating profit be? What is the impact on operating profit if the sales price decreases by 20 percent? Increases by 10 percent? What is the impact on operating profit if variable costs per unit decrease by 10 percent? Increase by 20 percent? Suppose that fixed costs for the year are 20 percent lower than projected, and variable costs per unit are 10 percent higher than projected. What impact will these cost changes have on operating profit for the year? Will profit go up? Down? By how much?arrow_forward

- Grove Audio is considering the introduction of a new model of wireless speakers with the following price and cost characteristics. Sales price $ 433.00 per unit Variable costs 193.00 per unit Fixed costs 645,000 per year Assume that the projected number of units sold for the year is 3,900. Consider requirements (b), (c), and (d) independently of each other. Questions: What will the operating profit be? What is the impact on operating profit if the sales price decreases by 20 percent? Increases by 10 percent? What is the impact on operating profit if variable costs per unit decrease by 10 percent? Increase by 20 percent? Suppose that fixed costs for the year are 20 percent lower than projected, and variable costs per unit are 10 percent higher than projected. What impact will these cost changes have on operating profit for the year? Will profit go up? Down? By how much?arrow_forwardGroove auto is considering the introduction of a new model of wireless speakers with the following price and cost characteristics.sales price 443.00 per unit.variable cost 203.00 per unit.fixed costs 715,000assume that the projected number of units sold for the year is 4 400.consider requirement b,c,d independent from each other. [a] What will the operating profit be? [b] What is the impact of operating profit if the sales price decreases by twenty percent increases by ten percent? [c] What is the impact on operating profit A veritable cost per unit decrease by ten percent increase by twenty? [d] Suppose that fixed costs for the year are 20% lower. Than projected and bearable costs per unit are 10% higher than projected. What impact will these costs changes have on operating profit for the year Kindly solve b c and darrow_forwardGrove Audio is considering the introduction of a new model of wireless speakers with the following price and cost characteristics. Sales price $ 570.00 per unit Variable costs 330.00 per unit Fixed costs 960,000 per year Required: What number must Grove Audio sell annually to break even? What number must Grove Audio sell to make an operating profit of $180,000 for the year?arrow_forward

- Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.10. The machine will increase fixed costs by $12,000 per year. The information they will use to consider these changes is shown here. A. What will the impact be on the break-even point if Flanders purchases the new machinery? Round per unit cost answers to two decimal places. Current New Machine Units Sold 221,000 Sales Price Per Unit $2.10 Variable Cost Per Unit $1.70 Contribution Margin Per Unit $0.40 %24 Fixed Costs $60,000 Break-Even (in units) 150,000 Break-Even (in dollars) $315,000 B. What will the impact be on net operating income if Flanders purchases the new machinery? Current New Machine Sales $464,100 Variable Costs 375,700 Contribution Margin $88,400 Fixed Costs 60,000 Net Income (Loss) $28,400 C. What would your recommendation be to Flanders regarding this purchase? a. The new equipment will increase fixed costs substantially but net income will still…arrow_forwardPosting in General Accountarrow_forwardRoadside Inc's new product would sell for $41.78. Variable cost of production would be $11.33 per unit. Setting up production would entail relevant fixed costs of $258,687. The project cannot go forward unless the new product would earn a return on sales of 15%. Calculate breakeven sales in UNITS, meeting the profit target. (Rounding: tenth of a unit.)arrow_forward

- Grove Audio is considering the Introduction of a new model of wireless speakers with the following price and cost characteristics. $430.00 per unit 190.00 per unit 624,000 per year Sales price Variable costs Fixed costs Required: a. What number must Grove Audio sell annually to break even? b. What number must Grove Audio sell to make an operating profit of $180,000 for the year? a. Break-even sales in units b. Number of units to be soldarrow_forwardFlanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here. The following names are to be used when completing this problem: Operating Income Variable Costs Sales Fixed Costs per Unit Selling Price per Unit Variable Cost per Unit Contribution Margin Fixed Costs Operating Loss If Flanders purchases the new machinery, what will be the company’s break-even point in units? . Use commas as needed (i.e. 1,234). If Flanders purchases the new machinery, what will be the company’s break-even point in dollars? . Rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). Assuming Flanders purchases the new machinery, construct a contribution margin income statement for sale of 216,000 units. Rounded to whole dollars and shown with "$" and commas as needed (i.e.…arrow_forwardCurrently, the unit selling price of a product is $210, the unit variable cost is $170, and the total fixed costs are $312,000. A proposal is being evaluated to increase the unit selling price to $230. a. Compute the current break-even sales (units). b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT