College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

General Accounting

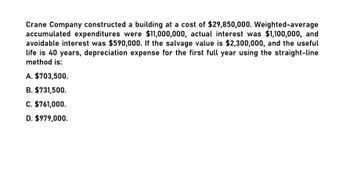

Transcribed Image Text:Crane Company constructed a building at a cost of $29,850,000. Weighted-average

accumulated expenditures were $11,000,000, actual interest was $1,100,000, and

avoidable interest was $590,000. If the salvage value is $2,300,000, and the useful

life is 40 years, depreciation expense for the first full year using the straight-line

method is:

A. $703,500.

B. $731,500.

C. $761,000.

D. $979,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Utica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.arrow_forwardMontello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forward

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardMendenhall Corp constructed a building at a cost of 14,000,000. Weighted average accumulated expenditures were 5,600,000 actual interest was 560,000 and avoidable interest was 280,000. If the salvage value is 1,120,000 and the useful life is 40 years, depreciation expense for the first full year using the straight line method is? Want Answerarrow_forwardMendenhall Corp constructed a building at a cost of 14,000,000. Weighted average accumulated expenditures were 5,600,000 actual interest was 560,000 and avoidable interest was 280,000. If the salvage value is 1,120,000 and the useful life is 40 years, depreciation expense for the first full year using the straight line method is?arrow_forward

- Need answerarrow_forwardPlease help with questionarrow_forwardKM Corp. constructed a warehouse at a cost of $32,500,000. Actual interest incurred was $1,250,000, and avoidable interest was $675,000(part of calculation). The salvage value is $2,800,000, and the useful life is 45 years. Using the straight-line method, what is the depreciation expense for the first full year?arrow_forward

- CPJ Enterprise constructed a building at a cost of $24,000,000. Average accumulated expenditures were $17,000,000, actual interest was $2,120,000, and avoidable interest was $1,600,000. The salvage value of the new building is $4,600,000, with an estimated useful life is 30 years. What is the building’s depreciation expense for the first full year using the straight-line method? $Answerarrow_forwardUsing the straight-line methodarrow_forwardConcord Corporation constructed a building at a cost of $13650000. Weighted-average accumulated expenditures were $5600000, actual interest was $562000, and avoidable interest was $272000. If the salvage value is $1150000, and the useful life is 40 years. What will be the depreciation expense for the first full year using the straight-line method (SLM)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning