Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Rockwell jewellers has announced net earnings solve this accounting question

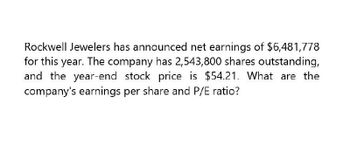

Transcribed Image Text:Rockwell Jewelers has announced net earnings of $6,481,778

for this year. The company has 2,543,800 shares outstanding,

and the year-end stock price is $54.21. What are the

company's earnings per share and P/E ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardGiven the following year-end information for Somerset Corporation, compute its basic earnings per share. Net income, 13,000 Preferred dividends declared, 4,000 Weighted average common shares for the year, 4,500arrow_forward

- Song Corp's stock price at the end of last year was $27.75 and its earnings per share for the year were $1.30. What was its P/E ratio?arrow_forwardSmith Inc. has announced net earnings of $877,500 for this year. The company has 325,660 shares outstanding, and the year-end stock price is $50.48. What are the company’s earnings per share and P/E ratio? a. EPS: $2.69; P/E: 18.77 times b. EPS: $0.37; P/E: 18.77 times c. EPS: $0.37; P/E: 10.55 times d. EPS: $2.69; P/E: 10.55 timesarrow_forwardRutland Corp's stock price at the end of last year was $30.25 and its earnings per share for the year were $2.45. What was its P/E ratio?arrow_forward

- Ames, Inc., has a current stock price of $58. For the past year, the company had a net income of $8,400,000, total equity of $25,300,000, sales of $52,800,000, and 4.6 million shares of stock outstanding. a. What are earnings per share (EPS)? b. What is the Price-earnings ratio? c. What is the Price sales ratio? d. What is Book value per share?arrow_forwardCrane Jewelers management announced that the company had net earnings of $4,356,000 for this year. The company has 1,613,000 shares outstanding, and the year-end stock price is $68.91. What are Crane’s earnings per share and P/E ratio? (Round answers to 2 decimal places, e.g. 12.25)arrow_forwardSong Corp's stock price at the end of last year was $28.75 and its earnings per share for the year were $1.30. What was its P/E ratio? a. 27.64 b. 22.12 c. 17.69 d. 23.00 e. 18.80arrow_forward

- Pharoah Jewelers management announced that the company had net earnings of $8,107,000 for this year. The company has 3,586,000 shares outstanding, and the year-end stock price is $43.53. What are Pharoah’s earnings per share and P/E ratio? (Round answers to 2 decimal places, e.g. 12.25) Earnings per share $ enter a dollar amount rounded to 2 decimal places P/E ratio enter P/E ratio in times rounded to 2 decimal places timesarrow_forwardRiggins Trucking, Inc. has a current stock price of $41. For the past year, the company had a net income of $5,150,000, total equity of $21,580,000, sales of $39,000,000, and 4.1 million shares of stock outstanding. What is the price-sales ratio? What do market ratios measure? Want detailed answerarrow_forwardGeneral Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning