SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

some expert tutor answer this query asap for both

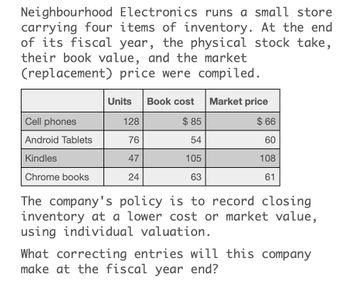

Transcribed Image Text:Neighbourhood Electronics runs a small store

carrying four items of inventory. At the end

of its fiscal year, the physical stock take,

their book value, and the market

(replacement) price were compiled.

Units

Book cost

Market price

Cell phones

128

$ 85

$ 66

Android Tablets

76

54

60

Kindles

47

105

108

Chrome books

24

63

61

The company's policy is to record closing

inventory at a lower cost or market value,

using individual valuation.

What correcting entries will this company

make at the fiscal year end?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lower of Cost or Market Garcia Company uses FIFO, and its inventory at the end of the year was recorded in the accounting records at $17,800. Due to technological changes in the market, Garcia would be able to replace its inventory for $16,500. Required: 1. Using the lower of cost or market method, what amount should Garcia report for inventory on its balance sheet at the end of the year? 2. Prepare the journal entry required to value the inventory at the lower of cost or market.arrow_forwardWestcoast Purveyors had 343 computer system in stock at the end of the year. Inventory records show the following information: *Chart Attached* A): Using the LIFO method of inventory pricing, calculate the dollar value of the ending inventory. $ B): Use the lower-of-cost-or-market rule to determine the value (in $) of the following inventory for Save-Mor Merchandisers. *Chart attached*arrow_forwardLower of Cost or Market Garcia Company's inventory at the end of the year was recorded in its accounting records at $17,800. Due to technological changes in the market, Garcia would be able to replace its inventory for $16,500. Required: 1. Using the lower of cost or market method, what amount should Garcia report for inventory on its balance sheet at the end of the year?$ Hide 2. Prepare the journal entry required to value the inventory at the lower of cost or market. Dec. 31 (Reduced inventory to market value)arrow_forward

- Tamworth Trading Ltd is a company operating in the retail sector. The beginning inventory of ProductEF5089 and information about purchases and sales made during June are shown in the picture.Tamworth Trading Ltd uses the perpetual inventory system, and all purchases and sales are on credit. Selling price is $5 per unit. A stocktake on 30 June revealed 7,700 units in inventory. Ignore GST. Please answer:a) Using the FIFO method, prepare an appropriate inventory record for Product EF5089 for June. b) Prepare an income statement down to the gross profit for Tamworth Trading Ltd for June.arrow_forwardTamworth Trading Ltd is a company operating in the retail sector. The beginning inventory of Product EF5089 and information about purchases and sales made during June are shown in the image. Tamworth Trading Ltd uses the perpetual inventory system, and all purchases and sales on credit,Selling price is $5 per unit. A stocktake on 30 June revealed 7,700 units in inventory. Ignore GST.Required:a) Using the FIFO method, prepare an appropriate inventory record for Product EF5089 for June. b) Prepare an income statement down to the gross profit for Tamworth Trading Ltd for June.arrow_forwardPurrfect Pets uses the perpetual inventory system. At the beginning of the quarter, Purrfect Pets has $35,000 in inventory. During the quarter, the company purchased, $8,650 of new inventory from a vendor, returned $1,200 of inventory to the vendor, and took advantage of discounts from the vendor of $250. At the end of the quarter, the balance in inventory is $29,000 What is the cost of goods sold? A. $6,000 B. $14,650 C. $14,650 D. $13,200 E. $15,150arrow_forward

- earrow_forwardThe Sherri’s Retail Shop uses the FIFO retail inventory method to determine its ending inventory. The accounting records for the current year for Sherri’s contained the following information: Cost Retail Purchases $225,000 $362,250 Beginning inventory 55,000 73,000 Sales 385,750 Net markups 32,500 Net markdowns 19,750 Employee discounts 12,500 What is the cost-to-retail percentage to be used for ending inventory calculations? a. 59.9% b. 60.0% c. 62.1% d. 62.5%arrow_forwardH.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows: Item Quantity on Hand Unit Cost When Acquired (FIFO) Net Realizable Value (Market) at Year-End A 70 $ 21 $ 24 B 100 49 39 30 61 57 D 90 39 34 E 370 14 19 Required: {Subject:- General Account}{4} Compute the valuation that should be used for the current year-ending inventory using lower cost or net realizable value applied on an item- by-item basis.arrow_forward

- [The following information applies to the questions displayed below.] Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available information follows: The inventory at January 1, 2022, had a retail value of $45,000 and a cost of $27,500 based on the conventional retail method. Transactions during 2022 were as follows: CostRetailGross purchases$ 282,000S 490,000 Purchase returns 6,50010,000 Purchase discounts 5,000 Sales 492,000Sales returns 5,000 Employee discounts 3,000 Freight - in26, 500 Net markups 25,000Net markdowns 10,000 Sales to employees are recorded net of discounts. The retail value of the December 31, 2023, inventory was $56, 100, the cost-to-retail percentage for 2023 under the LIFO retail method was 62 %, and the appropriate price index was 102% of the January 1, 2023, price level. The retail value of the December 31, 2024, inventory was $48, 300, the cost-to-retail percentage for 2024 under the LIFO retail method was 61…arrow_forwardVargas Company uses the perpetual inventory system and the FIFO cost flow method. During the current year, Vargas purchased 400 units of inventory that cost $15.00 each. At a later date during the year, the company purchased an additional 800 units of inventory that cost $18.00 each. Vargas sold 500 units of inventory for $27.00. What is the amount of cost of goods sold that will appear on the current year's income statement? Multiple Choice ο ο ο ο $4,500 $6,000 $7,800 $5,700arrow_forwardJonas Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sales follow: ENDING INVENTORY, CURRENT YEAR Ite Quantity on Unit Cost When m Hand Acquired (FIFO) Net Realizable Value (Market) at Year-End A 60 $25 $ 22 B 90 40 60 0 20 58 62 D 80 35 40 E 360 20 15 Compute the valuation that should be used for the current year ending inventory using the LCM rule applied on an item-by-item basis. Item Quantity Total Cost Total Market LCM Valuation A 60 60 B 90 0 20 D 80 E 360 Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning