FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

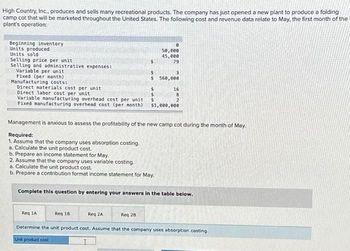

Transcribed Image Text:High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding

camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the

plant's operation:

Beginning inventory

Units produced

Units sold

Selling price per unit

Selling and administrative expenses:

Variable per unit

Fixed (per month)

Manufacturing costs:

Direct materials cost per unit

Direct labor cost per unit

Variable manufacturing overhead cost per unit

Fixed manufacturing overhead cost (per month) $1,000,000

5

2. Assume that the company uses variable costing.

a. Calculate the unit product cost.

b. Prepare a contribution format income statement for May

Req 18

8

50,000

45,000

79

$ 560,000

$

Reg 2A

Management is anxious to assess the profitability of the new camp cot during the month of May.

Required:

1. Assume that the company uses absorption costing.

a. Calculate the unit product cost.

b. Prepare an income statement for May.

Reg 28

16

Complete this question by entering your answers in the table below.

2

Req 1A

Determine the unit product cost. Assume that the company uses absorption costing.

Unit product cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JK Company, located in Indonesia, specializes in producing sets of wooden patio furniture consisting of a table and four chairs. The company is currently operating at 80% of its full capacity of 5,000 sets per quarter. Quarterly cost data at this level of operations follow: Factory labour, direct Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building General office supplies (billing) General office salaries Direct materials used (wood, bolts, etc.) Utilities, factory $360,000 90,000 100,000 15,500 180,000 6,500 26,000 18,000 28,000 23,000 9,000 85,000 224,000 55,000 Required: 1. Enter each cost item on your answer sheet, placing the dollar amount of each cost item under the appropriate headings. As examples, this has been done already for the first two items in the preceding list. Note that each cost item is classified in…arrow_forwardFeed 'N Grow Co. manufactures fertilizer for farmers in the prairies. It specialises in fertilizer that helps crops grow during dry seasons. The income statement presented below shows the operating results for the fiscal year just ended. Feed 'N Grow had sales of 1,800 tonnes of product during that year. The maximum output under the existing manufacturing facilities at Feed 'N Grow is 4,800 tonnes. Feed 'N Grow Co. Revenues Variable Costs: Income Statement For the year ended June 30, Year 6 Direct materials Direct labour Sales commissions Maintenance expenses Administration expenses Total variable costs Fixed costs: Amortization - Factory equipment Marketing expenses Administrators' salaries Other Total fixed costs Operating income before income taxes Income taxes Net Income 225,000 75,000 55,000 44,000 33,000 125,000 90,000 60,000 25,350 $1,080,000 432,000 300,350 347,650 69,530 $ 278,120 Required: a) If the sales volume is estimated to increase by 600 tonnes for next year, and if the…arrow_forwardHigh Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant’s operation: Beginning inventory 0 Units produced 49,000 Units sold 44,000 Selling price per unit $ 84 Selling and administrative expenses: Variable per unit $ 4 Fixed (per month) $ 561,000 Manufacturing costs: Direct materials cost per unit $ 15 Direct labor cost per unit $ 6 Variable manufacturing overhead cost per unit $ 3 Fixed manufacturing overhead cost (per month) $ 735,000 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Calculate the…arrow_forward

- Office Products Inc. manufactures and sells various high-tech office automation products. Two divisions of Office products Inc. are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a "super chip," that can be used by both the Computer Division and other external customers. The following information is available on this month's operations in the Computer Chip Division: Selling price per chip Variable cost per chip Fixed production cost Fixed SG & A costs Monthly capacity External sales Internal sales $50 $20 $60,000 $90,000 $50 $45 $20 10,000 chips 6,000 chips 0 chips Presently the Computer Division purchases no chips from the Computer Chip Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month. Assume that next month's costs and levels of operation in the Computer and the Computer Chip Divisions are similar to this month. What is the minimum of the transfer price range for a possible…arrow_forwardThe cost of energy consumed in producing good units in the Bottling Department of Mountain Springs Water Company was $1,100 and $1,107 for June and July, respectively. The number of equivalent units produced in June and July was 11,000 and 12,300 liters, respectively. Evaluate the change in the cost of energy between the two months. Round your answers to the nearest cent. Energy cost per liter, June Energy cost per liter, July The cost of energy has LA by $arrow_forwardFamily Fun Time, Inc. makes board games. The following data pertains to the last six months: Manufacturing Overhead Direct Labor Hours 45,000 63,000 57,000 Month 1 Month 2 Month 3 Month 4 Month 5 $247,250 $178,200 $165,500 Month 6 Based on this data, what is the linear cost equation? (Round intermediary calculations to the nearest cent. Use the "high" data month to calculate your final answer. Do not use the "low" month, as it will result in an approximation of the cost.) 52,000 34,000 24,000 O A. y = $0.26X + $152,500 O B. y = $5.40X + $33,100 O C. y = $3.91X + $71,670 O D. Cannot be determined from information given. $295,000 $318,000 $323,000arrow_forward

- High Country, Incorporated, produces and sells many recreational products. The company just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) Required: 1. Assume the company uses absorption costing. a. Calculate the camp cot's unit product cost. b. Prepare an income statement for May. 2. Assume the company uses variable costing. a. Calculate the camp cot's unit product cost. b. Prepare a contribution format income statement for May. 0 46,000 41,000 $83 $4 $ 565,000 $ 16 $ 8 $1 $ 782,000 Complete this question by entering your answers in…arrow_forwardHigh Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory 0 Units produced 43, 000 Units sold 38,000 Selling price per unit $ 80 Selling and administrative expenses: Variable per unit $ 3 Fixed (per month) $ 564,000 Manufacturing costs: Direct materials cost per unit $ 15 Direct labor cost per unit $ 7 Variable manufacturing overhead cost per unit $ 3 Fixed manufacturing overhead cost (per month) $ 817,000 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Calculate the unit product cost. b. Prepare a…arrow_forwardRowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,250, 200 958, 800 $ 291,400 220,900 $ 70,500 Per Unit $ 26,60 20.40 $6.20 4.70 $ 1.50 Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production…arrow_forward

- need help pleasearrow_forwardHello Company makes three different products. Due to the constraints of their manufacturing equipment and warehouse facility, the company is only able to produce, store, and sell a total of 50,000 units each month. The production of Products A and B varies each month; however, Product C is a special order for one customer who purchases the same number of units every month. Pete Davila, the CEO, has |provided the following data from last month for each product. Income Statement Product A Product B Product C Мax Cарacity 5,000 8.00 $ 2.00 $ Units 43,000 10.00 $ 3.00 $ 20,000 $ 2,000 50,000 Price per unit Variable expense per unit $ $ $ 50.00 15.00 $ 20.00 Total Fixed Costs 40,000 $ 10,000 Product Sales $ 430,000 $ 40,000 $ 100,000 $ 570,000 (169,000) 401,000 (70,000) 331,000 Variable Costs (129,000) (10,000) 30,000 $ (30,000) 70,000 $ Contribution Margin $ 301,000 $ Fixed Costs (20,000) 281,000 (40,000) (10,000) (10,000) 60,000 $ Operating income (loss) Required Using the Data Table…arrow_forwardSubject: Acountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education