FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

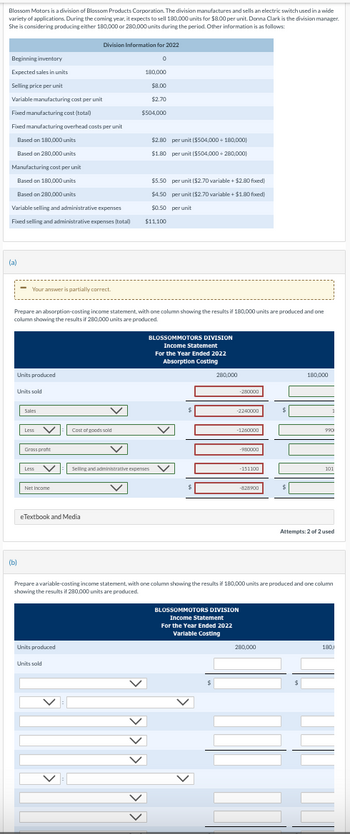

Transcribed Image Text:Blossom Motors is a division of Blossom Products Corporation. The division manufactures and sells an electric switch used in a wide

variety of applications. During the coming year, it expects to sell 180,000 units for $8.00 per unit. Donna Clark is the division manager.

She is considering producing either 180,000 or 280,000 units during the period. Other information is as follows:

Beginning inventory

Expected sales in units

Selling price per unit

Variable manufacturing cost per unit

Fixed manufacturing cost (total)

Fixed manufacturing overhead costs per unit

Based on 180,000 units

Based on 280,000 units

Manufacturing cost per unit

Based on 180,000 units

(a)

Based on 280,000 units

Variable selling and administrative expenses

Fixed selling and administrative expenses (total)

- Your answer is partially correct.

Units produced

Units sold

(b)

Sales

Less

Prepare an absorption-costing income statement, with one column showing the results if 180,000 units are produced and one

column showing the results if 280,000 units are produced.

Gross profit

Less

V

Division Information for 2022

v

Net Income

Units sold

eTextbook and Media

Units produced

Cost of goods sold

0

180,000

$8.00

$2.70

$504,000

$2.80 per unit ($504,000+ 180,000)

$1.80 per unit ($504,000+ 280,000)

$5.50 per unit ($2.70 variable + $2.80 fixed)

$4.50 per unit ($2.70 variable + $1.80 fixed)

$0.50

per unit

$11,100

BLOSSOMMOTORS DIVISION

Income Statement

For the Year Ended 2022

Absorption Costing

V

Selling and administrative expenses V

280,000

$

-280000

-2240000

-1260000

BLOSSOMMOTORS DIVISION

Income Statement

For the Year Ended 2022

Variable Costing

-980000

-151100

-8.28900

$

Prepare a variable-costing income statement, with one column showing the results if 180,000 units are produced and one column

showing the results if 280,000 units are produced.

280,000

180,000

990

101

Attempts: 2 of 2 used

180)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: acountingarrow_forwardDuring Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales (@ $62 per unit) Year 1 $ 1,178,000 Gross margin 513,000 Selling and administrative 303,000 expenses* Net operating $ income Cost of goods sold (@$35 665,000 1,015,000 per unit) Year 2 210,000 $ 1,798,000 783,000 333,000 $ 450,000 *$3 per unit variable; $246,000 fixed each year. The company's $35 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($360,000 ÷ 24,000 units) Absorption costing unit product cost $9 9 2 15 $ 35arrow_forwardIvanhoe Company has the following information available for September 2022. Unit selling price of video game consoles $480 Unit variable costs $336 Total fixed costs $63,360 Units sold 600 Compute the unit contribution margin. Unit contribution margin eTextbook and Media $ 144 Prepare a CVP income statement. Sales Variable Costs Contribution Margin Fixed Costs $ IVANHOE COMPANY CVP Income Statement For the Month Ended September 30, 2022 Total Per Unit Perc 480 $ 336 144 $ 63360 Net Income/(Loss) = $ (63216) eTextbook and Media Compute Ivanhoe' break-even point in sales units. Break-even point in units unitsarrow_forward

- I need help with question is correct answerarrow_forwardPlease give me step by step instruction on how to get cost of goods manufactured using the following: Cost of Goods Manufactured, using Variable and Absorption Costing On June 30, the end of the first year of operations, Johnson Industries, Inc., manufactured 6,100 units and sold 5,200 units. The following income statement was prepared, based on the variable costing concept: Johnson Industries, Inc.Variable Costing Income StatementFor the Year Ended June 30, 2016 Sales $1,300,000 Variable cost of goods sold: Variable cost of goods manufactured $732,000 Less inventory, June 30 108,000 Variable cost of goods sold 624,000 Manufacturing margin $676,000 Variable selling and administrative expenses 156,000 Contribution margin $520,000 Fixed costs: Fixed manufacturing costs $335,500 Fixed selling and administrative expenses 104,000 439,500 Income from operations $80,500 Determine the unit cost of goods manufactured,…arrow_forwardQuestion Content Area Moon Company uses the variable cost method of applying the cost-plus approach to product pricing. The costs and expenses of producing and selling 75,000 units of Product T are as follows: Variable costs per unit: Direct materials $ 7.00 Direct labor 3.50 Factory overhead 1.50 Selling and administrative expenses 3.00 Total $15.00 Fixed costs: Line Item Description Amount Factory overhead $45,000 Selling and administrative expenses 20,000 Moon desires a profit equal to an 18% return on invested assets of $1,440,000. c. Determine the markup percentage for Product T. Round your answer to one decimal place.fill in the blank 1 of 1%arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 25, 700 Variable expenses 13,900 Contribution margin 11, 800 Fixed expenses 7, 788 Operating income $ 4,012 7. If the variable cost per unit increases by $0.60, spending on advertising increases by $1,100, and unit sales increase by 250 units, what would be the operating income? (Do not round intermediate calculations.)arrow_forwardplease answer completely and correctly in text form with all working describe each and every step with explanation computation formulaarrow_forwardBased on the following information, prepare a contribution margin income statement assuming the company uses variable costing. Annual production Sales price Variable production cost per unit Direct materials 50,000 units $40 per unit $10 3 Direct labor $25 per unit Manufacturing overhead Fixed production costs 12. $150,000 each year; $3 per unit at 50,000 units of production Variable selling and administrative cost $1 per unit Fixed selling and administrative cost $100,000 each year Sales: А. Var. Production В. Var Selling & Admin 50,000 1,300,000 Contribution Margin С. Fixed Expenses: Fixed Mfg Overhead 150,000 Fixed Selling & Admin 100,000 250,000 Net Income D.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education