FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

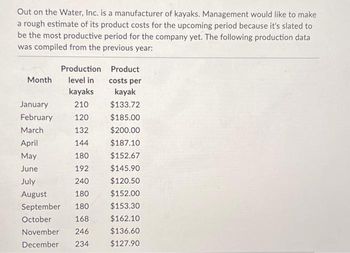

Out on the Water, Inc. is a manufacturer of kayaks. Management would like to make a rough estimate of its product costs for the upcoming period because it's slated to be the most productive period for the company yet. The following production data was compiled from the previous year: Production level in kayaks January 210 February 120 March 132 April 144 May 180 June 192 July 240 August 180 September 180 October 168 November 246 December 234 Month Product costs per kayak $133.72 $185.00 $200.00 $187.10 $152.67 $145.90 $120.50 $152.00 $153.30 $162.10 $136.60 $127.90

Transcribed Image Text:Out on the Water, Inc. is a manufacturer of kayaks. Management would like to make

a rough estimate of its product costs for the upcoming period because it's slated to

be the most productive period for the company yet. The following production data

was compiled from the previous year:

Production

Product

level in

costs per

kayaks

kayak

210

$133.72

120

$185.00

132

$200.00

April

144

$187.10

May

180 $152.67

June

192

$145.90

July

240

$120.50

August

180

$152.00

September 180

$153.30

October

168

$162.10

November 246

$136.60

December 234 $127.90

Month

January

February

March

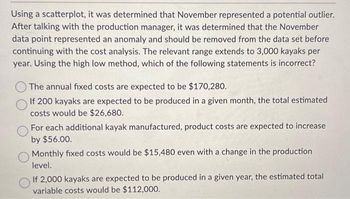

Transcribed Image Text:Using a scatterplot, it was determined that November represented a potential outlier.

After talking with the production manager, it was determined that the November

data point represented an anomaly and should be removed from the data set before

continuing with the cost analysis. The relevant range extends to 3,000 kayaks per

year. Using the high low method, which of the following statements is incorrect?

The annual fixed costs are expected to be $170,280.

If 200 kayaks are expected to be produced in a given month, the total estimated

costs would be $26,680.

For each additional kayak manufactured, product costs are expected to increase

by $56.00.

Monthly fixed costs would be $15,480 even with a change in the production

level.

If 2,000 kayaks are expected to be produced in a given year, the estimated total

variable costs would be $112,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Similar questions

- Please help me with show calculation thankuarrow_forwardWestern Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are $80,910 in March and rose to $93,120 in April. It costs Western Trucking $0.14 per mile in variable costs. In March, the delivery trucks were driven a total of 87,000 miles, and in April, they were driven a total of 97,000 miles. Using this information, answer the following: A. What were the total costs to operate the fleet in March and April, respectively? March April Total cost $fill in the blank 1 $fill in the blank 2 B. What were the cost per mile to operate the fleet in March and April, respectively? If required, round your answers to nearest cent. March April Cost per mile $fill in the blank 3 $fill in the blank 4arrow_forwardThe following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Number of units produced Number of units sold Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($224,000/2,800 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. Full Absorption Costing 2,800 2,400 340 60 45 13 80 Variable Costing $ 26,400 $ 60,000arrow_forward

- Give me correct answer and explanation.sarrow_forwardPlease help mearrow_forwardWestern Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are $80,910 in March and rose to $92,150 in April. It costs Western Trucking $0.14 per mile in variable costs. In March, the delivery trucks were driven a total of 87,000 miles, and in April, they were driven a total of 95,000 miles. Using this information, answer the following: A. What were the total costs to operate the fleet in March and April, respectively? March April Total cost $ B. What were the cost per mile to operate the fleet in March and April, respectively? If required, round your answers to nearest cent. March April Cost per mile $arrow_forward

- Yancey, Inc. reports the following information: Units produced Units sold Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 580 units 580 units $130 per unit $10 per unit $25 per unit - $30 per unit $22,000 per year Variable selling and administrative costs Fixed selling and administrative costs $20 per unit $15,000 per year What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent.) OA. $95.00 OB. $72.93 OC. $102.93 OD. $62.93arrow_forwardSubject: Acountingarrow_forwardWestern Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are $80,910 in March and rose to $92,150 in April. It costs Western Trucking $0.14 per mile in variable costs. In March, the delivery trucks were driven a total of 87,000 miles, and in April, they were driven a total of 95,000 miles. Using this information, answer the following: A. What were the total costs to operate the fleet in March and April, respectively? March April Total cost $fill in the blank 1 $fill in the blank 2 B. What were the cost per mile to operate the fleet in March and April, respectively? If required, round your answers to nearest cent. March April Cost per mile $fill in the blank 3 $fill in the blank 4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education