Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

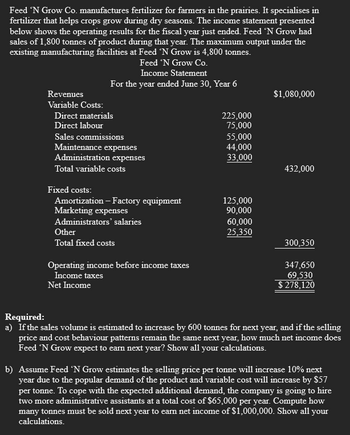

Transcribed Image Text:Feed 'N Grow Co. manufactures fertilizer for farmers in the prairies. It specialises in

fertilizer that helps crops grow during dry seasons. The income statement presented

below shows the operating results for the fiscal year just ended. Feed 'N Grow had

sales of 1,800 tonnes of product during that year. The maximum output under the

existing manufacturing facilities at Feed 'N Grow is 4,800 tonnes.

Feed 'N Grow Co.

Revenues

Variable Costs:

Income Statement

For the year ended June 30, Year 6

Direct materials

Direct labour

Sales commissions

Maintenance expenses

Administration expenses

Total variable costs

Fixed costs:

Amortization - Factory equipment

Marketing expenses

Administrators' salaries

Other

Total fixed costs

Operating income before income taxes

Income taxes

Net Income

225,000

75,000

55,000

44,000

33,000

125,000

90,000

60,000

25,350

$1,080,000

432,000

300,350

347,650

69,530

$ 278,120

Required:

a) If the sales volume is estimated to increase by 600 tonnes for next year, and if the selling

price and cost behaviour patterns remain the same next year, how much net income does

Feed 'N Grow expect to earn next year? Show all your calculations.

b) Assume Feed 'N Grow estimates the selling price per tonne will increase 10% next

year due to the popular demand of the product and variable cost will increase by $57

per tonne. To cope with the expected additional demand, the company is going to hire

two more administrative assistants at a total cost of $65,000 per year. Compute how

many tonnes must be sold next year to earn net income of $1,000,000. Show all your

calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Definition of net income:

VIEW Step 2: Working note- Calculation of selling price per tonne, variable cost per tonne, and income tax rate:

VIEW Step 3: Requirement a- Calculation of net income with the increase in sales by 600 tonnes:

VIEW Step 4: Requirement b- Calculation of tonnes to be sold to achieve net income of $,1,000,000:

VIEW Solution

VIEW Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Similar questions

- Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the company produced 10,000 leaf blowers and sold 8,500. At year-end, the company reported the following income statement using absorption costing: Sales (8,500 × $45) Cost of goods sold (8,500 × $20) Gross margin Selling and administrative expenses Net income Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing. Multiple Choice $158,500 $246,500 $206,500 $382,500 170,000 $212,500 60,000 $152,500 $237.500arrow_forwardEaston Company makes and sells scooters. Easton incurred the following costs in its most recent fiscal year: Cost Items Appearing on the Income Statement Materials cost ($10 per unit) Company president's salary Depreciation on manufacturing equipment Salaries of administrative personnel Labor cost ($4 per unit) Advertising costs (150,000 per year) Shipping and handling ($500 per year) Research and development costs Real estate taxes on factory Inspection costs Easton can currently purchase the scooters it makes from Weston Company. If the company purchases the scooters, Easton would still continue to use its own logo, sales staff, and advertising programs. If Easton outsources the scooters to Weston, which of the following costs would be relevant to the outsourcing decision? Multiple Choice X Materials cost Shipping and handling Inspection costs All of these answers are correct.arrow_forwardRowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 61,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Required A Fixed costs included in this income statement are $396,500 for depreciation on plant and machinery and miscellaneous factory operations and $102,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $21.60 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production of the 10,000 units will incur all variable manufacturing costs but no fixed…arrow_forward

- During its first year of operations, Silverman Company paid $9,160 for direct materials and $9,700 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,700 while general, selling, and administrative expenses totaled $4,200. The company produced 5,300 units and sold 3,200 units at a price of $7.70 a unit. What is Silverman's cost of goods sold for the year? Multiple Choice O $27,560 $13,923 $16,640 $23,060arrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,150 rackets and sold 4,980. Each racket was sold at a price of $90. Fixed overhead costs are $79,950 per year, and fixed selling and administrative costs are $65,600 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Prepare an income statement under variable costing. Contribution margin Less: Fixed expenses Income X Answer is not complete. Sales Less: Variable expenses Variable selling and administrative expenses Variable cost of goods sold ACES INCORPORATED Income Statement (Variable Costing) Fixed overhead Fixed selling and administrative expenses $ 448,200 2852 $12arrow_forwardBlazer Chemical produces and sells an ice-melting granular used on roadways and sidewalks in winter. It annually produces and sells 25,125 tons of its granular. Because of this year's mild winter, projected demand for its product is only 20.100 tons. Based on projected production and sales of 20.100 tons, the company estimates the following income using absorption costing. Sales (20,100 tons at $148 per ton) Cost of goods sald (20,100 tons at 360 per ton) Gross profit Selling and administrative expenses Income Its product cost per ton follows and consists mainly of fixed overhead because its automated production process uses expensive equipment Direct materials Direct labor Variable overhead Fixed overhead ($884,098/28,100 tons) Selling and administrative expenses consist of variable selling and administrative expenses of $6 per ton and fixed selling and administrative expenses of $213,400 per year. The company's president will not earn a bonus unless a positive income is reported. The…arrow_forward

- Gorman Nurseries Inc. grows poinsettias and fruit trees in a green house/nursery operation. The following information was provided for the coming year. Poinsettias Fruit Trees Sales $970,000 $3,100,000 Variable cost of goods sold 460,000 1,630,000 Direct fixed overhead 160,000 200,000 A sales commission of 4% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $146,000 for the poinsettia line and $87,000 for the fruit tree line. Common fixed overhead for the nursery operation was estimated to be $800,000; common selling and administrative expense was estimated to be $450,000. Required: Prepare a segmented income statement for Gorman Nurseries for the coming year, using variable costing. Note: Enter all amounts as positive numbers except operating loss, if applicable.arrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,600 rackets and sold 5.500. Each racket was sold at a price of $96. Fixed overhead costs are $89,760 for the year, and fixed selling and administrative costs are $65,800 for the year. The company also reports the following per unit variable costs for the year: Direct materials Direct labor Variable overhead Variable selling and administrative expenses Required: Prepare an income statement under absorption costing. ACES INCORPORATED Income Statement (Absorption Costing) $ 12.18 8.18 5.24 2.60arrow_forwardWind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the company produced 10,000 leaf blowers and sold 8,500. At year-end the company reported the following income statement using absorption costing. Sales (8,500 x $45): 382,500 cost of goods sold (8,500 x $20): 170,000 gross margin: $212,500 selling and administrative expenses: 60,000 net income: $152,500 Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing. $146,500 $158,500 $237,500 $206,500 $246,500arrow_forward

- Can you please answer the accounting question?arrow_forwardGorman Nurseries Inc. grows poinsettias and fruit trees in a green house/nursery operation. The following information was provided for the coming year. Sales $9,70,000 $31,00,000 Variable cost of goods sold 4,60,000 16,30,000 1,60,000 2,00,000 Direct fixed overhead A sales commission of 4% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $146,000 for the poinsettia line and $87,000 for the fruit tree line. Common fixed overhead for the nursery operation was estimated to be $800,000; common selling and administrative expense was estimated to be $450,000. Prepare a segmented income statement for Gorman Nurseries for the coming year, using variable costing.arrow_forwardapplies to the questions displayed below.] Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense Profit will The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. 14.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning