FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

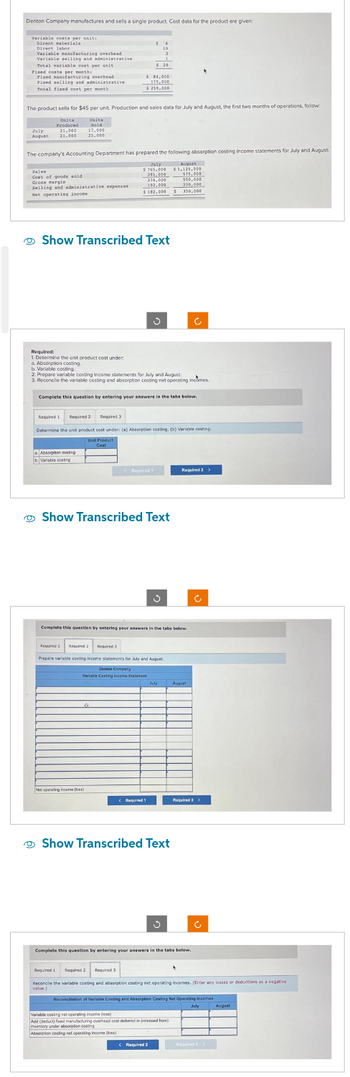

Transcribed Image Text:Denton Company manufactures and sells a single product. Cost data for the product are given:

Variable costs per unit

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

Total variable cost per unit

Fixed costa per months

Fixed manufacturing overhead

Fixed selling and administrative

Total fixed cost per month

Units

Produced

July

21,000

August 21,000

The product sells for $45 per unit. Production and sales data for July and August, the first two months of operations, follow

Unite

fold

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses.

Set operating incone

17,000

25,000

The company's Accounting Department has prepared the following absorption costing income statements for July and August

Required:

1. Determine the unit product cost under

a. Absorption costing.

16

10

$ 84,000

175,00D

$ 259,000

Show Transcribed Text

Absorption costing

3

1

$20

b Variable costing

July

$765,000

391,000

374,000

197,000

$182,000

b. Variable costing.

2. Prepare variable costing income statements for July and August

3. Reconcile the variable costing and absorption costing net operating incomes

Net operating income)

Complete this question by entering your answers in the tabs below.

Required 1

Required 1 Required 2 Required 3

Determine the unit product cost under: (a) Absorption costing, (b) Variable costing

Unit Product

Cost

Show Transcribed Text

< Required 1

J

Required 1 Required 2 Required 3

Prepare variable costing income statements for July and August.

Dention Company

Variable Casting Income Statement

August

$1,125,000

575,000

550,000

200,000

$ 350

Complete this question by entering your answers in the tabs below.

350,000

Show Transcribed Text

July Augu

Required 2 >

Variable costing net operating income (s)

Add (deduct) faxed manufacturing overhead cest deferred in (released from)

inventory under absorption costing

Absorption costing net operating income doss)

< Required 2

Complete this question by entering your answers in the tabs below.

*

Required 3 >

Ĉ

Ĉ

Required 1 Required 2 Required 3

Reconcile the variable costing and absorption costing net operating incomes. (Enter any losses or deductions as a negative

value.)

Reconciliation of Variable Costing and Absorption Casting Net Operating incomes

July August

Required 3>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense The total gross margin for the month under absorption costing is: $65,000 $95,100 $20,000 $57,500 S SSSS S S 119 0 3,000 2,600 400 31 45 29 48,000 15,000arrow_forwardThe following information pertains to the first year of operation for Crystal Cold Coolers Incorporated: Number of units produced Number of units sold 3,100 2,600 $ 355 Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($201,500÷3,100 units) Total variable selling expenses ($14 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Full Absorption Costing Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the y Answer is not complete. Variable Costing Prepare Crystal Cold's full absorption costing income statement for the year. Crystal Cold Coolers Incorporated Full Absorption Costing Income Statement Sales $ 60 $ 50 923,000 $12 $65 $36,400 $ 65,000arrow_forwardConner's Fixtures produces and sells a single product, a specialized plumbing fixture. The business began operations on January 1 this year and its costs incurred during the year include the following: Variable costs (based on units produced): Direct materials cost Direct manufacturing labor costs Indirect manufacturing costs Administration and marketing Fixed costs: Administration and marketing costs Indirect manufacturing costs At the end of the first year (December 31), direct materials inventory consisted of 7,500 pounds of material. Production in that year was 10,000 fixtures. All prices and unit variable costs remained constant during the year. Sales revenue for year 1 was $293,250. Finished goods inventory was $24,420 on December 31. Each finished fixture requires 3.20 pounds of material. Required: L a. Compute the direct materials inventory cost, December 31. b. Compute the finished goods ending inventory in units (fixtures) on December 31. c. Compute the selling price per…arrow_forward

- Denton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials. Direct labor Variable manufacturing overhead Variable selling and administrative July August Total variable cost per unit. Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative Total fixed cost per month The product sells for $47 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced 21,000 21,000 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income. $ 3 11 Units Sold 17,000 25,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable costing. 4 1 $ 19 The company's Accounting Department has prepared the following absorption costing income statements for July and August: July $ 799,000 408,000 391,000 183,000 $ 208,000 $ 126,000 166,000 $ 292,000 2. Prepare variable costing income…arrow_forwardThe Dorset Corporation produces and sells a single product. The following data refer to the year just completed: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit 0 30,300 24,700 $ 465 $ 25 Fixed per year $ 469,300 Manufacturing costs: Direct materials cost per unit $ 211 Direct labor cost per unit $ 53 Variable manufacturing overhead cost per unit $ 36 $ 454,500 Fixed manufacturing overhead per year Assume that direct labor is a variable cost. Required: a. Compute the unit product cost under both the absorption costing and variable costing approaches. b. Prepare an income statement for the year using absorption costing. c. Prepare an income statement for the year using variable costing. d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare an…arrow_forwardYaHo, Ltd. is a manufacturer that produces a single product. Below is data concerning its most recent month of operations: Units in beginning inventory 0 Units produced 81,450 Units sold 77,820 Selling price per unit: $13.80 Variable costs per unit: Direct materials $2.90 Direct labor $2.05 Variable manufacturing overhead $1.30 Variable selling and administrative expense $1.05 Fixed costs (per month): Fixed manufacturing overhead $195,480 Fixed selling and administrative expense $218,825 Calculate net income for the month using variable costing. a. $173,236 b. $153,781 c. $115,120 d. $100,237 e. $91,525arrow_forward

- During the first month of operations ended July 31, Head Gear Inc. manufactured 25,600 hats, of which 24,100 were sold. Operating data for the month are summarized as follows: Line Item Description Amount Amount Sales $226,540 Manufacturing costs: Direct materials $138,240 Direct labor 35,840 Variable manufacturing cost 17,920 Fixed manufacturing cost 15,360 207,360 Selling and administrative expenses: Variable $12,050 Fixed 8,800 20,850 During August, Head Gear Inc. manufactured 22,600 hats and sold 24,100 hats. Operating data for August are summarized as follows: Line Item Description Amount Amount Sales $226,540 Manufacturing costs: Direct materials $122,040 Direct labor 31,640 Variable manufacturing cost 15,820 Fixed manufacturing cost 15,360 184,860 Selling and administrative expenses: Variable $12,050 Fixed 8,800 20,850 Required: Question…arrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense The total gross margin for the month under absorption costing is: Multiple Choice $81,900 $21,840 $128,430 $139,230 $ 144 0 3,020 2,730 290 $ 47 $21 $ 16 $9 $90,600 $35,490arrow_forwardS Conner's Fixtures produces and sells a single product, a specialized plumbing fixture. The business began operations on January 1 this year and its costs incurred during the year include the following: Variable costs (based on units produced): Direct materials cost Direct manufacturing labor costs Indirect manufacturing costs Administration and marketing Fixed costs: Administration and marketing costs Indirect manufacturing costs $ 24,000 108,000 21,600 13,500 72,000 24,000 At the end of the first year (December 31), direct materials inventory consisted of 7,500 pounds of material. Production in that year was 10,000 fixtures. All prices and unit variable costs remained constant during the year. Sales revenue for year 1 was $293,250. Finished goods inventory was $24.420 on December 31. Each finished fixture requires 3.20 pounds of material. Required: a. Compute the direct materials inventory cost, December 31. b. Compute the finished goods ending inventory in units (fixtures) on…arrow_forward

- Sagararrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Units in beginning inventory 0 Units produced 4,450 Units sold 4,350 Units in ending inventory 100 Variable costs per unit: Direct materials $ 50 Direct labor $ 52 Variable manufacturing overhead $ 15 Variable selling and administrative expense $ 13 Fixed costs: Fixed manufacturing overhead $93,450 Fixed selling and administrative expense $43,500 What is the variable costing unit product cost for the month? $130 per unit $151 per unit $117 per unit $129 per unitarrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (6, 100 units) $201, 300 Cost of goods sold: Cost of goods manufactured (7, 100 units) $163,300 Inventory, April 30 (1,000 units) (23,000) Total cost of goods sold (140, 300) Gross profit $61,000 Selling and administrative expenses (36,830) Operating income $24, 170 If the fixed manufacturing costs were $ 44,091 and the fixed selling and administrative expenses were $18, 040, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin Company Variable Costing Income Statement For the Month Ended April 30 $Sales Variable cost of goods sold: $- Select - - Select - - Select - $- Select - - Select - $ - Select - Fixed costs: $Variable cost of goods sold Fixed…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education