FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

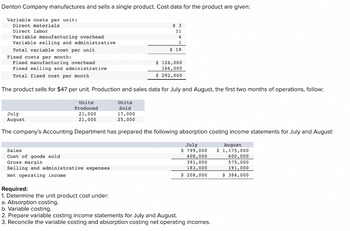

Transcribed Image Text:Denton Company manufactures and sells a single product. Cost data for the product are given:

Variable costs per unit:

Direct materials.

Direct labor

Variable manufacturing overhead

Variable selling and administrative

July

August

Total variable cost per unit.

Fixed costs per month:

Fixed manufacturing overhead

Fixed selling and administrative

Total fixed cost per month

The product sells for $47 per unit. Production and sales data for July and August, the first two months of operations, follow:

Units

Produced

21,000

21,000

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income.

$ 3

11

Units

Sold

17,000

25,000

Required:

1. Determine the unit product cost under:

a. Absorption costing.

b. Variable costing.

4

1

$ 19

The company's Accounting Department has prepared the following absorption costing income statements for July and August:

July

$ 799,000

408,000

391,000

183,000

$ 208,000

$ 126,000

166,000

$ 292,000

2. Prepare variable costing income statements for July and August.

3. Reconcile the variable costing and absorption costing net operating incomes.

August

$ 1,175,000

600,000

575,000

191,000

$ 384,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the first month of operations ended July 31, Head Gear Inc. manufactured 25,600 hats, of which 24,100 were sold. Operating data for the month are summarized as follows: Line Item Description Amount Amount Sales $226,540 Manufacturing costs: Direct materials $138,240 Direct labor 35,840 Variable manufacturing cost 17,920 Fixed manufacturing cost 15,360 207,360 Selling and administrative expenses: Variable $12,050 Fixed 8,800 20,850 During August, Head Gear Inc. manufactured 22,600 hats and sold 24,100 hats. Operating data for August are summarized as follows: Line Item Description Amount Amount Sales $226,540 Manufacturing costs: Direct materials $122,040 Direct labor 31,640 Variable manufacturing cost 15,820 Fixed manufacturing cost 15,360 184,860 Selling and administrative expenses: Variable $12,050 Fixed 8,800 20,850 Required: Question…arrow_forwardLindquist Company has the following information for February: Line Item Description Amount Sales $370,000 Variable cost of goods sold 173,900 Fixed manufacturing costs 55,500 Variable selling and administrative expenses 40,700 Fixed selling and administrative expenses 22,200 Determine the following for Lindquist Company for the month of February: Line Item Description Amount a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardLocklear, Inc. reports the following information for the year ended December 31: Units sold Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs 650 units $160 per unit $25 per unit $11 per unit $15 per unit $25 per unit $6 per unit $12,600 per year The operating income calculated using variable costing and absorption costing amounted to $9,100 and $10,300, respectively. There were no beginning inventories. Determine the total fixed manufacturing overhead that will be expensed under absorption costing for the year. OA. $32,500 B. $16,250 C. $17,450 D. $33,150arrow_forward

- Sagararrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Units in beginning inventory 0 Units produced 4,450 Units sold 4,350 Units in ending inventory 100 Variable costs per unit: Direct materials $ 50 Direct labor $ 52 Variable manufacturing overhead $ 15 Variable selling and administrative expense $ 13 Fixed costs: Fixed manufacturing overhead $93,450 Fixed selling and administrative expense $43,500 What is the variable costing unit product cost for the month? $130 per unit $151 per unit $117 per unit $129 per unitarrow_forwardSims Company began operations on January 1. Its cost and sales information for this year follow. Direct materials $ 30 per unit Direct labor $ 50 per unit Variable overhead $ 20 per unit Fixed overhead $ 8,400,000 per year Variable selling and administrative expenses $ 11 per unit Fixed selling and administrative expenses $ 4,750,000 per year Units produced 105,000 units Units sold 75,000 units Sales price $ 360 per unit 1. Prepare an income statement for the year using variable costing.2. Prepare an income statement for the year using absorption costing.arrow_forward

- Marley Company has the following information for March: Sales $912,000 Variable cost of goods sold 474,000 Fixed manufacturing costs 82,000 Variable selling and administrative expenses 238,100 Fixed selling and administrative expenses 54,700 Determine the following for Marley Company for the month of March: a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardAdams Company makes a single product that it sells for $8.45 per unit. Provided below is information about this product for the past nine months: Month January February March April May June July August September Total Cost Incurred $28,730 $24,580 $30,660 $16,890 $19,120 $20,610 $17,490 $25,380 $15,540 Units Sold 6,400 5,150 6,900 2,950 3,600 4,150 3,350 5,500 2,700 Adams Company expects to sell 4,620 units of this product during October. Using the high-low method, calculate Adams Company's expected margin of safety for October.arrow_forwardBetty DeRose, Inc. manufactures and sells a single product. Information related to the cost of producing this product for the past six months is provided below: Units Produced 5,360 4,840 7,580 4,930 6,110 7,620 Month June July August September October November Total Cost Incurred $126,017 $118,831 $155,833 $119,246 $136,932 $157, 195 Betty DeRose, Inc. expects to produce 6,495 units of this product during December. Using the high-low method, calculate Betty DeRose, Inc's expected total cost incurred for December.arrow_forward

- Norwood Company has the following information for July: Sales $440,000 Variable cost of goods sold 198,000 Fixed manufacturing costs 70,400 Variable selling and administrative expenses 44,000 Fixed selling and administrative expenses 26,400 Determine the following for Norwood Company for the month of July: a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardSims Company began operations on January 1. Its cost and sales information for this year follow. Direct materials $ 40 per unit Direct labor $ 60 per unit Variable overhead $ 40 per unit Fixed overhead $ 6,600,000 per year Variable selling and administrative expenses $ 11 per unit Fixed selling and administrative expenses $ 4,000,000 per year Units produced 110,000 units Units sold 80,000 units Sales price $ 360 per unit 1. Prepare an income statement for the year using variable costing.2. Prepare an income statement for the year using absorption costing.arrow_forwardProvide tablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education