FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

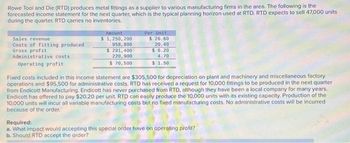

Transcribed Image Text:Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the

forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units

during the quarter. RTD carries no inventories.

Sales revenue

Costs of fitting produced

Gross profit

Administrative costs

Operating profit

Amount

$ 1,250, 200

958, 800

$ 291,400

220,900

$ 70,500

Per Unit

$

26,60

20.40

$6.20

4.70

$ 1.50

Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory

operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter

from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years.

Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production of the

10,000 units will incur all variable manufacturing costs but no fixed manufacturing costs. No administrative costs will be incurred

because of the order.

Required:

a. What impact would accepting this special order have on operating profit?

b. Should RTD accept the order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit $ 25 Variable expense per unit $ 17 Fixed expense per month $6,880 Unit sales per month 1,010 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forwardThe following is Pacific Limited’s contribution format income statement for January 2022: Sales $1,400,000 Variable expenses 700,000 Contribution margin 700,000 Fixed expenses 400,000 Net operating income $ 300,000 The company has no beginning or ending inventories and produced and sold 25,000 units during the month. Required (show your calculation): a. The company’s top management team is currently investigating how many units they need to sell to reach the break-even point. Also, they want to know how much revenue they need to generate to reach the break-even point. What do you think? d.d. Company’s Marketing Manager is confident that she can increase sales by 28% next year with some effort. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your answerarrow_forwardBeckett Manufacturing produces self-watering planters for use in upscale retail establishments. Sales projections for the first five months of the upcoming year show the estimated unit sales of the planters each month to be as follows: (Click the icon to view additional information.) Inventory at the start of the year was 850 planters. The desired inventory of planters at the end of each month should be equal to 25% of the following month's budgeted sales. Each planter requires four pounds of polypropylene (a type of plastic). The company wants to have 20% of the polypropylene required for next month's production on hand at the end of each month. The polypropylene costs $0.10 per pound. Read the requirements. Data table For the Months of January through March January February March Quarter Number of planters to be sold Units to be produced 3,425 3,400 3,525 10,350 January. 3,400 4 Multiply by: Quantity of direct materials needed per unit Quantity needed for production February 3,500…arrow_forward

- The production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year: Units to be produced Each unit requires 0.75 direct labor-hours, and direct laborers are paid $16.00 per hour. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 11,000 8,000 8,500 10,800 Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) Required production in units Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost Rordan Corporation Direct Labor Budget 2nd Quarter 8,000 1st Quarter 11,000 8,250✔✔ Answer is not complete. $ 132,000 6,000 3rd Quarter 8,500 6,375 4th Quarter 10,800 S 96,000 $ 102,000 $ 8,100 129,600 Yeararrow_forwardOak Industrial has estimated that production for the next five quarters will be:. Production Information 1st quarter, 2020 44,100 units 2nd quarter, 2020 40,000 units 3rd quarter, 2020 48,200 units 4th quarter, 2020 37,600 units 1st quarter, 2021 45,700 units Finished units of production require 6 pounds of raw material per unit. The raw material cost is $7 per pound. There is $277,830 of raw material on hand at the beginning of the first quarter, 2020. Oak desires to have 15 percent of next quarter's material requirements on hand at the end of each quarter.Prepare quarterly direct materials purchases budgets for Oak Industrial for 2020.arrow_forwardThe following information is located in the production department of Mindy Ca Second First Quarter 14,300 Quarter Third Quarter Fourth Quarter 21,000 22,500 21,300 Units produced Other information found in the production department includes: Prior Year Ending RM Inventory Prior Year Ending A/P Pounds of RM per unit The ending raw material inventory per month should be 25% of the following month's production needs. The desired ending inventory for the fourth quarter is 3,700 pounds. Management plans to pay for 70% of the raw material purchases in the month bought and 30% in the following month. Direct Materials Budget Question: Given the data, the second quarter direct materials budget should be: Costs of Raw Materials per pound 5. $ Cost of DM Purchased: 10,725 11,775 First Second Quarter Quarter Third Quarter Fourth Quarter $ 4.50 $ 4.50 $ 4.50 $ 4.50arrow_forward

- Use the information below for Mandy Corporation to answer the question that follow. Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 643,000 units, estimated beginning inventory is 105,000 units, and desired ending inventory is 84,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A: 0.50 lb. per unit @ $0.61 per poundMaterial B: 1.00 lb. per unit @ $2.37 per poundMaterial C: 1.20 lb. per unit @ $0.86 per poundThe dollar amount of Material C used in production during the year is a.$577,714 b.$770,285 c.$706,094 d.$641,904arrow_forwardAAA Manufacturing Firm has provided the following sales, cost and expense figures in relation to expected operations for the coming year. You are tasked to prepare forecast Statements of Financial Performance using flexible budget techniques and incorporating the following information.All units are sold when manufactured due to the highly perishable nature of the company’s product. As such there are no inventories of raw materials, work in process or finished goods on hand.The selling price of the company’s single product is $50.00 and the expected sales quantity for the coming year is in the vicinity of 20,000 and 25,000 units.Required: Prepare an Income Statement budget using flexible budgeting techniques at production and sales levels of:(Scenario a) 20,000 units(Scenario b) 25,000 units Question: 1. Total fixed factory overhead under Scenario A (No dollar sign and comma) 2. Gross profit under Scenario B? (No dollar sign and comma) 3. Total non-manufacturing expenses under…arrow_forwardThe Simmons Company finished their sales projections for the coming year. The company produces one product. Part of next year's sales projections are as follows. Projected Sales in Units July 125,000 August 145,000 September 139,000 October 155,000 November 180,000 The budget committee has also completed the following information on inventories. Raw Materials Ending Balance, June, 50,000 lbs Desired ending levels (monthly 10% of next month's production needs) Work-In-Progress None Finished Goods Inventory Ending Balance, June, 22,000 units Desired ending levels: 20% of next month's sales The Engineering Department has developed the following standards upon which the production budgets will be developed. Item Standard Material usage 3 pounds per unit Material price per pound $2.00 per pound Labor usage 0.5 hours per unit Labor rate $40 per hour Machine hours 2 machine hours per unit The Simmons Company uses a modified allocation method for…arrow_forward

- Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price per unit $ 30 Variable expense per unit $ 19 Fixed expense per month $ 9,570 Unit sales per month 1,020 Required: 1. What is the company’s margin of safety? (Do not round intermediate calculations.) 2. What is the company’s margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forwardPlease help me to solve this problemarrow_forwardDuring the current year, Mute Corporation expected to sell 24,600 telephone switches. Fixed costs for the year were expected to be $12,147,000, the unit sales price was budgeted at $3,500, and unit variable costs were budgeted at $1,680. Mute's margin of safety (MOS) in units is Multiple Choice O O 17,925. 21,705. 23,015. 19,095. 17,795.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education