Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinking through the production process and the costs of raw materials and new equipment, Williams estimates the variable costs of each unit produced and sold at $6 and the fixed costs per year at $60,000.

- If the selling price is set at $18 each, how many unit must be produced and sold for Williams to break even? Use both graphic and algebraic approaches to get your answer.

- Williams

forecasts sales of 10,000 units for the first year if the selling price is set at $14 each. What would be the total contribution to profits from this new product during the first year? - If the selling price is set at $12.50, Williams forecasts that first-year sales would increase to 15,000 units. Which pricing strategy ($14.00 or $12.50) would result in the greater total contribution to profits?

- What oilier considerations would be crucial to the final decision about making and marketing the new product?

a.

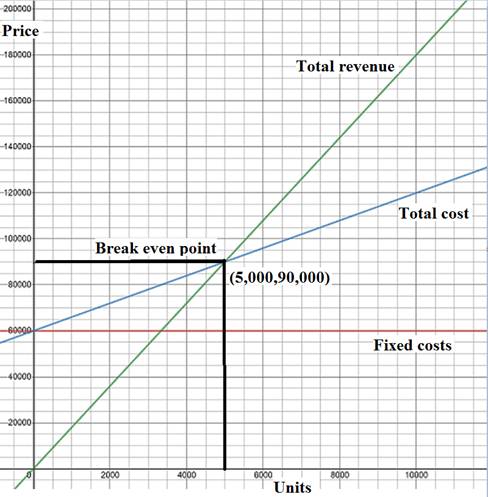

To calculate: The break even quantity using both graphic and algebraic approaches.

Concept Introduction: Break-even point is explained as a point where a company is earning no profits and incurring no losses reflecting that total cost is equivalent to total income.

Explanation of Solution

Given information:

Variable costs: $6 per unit

Fixed costs: $60,000

Selling price: $18 per unit

Break-even quantity: ?

Calculation of break even quantity:

Hence, the break even quantity is 5,000 units.

Graphic approach for calculating break even quantity:

Fig (1)

b.

To calculate: The total contribution to profits from this new product.

Concept Introduction: Profit is explained as surplus of total income over total costs.

Explanation of Solution

Given information:

Forecasted sales: 10,000 units

Selling price: $14 per unit

Calculation of total contribution to the profits:

Therefore, the total contribution from the new product is $20,000.

c.

To calculate: The total contribution to profits from this new product if selling price is $12.50.

Concept Introduction: Profit is explained as surplus of total income over total costs.

Explanation of Solution

Given information:

Forecasted sales: 15,000 units

Selling price: $12.50 per unit

Calculation of total contribution to the profits:

Therefore, the total contribution from the new product is $37,500.

If selling price is $14 and forecasted sales are 15,000 units, then,

Calculation of total contribution to the profits:

It can be concluded that when selling price is $14 then it can get a greater total contribution to Company W.

d.

To identify: The other considerations that would be crucial for final decision making for the new product.

Concept Introduction: Decision making is a process in which members of an organization select a particular course of action in response to both problem and opportunity. The objective of decision making is to gain a maximum and profitable result.

Explanation of Solution

Other considerations that would be crucial for final decision making of new product are:

- Company W can identify and evidently state the problems.

- Various other alternatives should be evaluated and for the same information should be collected.

Decisions are taken by organizations on the basis these procedures that are generally performed: break even analysis, decision tree, preference matrix and preference decision tree.

Want to see more full solutions like this?

Chapter A Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Additional Business Textbook Solutions

Operations and Supply Chain Management 9th edition

Operations Management, Binder Ready Version: An Integrated Approach

Loose-leaf for Operations Management (The Mcgraw-hill Series in Operations and Decision Sciences)

Business in Action (8th Edition)

Principles Of Operations Management

Business in Action

- I love being a Dad and I intend to capture my daughter’s life on some sort of permanent media. Specifically, I have chosen to use a Panasonic camera and have its film developed at Bryan Photo Studio. My choices to use the Panasonic camera and Picture Perfect Photo Studio represent choices based on: a.Need b.Demand c.Affordability d.Wantarrow_forwardDanny Meyer Leads His Company through the Challenges of Eliminating Tips What happens when your CEO wants to remove the tip structure from your restaurant? Do you complain about the new prices as a customer? Do you worry about your paychecks as a server? Danny Meyer, CEO of Union Square Hospitality (home to some of the most successful New York restaurants), discovered these answers when he began eliminating the tip structure in most of his restaurants. He had seen firsthand the largest negative impact of a tipping culture: employees stuck in front-line positions with no chance to advance to management without taking significant pay cuts. Meyer began by first involving the affected employees in town-hall talks. These town halls happened months before any publicity was released. Meyer then hosted town halls with customers to explain the importance of fair wages for all his employees at the restaurant, not just the few who served the food. The transition period for each restaurant to…arrow_forwardThe Concept of Present Value (PV) and Future Value (FV) involve compounding and discounting. Using Amazon provide real example and discuss how each is used and their importance.arrow_forward

- Who will least likely be involved in establishing standard costs for a company? a)the president b)the controller c)the factory administrator d)the marketing managerarrow_forwardI need the answer in Excel. Please help me. The following table contains 5-year quarterly sales information for the KYRYH product. Year Q1 Q2 Q3 Q4 Total 2016 43000 37800 32300 40600 153700 2017 47000 37000 31200 40000 155200 2018 46000 39000 28000 40500 153500 2019 49000 42300 33500 44000 168800 2020 52700 44000 33600 45700 176000 a) Determine the demand for the year 2021 using the moving averages. b) Comment on the validity of the model based on the 95% confidence level.arrow_forwardplease answer within 30 minutes with detailed explanation as to why the option is right and why other options are wrong. make sure the answer is well explained and is in details else i will give negative ratings.arrow_forward

- 4. Mostly customers try to buy products . (1 Point) of lowest value in comparison to their benefit of lowest value in comparison to their cost of highest value that meets their wants and needsarrow_forward1. Online sales are highest for: a. B2B products b. B2C products c. B2B services d. B2C services Explain why other options are incorrect.arrow_forwardPlease get to me soon.arrow_forward

- 3. A company has a linear total cost function and has determined that over the next three months it can produce 1,000 units at a total cost of $300,000. This same manufacturer can produce 2,000 units at a total cost of $400,000. The units sell for $180 each. Find (i) fixted cost (ii) marginal cost, (iii) the break-even point and (iv) construct the break-even chart.arrow_forwardWhen a multiproduct plant operates at full capacity, decision must be made as to which products to emphasize. These decisions are frequently made with a short run focus. In making such decisions, managers should select products with the A. Highest sales price per unit B. Highest sales volume potential C. Highest individual unit contribution margin D. Highest contribution margin per unit of the constraining resourcearrow_forwardThere are three steps to assessing product (ice cream) demand. Step 1: Talking Face-to-Face with Potential Customers Step 2: Using Online Tools Step 3: Library, Internet and Gumshoe Researcharrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.