Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

12th Edition

ISBN: 9780134741062

Author: Lee J. Krajewski, Manoj K. Malhotra, Larry P. Ritzman

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter A, Problem 21P

Summary Introduction

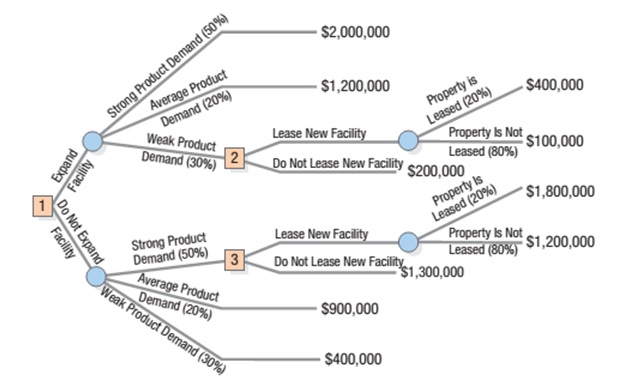

Interpretation: The owner of P Automotive Dealers is trying to decide whether to expand his current facility. If he expands and customer demand turns weak, there is a chance he could lease part of his newly constructed facility to another dealer. If he doesn’t expand and strong demand occurs, he could attempt to lease another facility across town. The decision tree shown in Figure A8 needs to be analyzed and the best set of decisions and expected payoffs needs to be determined.

Figure A.8

Concept Introduction: The measure of likelihood that an event will happen, in a random experiment is called probability.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The owner of Pearl Automotive Dealers is trying to decide whether to expand his current facility. If he expands and customer demand turns weak, there is a chance he could lease part of his newly constructed facility to another dealer.If he doesn’t expand and strong demand occurs, he could attempt to lease another facility across town. Analyze the decision tree in Figure A8. What is the best set of decisions and the expected payoff?

The following payoff table provides profits based on various possible decision alternatives adn various levels of demand at Robert Klassan's print shop:

decision low high

alt 1 $10,000 $36,000

alt 2 $6,000 $38,000

alt 3 -$2500 $52,000

The probability of low demand is 0.40 whereas the probability of high demand is 0.60.

a) The alternative that provides Robert the greatest expected monetary value is _________

The EMV for this decision is $_______

b) The expected value with perfect information (EVwPI)= $______

c) The expected value of perfect information (EVPI) for Robert= $________

A payoff table is given as:

S1

S2

S3

D1

250

750

500

D2

300

-250

1200

D3

500

500

600

(a) What choice should be made by the optimistic decision maker?

(b) What choice should be made by the conservative decision maker?

(c) What decision should be made under minimal regret?

(d) If the probabilities of d1, d2, and d3 are .2, .5, and .3, respectively, then what choice should be made under expected value?

Chapter A Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Ch. A - Mary Williams, owner of Williams Products, is...Ch. A - Prob. 2PCh. A - An interactive television service that costs $10...Ch. A - A restaurant is considering adding fresh brook...Ch. A - Spartan Castings must implement a manufacturing...Ch. A - A news clipping service is considering...Ch. A - Prob. 7PCh. A - Techno Corporation is currently manufacturing an...Ch. A - The Tri-County Generation and Transmission...Ch. A - Prob. 10P

Ch. A - Tri-County G&T sells 150,000 MWh per year of...Ch. A - The Forsite Company is screening three ideas for...Ch. A - Prob. 13PCh. A - Prob. 14PCh. A - Janice Gould of Krebs Consulting is in the process...Ch. A - Build-Rite Construction has received favorable...Ch. A - Prob. 17PCh. A - Prob. 18PCh. A - Prob. 20PCh. A - Prob. 21PCh. A - Prob. 22PCh. A - Prob. 24P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- The following payoff table provides profits based on various possible decision alternatives and various levels of demand. ALTERNATIVE DEMAND LOW MEDIUM HIGH Alternative 1 40 80 150 Alternative 2 80 120 130 Alternative 3 100 100 100 a. Which alternative should be chosen using the equally likely decision criterion? b. Set-up the opportunity loss table. c. Which alternative should be chosen using the minimax regret criterion?arrow_forwardDwayne Whitten, president of Whitten Industries, is considering whether to build a manufacturing plant in north Texas. His decision is summarized in the following table: Alternatives Favorable Market Unfavorable Market Build large plant $400,000 −$300,000 Build small plant $120,000 −$15,000 Don't Build $0 $0 Market Probability 0.40 0.60 a) The correct decision tree for Dwayne is shown in Figure ____ (all payoffs are in thousands). b) To maximize the return, Dwayne's decision should be to ______ . c) For Dwayne, the expected value of perfect information (EVPI) = $___________ (enter your answer as a whole numarrow_forwardSolve the following decision tree and create risk profiles and cumulative risk profiles for the alternatives defined by the original decision “A” and “B” using precisionTree. Which alternative is preferred? Explain.arrow_forward

- A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy 90 10 Rent 60 35 Lease 50 40 Using the Maximax criterion, what is the best decision and the expected payoff? Best decision Payoff 3 of 5arrow_forward1. Kirsten is trying to decide where to go for her well-earned vacation. She would like to camp, but if the weather is bad, she will have to go to a motel. Given the costs and probabilities of bad weather given below, which destination should she choose? Camping cost Motel cost Probability of bad weather Nevada $21.2 $80.9 0.2 Oregon $15.9 $84.6 0.4 California $30 $95 0.1 a. California, because its EMV = $33.14 b. Nevada, because its EMV = $33.14 c. California, because its EMV = $36.5 d. Any of the 3 choices. e. Oregon, because its EMV = $43.38 f. Nevada, because its EMV = $43.38 g. None of the 3 choices. h. Oregon, because its EMV is $36.50.arrow_forwardThere are two outcomes: a good market and a bad market. , The decision table is presented below. There are four alternatives: do nothing, build a small plant, build a medium-size plant, and build a large plant. PAYOFFS Outcomes Alternatives Good market Bad market Do nothing $0 $0 Small Plant $30,000 ($10,000) Medium Plant $100,000 ($15,000) Large Plant $200,000 ($30,000) So you are to workout the Maximax, the Maximin, the Equally likely the Hurwicz based on a .11 probability and the regret using minimax. In words give the answers to these questions: What are your answers under: Answers Best payoff option for maximax is Common Stock Best payoff option for maximin is doing nothing Best payoff option for equally likely is Common Stock Best payoff option for Hurwicz is doing nothing Put a Bold Box around the word Outcomes Keep the Bad Market amounts in Red Ink Make the type style Ariel and Size 12 in Blackarrow_forward

- A decision maker has prepared the following payoff table. States of Nature Alternative High Low 100 Buy Rent 80 45 Lease 50 40 Using the Maximin criterion, what is the best decision and the expected payoff? Best decision Payoffarrow_forwardBakery Products is considering the introduction of a new line of products. In order to produce the new line, the bakery is considering either a major or minor renovation of the current plant. Bakery Productshas the option of not developing the new line at all. The decision alternatives are shown in the payoff table below as well as the states of nature and probabilities. Payoffs are profits; Before making the final decision, Bakery Products can pay a market research firm $500.00 to survey consumer attitudes towards the company's products. The results can be either “vibrant” or “limp”. Thereliability of the company, based on past performance, is given below. That is: P(V|F) = 0.80;P(V|N) = 0.60;P(V|U) = 0.30; P(L|F) = 0.20;P(L|N) = 0.40;P(L|U) = 0.70; After you have computed the revised probabilities round to two decimal places a) Construct the appropriate decision tree to help Bakery products make the appropriate decisions. This tree must be constructed in logical order with labels…arrow_forwardA decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy 85 5 Rent 70 45 Lease 45 55 Using the Maximax criterion, what is the best decision and the expected payoff?arrow_forward

- The Irontown Independent School District wants to sell a parcel of unimproved land that it does not need. Its three best offers are as follows: Organization/Company Offer Proposed Use The State Department of Public Safety (DPS) $5.7 million New state highway patrol barracks The Lexington Presbyterian Church $5.6 million Start a church school Newberry Inc. $5.5 million Open a car dealership As the financial adviser for the school district, which offer would you prefer?arrow_forward1) A television network earns an average of $1.6 million each season from a hit program and loses an average of $400,000 each season on a program that turns out to be a flop, and of all programs picked up by this network in recent years, 25% turn out to be hits and 75% turn out to be flops. a) Construct a decision tree to help the television network identify the strategy that maximizes itsexpected profit in responding to a newly proposed television program. Make sure to label all decisionand chance nodes and include appropriate costs, payoffs and probabilities. b) What should the network do? What is their expected profit? c) The network can conduct market research to determine whether a program will be a hit or a flop. If the market research report is perfectly reliable, what is the most the network should be willing to pay for it? 2) A buyer for a large sporting goods store chain must place orders for professional footballs with the football manufacturer six months prior to the…arrow_forwardA decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy 75 -10 Rent 70 30 Lease 50 35 Prior Probability 0.5 0.5 Using Baye's Decision Rule, what is the best decision and the expected payoff? (Round your answer to 1 decimal place.) Best decision Рayofarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning