Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

12th Edition

ISBN: 9780134741062

Author: Lee J. Krajewski, Manoj K. Malhotra, Larry P. Ritzman

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter A, Problem 16P

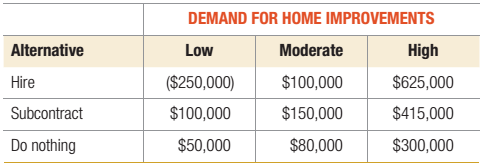

Build-Rite Construction has received favorable publicity from guest appearances on a public TV home improvement program. Public TV programming decisions seem to be unpredictable, so Build-Rite cannot estimate the probability of continued benefits from its relationship with the show. Demand for home improvements next year may he either low or high. But Build-Rite must decide now whether to hire more employees, do nothing, or develop subcontracts with other home improvement contractors. Build-Rite has developed the following payoff table:

Which alternative is best, according to each of the following decision criteria?

- Maximin

- Maximax

- Laplace

- Minimax regret

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

CVS signed a 15-year triple net lease for a 333,000 square foot distribution facility in Irvine, California with a first year base rent of $2,250,000 and fixed annual base rent increases of 3% per year. What would be the expected sale price of the property if it is sold at the end of the tenth lease year based on a sale capitalization rate of 4% that is applied to the eleventh year projected NOI?

a. $75,595,296

b. $56,250,000

c. $77,863,155

d. $73,393,492

Scenario: The buyer and seller are engaging in an FPIF (Fixed-Price Incentive Fee) contract and agree on the following parameters:

Target Cost: $380,000

Actual Cost: $395,000

Sharing Ratio: Buyer 70%/30% Seller

Target Profit (AKA Target Fee): $20,000

Price Ceiling (AKA Point of Total Assumption): $410, 000

Please fill in the blanks below with the appropriate values.

Target Cost: ----------------------------------

Actual Cost: -------------------------------------

Variance (over/under): --------------------------------

Seller sharing ratio: -------------------------------------

Overrun/Underrun:----------------------------------------------

Target Profit: --------------------------------------------------------

Profit:-------------------------------------------------------------

Actual Cost: -------------------------------------------------------

Price: ---------------------------------------------------------------

Price Ceiling:…

ysis ...

Help

Save & Exit

Submit

A decision maker has prepared the following payoff table.

States of Nature

Alternative

High

Low

Buy

85

-5

Rent

75

40

Lease

45

45

Using the Maximin criterion, what is the best decision and the expected payoff?

Best decision

Payoff

< Prev

5 of 5

Nexle

Chapter A Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Ch. A - Mary Williams, owner of Williams Products, is...Ch. A - Prob. 2PCh. A - An interactive television service that costs $10...Ch. A - A restaurant is considering adding fresh brook...Ch. A - Spartan Castings must implement a manufacturing...Ch. A - A news clipping service is considering...Ch. A - Prob. 7PCh. A - Techno Corporation is currently manufacturing an...Ch. A - The Tri-County Generation and Transmission...Ch. A - Prob. 10P

Ch. A - Tri-County G&T sells 150,000 MWh per year of...Ch. A - The Forsite Company is screening three ideas for...Ch. A - Prob. 13PCh. A - Prob. 14PCh. A - Janice Gould of Krebs Consulting is in the process...Ch. A - Build-Rite Construction has received favorable...Ch. A - Prob. 17PCh. A - Prob. 18PCh. A - Prob. 20PCh. A - Prob. 21PCh. A - Prob. 22PCh. A - Prob. 24P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Scenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling contract submitted by four suppliers. She was evaluating the quotes based on price, target quality levels, and delivery lead time promises. As she was working, her manager, Dave Cox, entered her office. He asked how everything was progressing and if she needed any help. She mentioned she was reviewing quotations from suppliers for a tooling contract. Dave asked who the interested suppliers were and if she had made a decision. Sharon indicated that one supplier, Apex, appeared to fit exactly the requirements Visionex had specified in the proposal. Dave told her to keep up the good work. Later that day Dave again visited Sharons office. He stated that he had done some research on the suppliers and felt that another supplier, Micron, appeared to have the best track record with Visionex. He pointed out that Sharons first choice was a new supplier to Visionex and there was some risk involved with that choice. Dave indicated that it would please him greatly if she selected Micron for the contract. The next day Sharon was having lunch with another buyer, Mark Smith. She mentioned the conversation with Dave and said she honestly felt that Apex was the best choice. When Mark asked Sharon who Dave preferred, she answered, Micron. At that point Mark rolled his eyes and shook his head. Sharon asked what the body language was all about. Mark replied, Look, I know youre new but you should know this. I heard last week that Daves brother-in-law is a new part owner of Micron. I was wondering how soon it would be before he started steering business to that company. He is not the straightest character. Sharon was shocked. After a few moments, she announced that her original choice was still the best selection. At that point Mark reminded Sharon that she was replacing a terminated buyer who did not go along with one of Daves previous preferred suppliers. Ethical decisions that affect a buyers ethical perspective usually involve the organizational environment, cultural environment, personal environment, and industry environment. Analyze this scenario using these four variables.arrow_forwardScenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling contract submitted by four suppliers. She was evaluating the quotes based on price, target quality levels, and delivery lead time promises. As she was working, her manager, Dave Cox, entered her office. He asked how everything was progressing and if she needed any help. She mentioned she was reviewing quotations from suppliers for a tooling contract. Dave asked who the interested suppliers were and if she had made a decision. Sharon indicated that one supplier, Apex, appeared to fit exactly the requirements Visionex had specified in the proposal. Dave told her to keep up the good work. Later that day Dave again visited Sharons office. He stated that he had done some research on the suppliers and felt that another supplier, Micron, appeared to have the best track record with Visionex. He pointed out that Sharons first choice was a new supplier to Visionex and there was some risk involved with that choice. Dave indicated that it would please him greatly if she selected Micron for the contract. The next day Sharon was having lunch with another buyer, Mark Smith. She mentioned the conversation with Dave and said she honestly felt that Apex was the best choice. When Mark asked Sharon who Dave preferred, she answered, Micron. At that point Mark rolled his eyes and shook his head. Sharon asked what the body language was all about. Mark replied, Look, I know youre new but you should know this. I heard last week that Daves brother-in-law is a new part owner of Micron. I was wondering how soon it would be before he started steering business to that company. He is not the straightest character. Sharon was shocked. After a few moments, she announced that her original choice was still the best selection. At that point Mark reminded Sharon that she was replacing a terminated buyer who did not go along with one of Daves previous preferred suppliers. What should Sharon do in this situation?arrow_forwardScenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling contract submitted by four suppliers. She was evaluating the quotes based on price, target quality levels, and delivery lead time promises. As she was working, her manager, Dave Cox, entered her office. He asked how everything was progressing and if she needed any help. She mentioned she was reviewing quotations from suppliers for a tooling contract. Dave asked who the interested suppliers were and if she had made a decision. Sharon indicated that one supplier, Apex, appeared to fit exactly the requirements Visionex had specified in the proposal. Dave told her to keep up the good work. Later that day Dave again visited Sharons office. He stated that he had done some research on the suppliers and felt that another supplier, Micron, appeared to have the best track record with Visionex. He pointed out that Sharons first choice was a new supplier to Visionex and there was some risk involved with that choice. Dave indicated that it would please him greatly if she selected Micron for the contract. The next day Sharon was having lunch with another buyer, Mark Smith. She mentioned the conversation with Dave and said she honestly felt that Apex was the best choice. When Mark asked Sharon who Dave preferred, she answered, Micron. At that point Mark rolled his eyes and shook his head. Sharon asked what the body language was all about. Mark replied, Look, I know youre new but you should know this. I heard last week that Daves brother-in-law is a new part owner of Micron. I was wondering how soon it would be before he started steering business to that company. He is not the straightest character. Sharon was shocked. After a few moments, she announced that her original choice was still the best selection. At that point Mark reminded Sharon that she was replacing a terminated buyer who did not go along with one of Daves previous preferred suppliers. What does the Institute of Supply Management code of ethics say about financial conflicts of interest?arrow_forward

- Using facts provided in the case, conduct a strengths, weaknesses, opportunities, and threats (SWOT) analysis of AE AE had already gone through several rounds of funding (see Exhibit 1),7 and in June 2019, it had onemanufacturing centre with an installed capacity of 20,000–25,000 units. The manufacturing centre waslocated in Bengaluru, which was also the only city in which AE sold its smart e-scooters. AE had alsocreated a comprehensive public charging network called AtherGrid, which was launched in May 2019.With 31 locations in Bengaluru and 7 more in Chennai, AtherGrid was designed to provide a charginginfrastructure within 4 kilometres (km) of any commuter. Over the next five years, AE planned to set up anew manufacturing facility and additional charging infrastructure in several more cities, with the goal ofselling 1 million smart e-scooters annually. The company also planned to begin accepting pre-orders inother Indian cities, such as Chennai, Pune, Hyderabad, and Delhi, with a…arrow_forwardShalimar Group of Industries reports the following information concerning cash balances and cash transactions for the month of April: A Cash balance per bank statement as of April 30 was $22,992.50 Two debit memoranda accompany the bank statement: one for $9 was for service charges for the month; the other for $62.50 was attached to an NSF check from Rizwan. Included with the bank statement was $3123.25 credit memorandum for interest earned on the bank account in April. The paid checks returned with the April bank statement disclosed an error in Shalimarcash records. Check no.751 for $67.35 for telephone expense had erroneously been listed in the cash payments journal as $76.35. A collection charge for $25 (not applicable to Daytona) was erroneously deducted from the account by the bank. Notice that this was the bank’s error. Cash receipts of April 30 amounting to $484.75 were mailed to the bank too late to be included in the April bank statement. Checks outstanding as of April 30…arrow_forwardMavis and John have joined forces to start M&J Food Products, a processor of packaged shredded lettuce for institutional use. John has years of food processing experience, and Mavis has extensive commercial food preparation experience. The process will consist of opening crates of lettuce and then sorting, washing, slicing, preserving, and finally packaging the prepared lettuce. Together, with help from vendors, they think they can adequately estimate demand, fixed costs, revenues, and variable cost per 5-pound bag of lettuce. They think a largely manual process will have monthly fixed cost of $50,000and a variable cost of $2.50 per bag. They expect to sell 75,000 bags of lettuce per month. They expect to sell the shredded lettuce for $3.25 per 5-pound bag. John and Mavis has been contacted by a vendor to consider a more mechanized process. This new process will have monthly fixed cost of $125,000 per month with a variable cost of $1.75 per bag. Based on the above scenario: Should…arrow_forward

- Given the following payoff table (in K million), about a cooking oil producer in Lusaka. The company is researching for its 2019 budget production levels. High Demand Average Demand Low Demand Produce 30,000 39 5 -13Produce 20,000 28 12 9Produce 12,000 13 4 -10Probability ? 0.5 0.2 a) Explain the meaning of 39 and -10 in the payoff table. b) What are the expected payoffs for each production level? (determine the missing probability). c) What is the expected payoff under perfect information? d) How much should the company invest in further market research to obtain perfect information?arrow_forwardExplain the primary purpose of a cost-allocation system. Explain the difference between a prospective and retrospective approach to a risk management program.arrow_forwardAs a result of an increase in demand for a town’s car parking facilities, the owners ofa car park are reviewing their business operations. A decision has to be made nowto select one of the following three options for the next year:Option 1 : Make no change. Annual profit is RM150, 000. There is littlelikelihood that this will provoke new competition this year.Option 2 : Raise prices by 50%. If this occurs there is a 75% chance that anentrepreneur will set up in competition this year. The Board’sestimate of its annual profit in this situation would be as follows:2A WITH new competitor 2B WITHOUT new competitorProbability Profit (RM) Probability Profit (RM)0.3 200, 000 0.5 250, 0000.4 170, 000 0.3 200, 0000.3 130, 000 0.2 150, 000Option 3 : Expand the car park quickly, at a cost of RM50, 000, keeping pricesthe same. The profits are then estimated to be like 2B, above, exceptthat the probabilities would be 0.6, 0.3 and 0.1 respectively.Requireda) Draw a decision tree for this problem,…arrow_forward

- The Opportunity Cost of any choice is: A the direct cost. B the indirect cost. C the foregone value of the third best alternative. D the foregone value of the next best alternative.arrow_forwardA public school is being renovated for $13.5 million. The building has geothermal heating and cooling, high-efficiency windows, and a solar array that permits the school to sell electricity back to the local electric utility. The annual value of these benefits is estimated to be $2.7 million. In addition, the residual value of the school at the end of its 40-year life is negligible. What is the simple payback period for the renovated school? [ Select ] What is the internal rate of return for the renovated [ Select ] school?arrow_forwardThe Jennings Construction Company has decided to bid on the construction for each of the two phases of a large project. The bidding requirements are that the costs for each phase be submitted separately together with a transition cost for turning over the first phase of the program to a second contractor should Jennings not receive both awards or perform unsatisfactorily on the first phase. The evaluation for the award of the second phase will not be made until the first phase is near completion. How can the transition costs be identified in the strategic planning model?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Inventory Management | Concepts, Examples and Solved Problems; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=2n9NLZTIlz8;License: Standard YouTube License, CC-BY