Concept explainers

Completing a

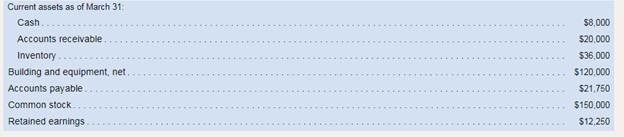

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods

a. The gross margin is 25°o of sales.

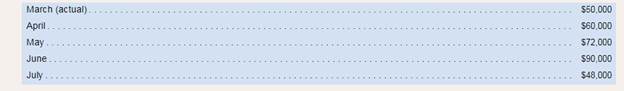

b. Actual and budgeted sales data:

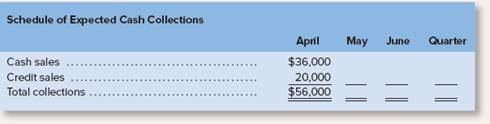

c. Sales are 609o for cash and 40% on credit. Credit sales are collected in the month following sale. The

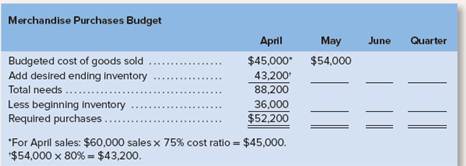

d. Each month’s ending inventory should equal 80°ó of the following month’s budgeted cost of goods sold.

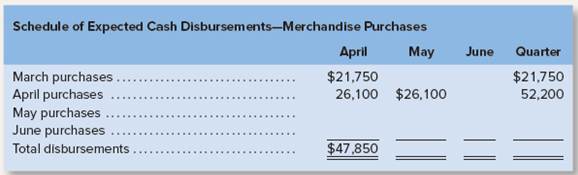

e. One-half of a month’s inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. Theaccounts payable at March 31 are the result of March purchases of inventory.

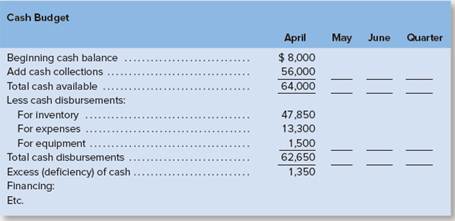

f. Monthly expenses are as follows: commissions, 12% of sales; rent, $2,500 per month; other expenses (excluding depreciation), 6% of sales.

Assume that these expenses are paid monthly. Depreciation is S900 per month (includes depreciation on new assets).

g. Equipment costing $1,500 will be purchased for cash in April.

h. Management would like to maintain a minimum cash balance of at least S4,000 at the end of each month. The company has an agreementwith a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The companywould, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

Using the preceding data:

1. Complete the following schedule:

2. Complete the following:

3. Complete the following

4. Using Schedule 9 as your guide, prepare an absorption costing income statement for the quarter ended June 30.

5. Prepare a

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Introduction To Managerial Accounting

- A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forwardOperating Budget, Comprehensive Analysis Allison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: a. Finished goods inventory on January 1 is 32,000 units, each costing 166.06. The desired ending inventory for each month is 80% of the next months sales. b. The data on materials used are as follows: Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next months production needs. This is exactly the amount of material on hand on December 31 of the prior year. c. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is 14.25. d. Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.) e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.) f. The unit selling price of the subassembly is 205. g. All sales and purchases are for cash. The cash balance on January 1 equals 400,000. The firm requires a minimum ending balance of 50,000. If the firm develops a cash shortage by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January. Required: 1. Prepare a monthly operating budget for the first quarter with the following schedules. (Note: Assume that there is no change in work-in-process inventories.) a. Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f. Selling and administrative expenses budget g. Ending finished goods inventory budget h. Cost of goods sold budget i. Budgeted income statement j. Cash budget 2. CONCEPTUAL CONNECTION Form a group with two or three other students. Locate a manufacturing plant in your community that has headquarters elsewhere. Interview the controller for the plant regarding the master budgeting process. Ask when the process starts each year, what schedules and budgets are prepared at the plant level, how the controller forecasts the amounts, and how those schedules and budgets fit in with the overall corporate budget. Is the budgetary process participative? Also, find out how budgets are used for performance analysis. Write a summary of the interview.arrow_forwardPerformance Report Based on Budgeted and Actual Levels of Production Balboa Company budgeted production of 4,500 units with the following amounts: At the end of the year, Balboa had the following actual costs for production of 4,700 units: Required: 1. Calculate the budgeted amounts for each cost category listed above for the 4,500 budgeted units. 2. Prepare a performance report using a budget based on expected (budgeted) production of 4,500 units. 3. Prepare a performance report using a budget based on the actual level of production of 4,700 units.arrow_forward

- Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of 15.9 million and cost of goods sold of 8.75 million. Advertising is a key part of Coral Seas business strategy, and total marketing expense for the year is budgeted at 2.8 million. Total administrative expenses are expected to be 675,000. Coral Seas has no interest expense. Income taxes are paid at the rate of 40 percent of operating income. Required: 1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year. 2. What if Coral Seas had interest payments of 500,000 during the year? What effect would that have on operating income? On income before taxes? On net income?arrow_forwardPrepare a cost of goods sold budget for the Crest Hills Manufacturing Co. for the year ended December 31, 2016, from the following estimates. Inventories of production units: Direct materials purchased during the year, 854,000; beginning inventory of direct materials, 31,000; and ending inventory of direct materials, 26,000. Totals from other budgets included:arrow_forwardBudgeted income statement and supporting budgets The budget director of Jupiter Helmets Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for May: Prepare a cost of goods sold budget for May. Work in process at the beginning of May is estimated to be $4200. and work in process at the end of May is desired to be $3800.arrow_forward

- Preparing a performance report Use the flexible budget prepared in P7-6 for the 29,000-unit level of activity and the actual operating results listed below for the 29,000- unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 29,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forwardPreparing a performance report Use the flexible budget prepared in P7-6 for the 31,000-unit level and the actual operating results listed below for the 31,000-unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 31,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forwardBlue Book printing is budgeting sales of 25,000 units and already has 5,000 in beginning inventory. How many units must be produced to also meet the 7,000 units required in ending inventory?arrow_forward

- Use the following information for Exercises 9-50 and 9-51: Assume that Stillwater Designs produces two automotive subwoofers: S12L7 and S12L5. The S12L7 sells for 475, and the S12L5 sells for 300. Projected sales (number of speakers) for the coming 5 quarters are as follows: The vice president of sales believes that the projected sales are realistic and can be achieved by the company. Exercise 9-50 Sales Budget Refer to the information regarding Stillwater Designs above. Required: 1. Prepare a sales budget for each quarter of 20X1 and for the year in total. Show sales by product and in total for each time period. 2. CONCEPTUAL CONNECTION How will Stillwater Designs use this sales budget?arrow_forwardDigital Solutions Inc. uses flexible budgets that are based on the following data: Prepare a flexible selling and administrative expenses budget for October for sales volumes of 500,000, 750,000, and 1,000,000.arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 50,000. Sales are higher than expected and management needs to revise its budget. Prepare a flexible budget for 100,000 and 110,000 units of sales.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning