Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 48BEB

Performance Report Based on Budgeted and Actual Levels of Production

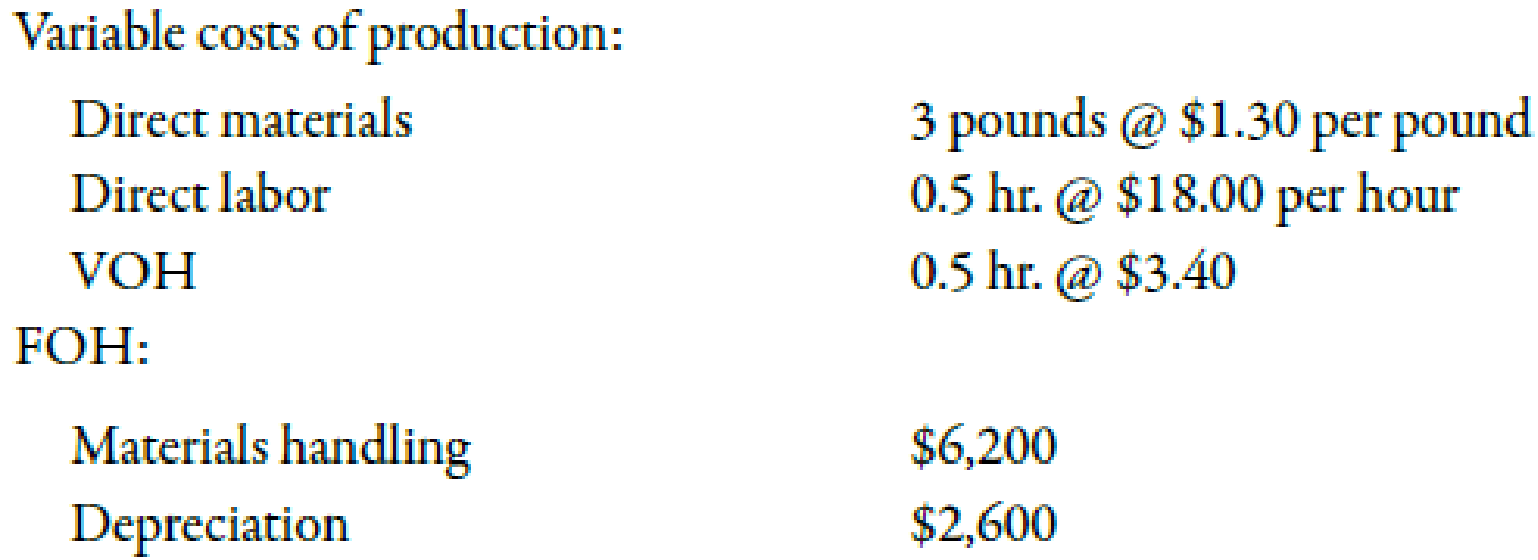

Balboa Company budgeted production of 4,500 units with the following amounts:

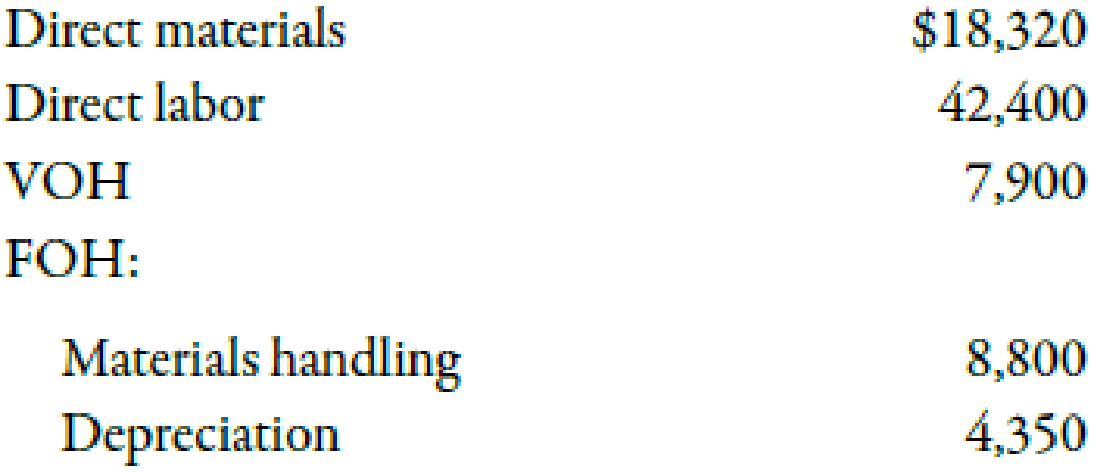

At the end of the year, Balboa had the following actual costs for production of 4,700 units:

Required:

- 1. Calculate the budgeted amounts for each cost category listed above for the 4,500 budgeted units.

- 2. Prepare a performance report using a budget based on expected (budgeted) production of 4,500 units.

- 3. Prepare a performance report using a budget based on the actual level of production of 4,700 units.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Solve Using with Accounting Method

The welding department had beginning work in process of 20,000 units, ending work in process of 26,000 units, and units transferred out of 60,000 units. What was the number of units started or transferred in?

Variable costs 24000 and fc 16500

Chapter 9 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 9 - Define the term budget. How are budgets used in...Ch. 9 - Prob. 2DQCh. 9 - Explain how both small and large organizations can...Ch. 9 - Prob. 4DQCh. 9 - What is a master budget? An operating budget? A...Ch. 9 - Explain the role of a sales forecast in budgeting....Ch. 9 - All budgets depend on the sales budget. Is this...Ch. 9 - Why is goal congruence important?Ch. 9 - Why is it important for a manager to receive...Ch. 9 - What is participative budgeting? Discuss some of...

Ch. 9 - A budget too easily achieved will lead to...Ch. 9 - Explain why a manager has an incentive to build...Ch. 9 - Discuss the differences between static and...Ch. 9 - Explain why mixed costs must be broken down into...Ch. 9 - What is the purpose of a before-the-fact flexible...Ch. 9 - Prob. 1MCQCh. 9 - Which of the following is part of the control...Ch. 9 - Which of the following is not an advantage of...Ch. 9 - The budget committee a. reviews the budget. b....Ch. 9 - A moving, 12-month budget that is updated monthly...Ch. 9 - Which of the following is not part of the...Ch. 9 - Before a direct materials purchases budget can be...Ch. 9 - The first step in preparing the sales budget is to...Ch. 9 - Which of the following is needed to prepare the...Ch. 9 - A company requires 100 pounds of plastic to meet...Ch. 9 - A company plans to sell 220 units. The selling...Ch. 9 - Select the one budget below that is not an...Ch. 9 - A company has the following collection pattern:...Ch. 9 - The percentage of accounts receivable that is...Ch. 9 - Which of the following is not an advantage of...Ch. 9 - Prob. 16MCQCh. 9 - For performance reporting, it is best to compare...Ch. 9 - To create a meaningful performance report, actual...Ch. 9 - To help assess performance, managers should use a...Ch. 9 - A firm comparing the actual variable costs of...Ch. 9 - Preparing a Sales Budget Patrick Inc. sells...Ch. 9 - Preparing a Production Budget Patrick Inc. makes...Ch. 9 - Preparing a Direct Materials Purchases Budget...Ch. 9 - Preparing a Direct Labor Budget Patrick Inc. makes...Ch. 9 - Preparing an Overhead Budget Patrick Inc. makes...Ch. 9 - Preparing an Ending Finished Goods Inventory...Ch. 9 - Preparing a Cost of Goods Sold Budget Andrews...Ch. 9 - Preparing a Selling and Administrative Expenses...Ch. 9 - Preparing a Budgeted Income Statement Oliver...Ch. 9 - Preparing a Schedule of Cash Collections on...Ch. 9 - Preparing an Accounts Payable Schedule Wight Inc....Ch. 9 - Preparing a Cash Budget La Famiglia Pizzeria...Ch. 9 - Flexible Budget with Different Levels of...Ch. 9 - Performance Report Based on Budgeted and Actual...Ch. 9 - Preparing a Sales Budget Tulum Inc. sells powdered...Ch. 9 - Preparing a Production Budget Tulum Inc. makes a...Ch. 9 - Preparing a Direct Materials Purchases Budget...Ch. 9 - Preparing a Direct Labor Budget Tulum Inc. makes a...Ch. 9 - Preparing an Overhead Budget Tulum Inc. makes a...Ch. 9 - Prob. 40BEBCh. 9 - Preparing a Cost of Goods Sold Budget Lazlo...Ch. 9 - Preparing a Selling and Administrative Expenses...Ch. 9 - Preparing a Budgeted Income Statement Jameson...Ch. 9 - Preparing a Schedule of Cash Collections on...Ch. 9 - Pilsner Inc. purchases raw materials on account...Ch. 9 - Preparing a Cash Budget Olivers Bistro provided...Ch. 9 - Flexible Budget with Different Levels of...Ch. 9 - Performance Report Based on Budgeted and Actual...Ch. 9 - Planning and Control a. Dr. Jones, a dentist,...Ch. 9 - Use the following information for Exercises 9-50...Ch. 9 - Prob. 51ECh. 9 - Production Budget and Direct Materials Purchases...Ch. 9 - Production Budget Aqua-Pro Inc. produces...Ch. 9 - Direct Materials Purchases Budget Langer Company...Ch. 9 - Direct Labor Budget Evans Company produces asphalt...Ch. 9 - Sales Budget Alger Inc. manufactures six models of...Ch. 9 - Production Budget and Direct Materials Purchases...Ch. 9 - Schedule of Cash Collections on Accounts...Ch. 9 - Schedule of Cash Collections on Accounts...Ch. 9 - Cash Payments Schedule Fein Company provided the...Ch. 9 - Cash Budget The owner of a building supply company...Ch. 9 - Flexible Budget for Various Levels of Production...Ch. 9 - Use the following information for Exercises 9-63...Ch. 9 - Use the following information for Exercises 9-63...Ch. 9 - Prob. 65PCh. 9 - Operating Budget, Comprehensive Analysis Allison...Ch. 9 - Use the following information for Problems 9-67...Ch. 9 - Use the following information for Problems 9-67...Ch. 9 - Use the following information for Problems 9-67...Ch. 9 - Ryan Richards, controller for Grange Retailers,...Ch. 9 - Participative Budgeting, Not-for-Profit Setting...Ch. 9 - Cash Budget The controller of Feinberg Company is...Ch. 9 - Optima Company is a high-technology organization...Ch. 9 - Direct Materials and Direct Labor Budgets Willison...Ch. 9 - Prob. 75PCh. 9 - Prob. 76CCh. 9 - Prob. 77CCh. 9 - Budgetary Performance, Rewards, Ethical Behavior...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Question can you please solve this problem?arrow_forwardNeed solutionarrow_forwardBefore issuing a report on the compilation of financial statements of a non-public entity, the accountant should: a. Apply analytical procedures to selected financial data to discover any material misstatements. b. Corroborate at least a sample of the assertions management has embodied in the financial statements. c. Inquire of the client's personnel whether the financial statements omit substantially all disclosures. d. Read the financial statements to consider whether the financial statements are free from obvious material errors.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY