Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7P

Preparing a performance report

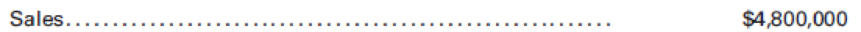

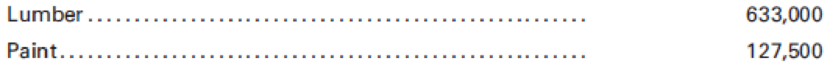

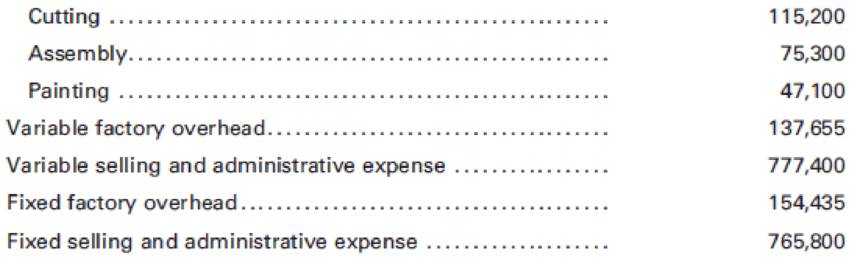

Use the flexible budget prepared in P7-6 for the 31,000-unit level and the actual operating results listed below for the 31,000-unit level.

Required:

- 1. Prepare a performance report.

- 2. List the major reasons why the actual operating income at 31,000 units differs from the

master budget operating income at 30,000 units in Figure 7-12. - 3. Given the level at which the company operated, how was its cost control?

Item

Direct materials:

Direct labor:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required:

a) Using Activity Based Costing, calculate the rate for each cost driver.

b) Using activity based budgeting, prepare a budgeted yearly operating statement for

Aero3D Ltd. Show the following separately, within the statement.

i. The budgeted output for each product per year;

ii. The contribution to profits for each product and in total before charging

activity based costs;

iii. The profit for each product and in total after charging activity based costs

but before charging core costs (non-activity based costs);

iv. The total profit after charging core based costs.

1. Match each of the following terms with the appropriate definition.

The difference between

actual and budgeted

revenue or cost caused by

the difference between the

actual number of units sold

or used and the budgeted

number of units.

A budget prepared after an

operating period is

complete in order to help

managers evaluate past

performance; uses fixed

and variable costs in

determining total costs.

The costs that should be

incurred under normal

conditions to produce a

specific product or to

perform a specific service.

The difference between

1. Cost Variance

total overhead cost that

would have been expected

if the actual operating

2. Volume Variance

volume had been

accurately predicted and

3. Price Variance

the amount of overhead

cost that was allocated to

products using the

predetermined standard

overhead rate.

4. Quantity Variance

5. Standard Costs

A planning budget based on

a single predicted amount

6. Fixed Budget

of sales or production

volume; unsuitable for

7. Flexible Budget…

Match the definition the term.

Terms:

Cost variance

Overhead cost variance

Price variance

Quantity variance

Standard costs

Sales budget

Production Budget

Balanced scorecard

Profit center

Cost center

Definitions:

1. A plan showing the units of goods to be sold and sales to be derived; usually starting pointing the budgeting process.

2. A system of performance measures, including the nonfinancial measures, used to asses manager performance.

3. A department that incurs cost and genrate revenues, such as a selling department

4. The difference between actual and budgeted sales or cost caused by the difference between the actual per unit and the budgeted price per unit.

5. The difference between actual cost and standard cost, made up of a price variance and a quantity variance.

6. The difference between the total overhead cost actually incurred and the total overhead cost applied to products

7. The difference between the actual budgeted cost caused by…

Chapter 7 Solutions

Principles of Cost Accounting

Ch. 7 - Prob. 1QCh. 7 - Prob. 2QCh. 7 - Prob. 3QCh. 7 - Prob. 4QCh. 7 - Explain zero-based budgeting and how it differs...Ch. 7 - Prob. 6QCh. 7 - Which operating budget must be prepared before the...Ch. 7 - Prob. 8QCh. 7 - Why is it important to have front-line managers...Ch. 7 - If the sales forecast estimates that 50,000 units...

Ch. 7 - What are the advantages and disadvantages of each...Ch. 7 - What three operating budgets can be prepared...Ch. 7 - Prob. 13QCh. 7 - What are the three budgets that are needed in...Ch. 7 - Why might Web-based budgeting be more useful than...Ch. 7 - What is a flexible budget?Ch. 7 - Why is a flexible budget better than a master...Ch. 7 - Why is it important to distinguish between...Ch. 7 - Why is the concept of relevant range important...Ch. 7 - In comparing actual sales revenue to flexible...Ch. 7 - How would you define the following? a. Theoretical...Ch. 7 - Is it possible for a factory to operate at more...Ch. 7 - If a factory operates at 100% of capacity one...Ch. 7 - How is the standard cost per unit for factory...Ch. 7 - When allocating service department costs to...Ch. 7 - The sales department of Macro Manufacturing Co....Ch. 7 - The sales department of F. Pollard Manufacturing...Ch. 7 - Barnes Manufacturing Co. forecast October sales to...Ch. 7 - Prepare a cost of goods sold budget for the Crest...Ch. 7 - Prepare a cost of goods sold budget for MacLaren...Ch. 7 - Roman Inc. has the following totals from its...Ch. 7 - Starburst Inc. has the following items and amounts...Ch. 7 - Using the following per-unit and total amounts,...Ch. 7 - Cortez Manufacturing, Inc. has the following...Ch. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Calculating factory overhead The normal capacity...Ch. 7 - The Sales Department of Minimus Inc. has forecast...Ch. 7 - Sales, production, direct materials, direct labor,...Ch. 7 - Budgeted selling and administrative expenses for...Ch. 7 - Prob. 4PCh. 7 - Selling and administrative expense budget and...Ch. 7 - Preparing a flexible budget Use the information in...Ch. 7 - Preparing a performance report Use the flexible...Ch. 7 - Preparing a performance report Use the flexible...Ch. 7 - Flexible budget for factory overhead Presented...Ch. 7 - Prob. 10PCh. 7 - Overhead application rate Creole Manufacturing...Ch. 7 - Overhead application rate Roll Tide Manufacturing...Ch. 7 - Flexible budgeting, performance measurement, and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Adjusting Journal Entries; Adjusted Trial Balance. Magic Cleaning Services (MCS) has a fiscal year-end of Decem...

Intermediate Accounting (2nd Edition)

What are assets limited as to use and how do they differ from restricted assets?

Accounting For Governmental & Nonprofit Entities

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Preparing a performance report Use the flexible budget prepared in P7-6 for the 29,000-unit level of activity and the actual operating results listed below for the 29,000- unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 29,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forwardWhich approach is most likely to result in employee buy-in to the budget? A. top-down approach B. bottom-up approach C. total participation approach D. basing the budget on the prior yeararrow_forwardGiven the following information from Power Enterprises direct materials budget, how much direct materials needs to be purchased?arrow_forward

- Prepare a performance report that compares flexible budget and actual costs for the period just ended (i.e., the report that the general manager likely used when assessing Kellerman’s performance).arrow_forwardWhich approach is most likely to result in employee buy-in to the budget? Group of answer choices A. top-down approach B. bottom-up approach D. basing the budget on the prior year C. total participation approacharrow_forward1. Prepare a performance report that compares static budget and actual costs for the period just ended (i.e., the report that Kellerman likely used when assessing his performancearrow_forward

- A company uses two major material inputs in its production. To prepare its manufacturing operations budget, the company has to project the cost changes of these material inputs. The cost changes are independent of one another. The purchasing department provides the following probabilities associated with projected cost changes. Cost Change Material 1 Material 2 3% increase 0.3 0.5 5% increase 0.5 0.4 10% increase 0.2 0.1 The probability that there will be a 3% increase in the cost of both Material 1 and Material 2 is (E) a. 15% O b. 20% O c. 80% O d. 40%arrow_forward1) The sales budget is based on assumptions about the ___________. a) Number of units to be sold and selling price per unit. b) Timing of cash receipts. c) Contribution margin per unit and the number of units to be sold. d) Costs of the units produced and the total fixed costs. 2) When constructing the production budget, the desired ending inventory for the period is determined based on: a) Next period sales b) Next period production c) Last period production and sales d) Credit period 3)Standard time allowed to complete one unit is 2 hours. A worker during a week (48 hours) completed 20 units and drawn a salary of Rs. 6000. The standard rate per day of 8 hours shift is Rs. 1000. Which one of the following is true? a)Labour efficiency variance is Zero b)Labour rate variance is zero c)Labour cost variance is zero d)None of the abovearrow_forward2. Flexible Budget for Selling and Administrative Expenses for a Service Company Morningside Technologies Inc. uses flexible budgets that are based on the following data:arrow_forward

- Variable service department costs should be charged to operating departments at the end of the period according to the formula Multiple Choice Budgeted rate Budgeted activity Actual rate Actual activity Budgeted total cost Percentage of peak period capacity required. Budgeted rate - Actual activity. Oarrow_forwardOn the production budget, the number of units to be produced is computed as Select one: a. unit sales + desired end inventory + beginning inventory. b. unit sales - desired end inventory - beginning inventory. c. unit sales - desired end inventory + beginning inventory. d. unit sales + desired end inventory - beginning inventory. e. unit sales - cost of goods sold + beginning inventory. PreviousSave AnswersNextarrow_forwardProduction budgets are used as a basis for the preparation of which of the following budgets? a. Operating expensesb. Direct materials purchases, direct labour cost, and factory overhead cost c. Sales in poundsd. Sales in unitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY