Concept explainers

Direct Materials and Direct Labor Budgets LOB—4, L08—5

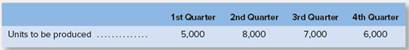

The production department of Zan Corporation has submitted the following

In addition, 6,000 grams of raw materials inventor is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is 52,880.

Each unit requires g grams of raw material that costs 51.20 per gram. Management desires to end each quarter with an inventory of raw materials equal to25% of the following quarters production needs. The desired ending inventory for the 4th Quarter is 8,000 grams. Management plans to pay for 60% of rawmaterial purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.20 direct labor-hours and direct laborers are paid S 11.50 perhour.

Required:

1. Calculate the estimated grams of raw material that need to be purchased each quarter and for the year as a whole (Hint: Refer to Schedule 3 for guidance).

2. Calculate the cost of raw material purchases for each quarter and for the year as a whole (Hint: Refer to Schedule 3 for guidance).

3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole (Hint: Refer to Schedule 3 for guidance).

4. Calculate the estimated direct labor cost for each quarter and for the year as a whole. Assume that the direct labor workforce is adjusted each quarter tomatch the number of hours required to produce the estimated number of units produced (Hint: Refer to Schedule 4 for guidance).

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Introduction To Managerial Accounting

- Operating Budget, Comprehensive Analysis Allison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: a. Finished goods inventory on January 1 is 32,000 units, each costing 166.06. The desired ending inventory for each month is 80% of the next months sales. b. The data on materials used are as follows: Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next months production needs. This is exactly the amount of material on hand on December 31 of the prior year. c. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is 14.25. d. Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.) e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.) f. The unit selling price of the subassembly is 205. g. All sales and purchases are for cash. The cash balance on January 1 equals 400,000. The firm requires a minimum ending balance of 50,000. If the firm develops a cash shortage by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January. Required: 1. Prepare a monthly operating budget for the first quarter with the following schedules. (Note: Assume that there is no change in work-in-process inventories.) a. Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f. Selling and administrative expenses budget g. Ending finished goods inventory budget h. Cost of goods sold budget i. Budgeted income statement j. Cash budget 2. CONCEPTUAL CONNECTION Form a group with two or three other students. Locate a manufacturing plant in your community that has headquarters elsewhere. Interview the controller for the plant regarding the master budgeting process. Ask when the process starts each year, what schedules and budgets are prepared at the plant level, how the controller forecasts the amounts, and how those schedules and budgets fit in with the overall corporate budget. Is the budgetary process participative? Also, find out how budgets are used for performance analysis. Write a summary of the interview.arrow_forwardPlay-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following manufacturing costs: For the coming year, Play-Disc expects to make 300,000 plastic discs, and to sell 285,000 of them. Budgeted beginning inventory in units is 16,000 with unit cost of 4.75. (There are no beginning or ending inventories of work in process.) Required: 1. Prepare an ending finished goods inventory budget for Play-Disc for the coming year. 2. What if sales increased to 290,000 discs? How would that affect the ending finished goods inventory budget? Calculate the value of budgeted ending finished goods inventory.arrow_forwardEach unit requires direct labor of 2.2 hours. The labor rate is $11.50 per hour and next years direct labor budget totals $834.900. How many units are included in the production budget for next year?arrow_forward

- Eastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc., budgeted sales of the following. At the end of the year, actual sales revenue for Product R and Product S was 3,075,000 and 3,254,000, respectively. The actual price charged for Product R was 25 and for Product S was 20. Only 10 was charged for Product T to encourage more consumers to buy it, and actual sales revenue equaled 540,000 for this product. Required: 1. Calculate the sales price and sales volume variances for each of the three products based on the original budget. 2. Suppose that Product T is a new product just introduced during the year. What pricing strategy is Eastman, Inc., following for this product?arrow_forwardNashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardAccepting business at a special price Box Elder Power Company expects to operate at 85% of productive capacity during May. The total manufacturing costs for May for the production of 40,000 batteries are budgeted as follows: The company has an opportunity to submit a bid for 5,000 batteries to be delivered by May 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during May or increase the selling or administrative expenses. What is the unit cost below which Box Elder Power Company should not go in bidding on the government contract?arrow_forward

- Each unit requires direct labor of 4.1 hours. The labor rate is $13.75 per hour and next years production is estimated at 75,000 units. What is the amount to be included in next years direct labor budget?arrow_forwardThe production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st Quarter 11, 200 2nd Quarter 8,500 3rd Quarter 8,600 4th Quarter 10,980 Units to be produced Each unit requires 0.55 direct labor-hours, and direct laborers are paid $16.00 per hour. Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost Rordan Corporation Direct Labor Budget 2nd Quarter 1st Quarter 3rd Quarter 4th Quarter Yeararrow_forwardThe production manager of Rordan Corporation prepared the following quarterly production forecast for next year: Units to be produced 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 10,600 8,000 8,300 10,600 Each unit requires 0.25 direct labor-hour, and direct laborers are paid $16.00 per hour. Required: 1. Prepare a direct labor budget for next year. Note: Round "Direct labor time per unit (hours)" answers to 2 decimal places. Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost 1st Quarter Rordan Corporation Direct Labor Budget 2nd Quarter 3rd Quarter 4th Quarter Yeararrow_forward

- Automatic Irrigation, Inc. is preparing its manufacturing overhead budget for the 2022 year. Relevant data consist of the following: Qtr. 4 Qtr. 1 Qtr. 2 Qtr. 3 Control Units to be produced (by quarters): 6,000 10,000 12,000 9,000 Direct labor time: 1 hour per unit Variable overhead costs per direct labor hour: Indirect Materials $0.90; Indirect Labor $1.40; and Maintenance $0.50. Fixed overhead costs per quarter: Supervisory salaries $27,600; depreciation $4,000; and maintenance $1,900. Required Prepare the manufacturing overhead budget for the 2022 year showing quarterly data.arrow_forwardThe production manager of Rordan Corporation prepared the following quarterly production forecast for next year: Units to be produced 1st Quarter 2nd Quarter 3rd Quarter 10,600 8,500 7,000 4th Quarter 11,100 Each unit requires 0.35 direct labor-hour, and direct laborers are paid $20.00 per hour. Required: 1. Prepare a direct labor budget for next year. Note: Round "Direct labor time per unit (hours)" answers to 2 decimal places. Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Rordan Corporation Direct Labor Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Yeararrow_forwardThe production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 8,400 6,500 7,200 8,100 Each unit requires 0.65 direct labor-hours, and direct laborers are paid $12.00 per hour. Required: Prepare the company’s direct labor budget for the upcoming fiscal year. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.)arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College