Concept explainers

Schedules of Expected Cash Collections and Disbursements L08—2, L08—4, L08—8

You have been asked to prepare a December

a. The cash balance on December 1 is $40,000.

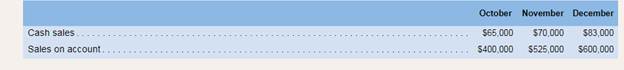

b. Actual sales for October and November and expected sales for December are as follows

Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible.

c. Purchases of inventory will total %280,000 for December. Thirty percent of a month’s inventorypurchases are paid during the month ofpurchase. The accounts payable remaining from November’s inventory purchases total $161,000, all of which will be paid in December.

d. Selling and administrative expenses are budgeted at $430000 for December. Of this amount, $50,000 is for depreciation.

e. A new web server for the Marketing Department costing $76,000 will be purchased for cash during December, and dividends totaling $9,000will be paid during the month.

£ The company maintains a minimum cash balance of S20000. An open line of credit is available from the company’s bank to increase itscash balance as needed.

Required:

1. Calculate the expected cash collections for December.

2. Calculate the expected cash disbursements for merchandise purchases for December.

3. Prepare a cash budget for December. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest willnot be paid until the following month.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Introduction To Managerial Accounting

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardRelevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardCash budget The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the following month (second month after sale). Depreciation, insurance, and property tax expense represent 12,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in February, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of June 1 include cash of 42,000, marketable securities of 25,000, and accounts receivable of 198,000 (150,000 from May sales and 48,000 from April sales). Sales on account in April and May were 120,000 and 150,000, respectively. Current liabilities as of June 1 include 13,000 of accounts payable incurred in May for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of 24,000 will be made in July. Mercury Shoes regular quarterly dividend of 15,000 is expected to be declared in July and paid in August. Management desires to maintain a minimum cash balance of 40,000. Instructions Prepare a monthly cash budget and supporting schedules for June, July, and August. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?arrow_forward

- Cash budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent 50,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of 40,000, marketable securities of 75,000, and accounts receivable of 300,000 (60,000 from July sales and 240,000 from August sales). Sales on account for July and August were 200,000 and 240,000, respectively. Current liabilities as of September 1 include 40,000 of accounts payable incurred in August for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of 55,000 will be made in October. Bridgeports regular quarterly dividend of 25,000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance of 50,000. Instructions Prepare a monthly cash budget and supporting schedules for September, October, and November. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?arrow_forwardTamarisk Garden Center has the following cash budget information available for the month of August: Beginning cash balance Cash receipts from sales and collections on account Collection of note receivable and interest Cash disbursements for operating expenses The company would have to $129,000 eTexthonk and Media 115,000 8,100 If the company has a policy of maintaining an end of the month cash balance of $120,000, determine the amount the company would have to borrow or the amount of excess cash it will have to invest in August. 96,400 SUPPORTarrow_forwardYou have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations: a. The cash balance on December 1 is $44,400. b. Actual sales for October and November and expected sales for December are as follows: Cash sales Sales on account October $ 72,600 $ 425,000 November $ 86,600 $ 601,000 December $ 89,000 $ 617,000 Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $358,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $207,000, all of which will be paid in December. d. Selling and administrative expenses are budgeted at $459,000…arrow_forward

- You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations: a. The cash balance on December 1 is $51,200. b. Actual sales for October and November and expected sales for December are as follows: October November December Cash sales Sales on account $ 74,200 $ 79,600 $ 83,600 $ 455,000 $ 550,000 $ 673,000 Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $346,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $177,000, all of which will be paid in December. d. Selling and administrative expenses are budgeted at $473,000…arrow_forwardThe following information was taken from Trusted Care Company's cash budget for the month of April: Beginning cash balance Cash receipts Cash disbursements If the company has a policy of maintaining an end of the month minimum cash balance of $25,000, the amount the company would have to borrow is $10,000 $13,000 $11,000 $0 $27,000 62,000 75,000arrow_forwardb. a. Prepare a schedule of cash payments for Fein Company for the month of August. OBJECTIVE 3 C. Exercise 9-45 Cash Budget The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following: Cash balance on June 1 is R7,360. b. Actual sales for April and May are as follows: d. F. a. April May Cash sales R180,000 Credit sales to 00 R530,000 Total sales R389,000 c. Credit sales are collected over a three-month period: R 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible. d. Inventory purchases average 64% of a month's total B sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month. Salaries and wages total R117,500 per month, including a R45,000…arrow_forward

- The following information is available for Larkspur Auto Supply Company for the month of February: expected cash receipts $54,000; expected cash disbursements $64,000; cash balance February 1, $20,000. Management wishes to maintain a minimum cash balance of $20,000. Prepare a basic cash budget for the month of February. Larkspur Auto Supply Company Cash Budget February ☑: ☑: +A $ Aarrow_forwardThe management of Palind Ltd decide to prepare a Cash Budget for November and December. The following information is available: Sales: Cash Credit Purchases Salaries & Wages Sundry Expenses WY Actual August September October R 194 500 287 300 510 000 72 600 17 800 R 235 700 350 000 490 000 72 600 18 400 R 275 000 410 000 495 000 72 600 22 000 Additional information: 1. Cash in respect of credit sales is collected as follows: • 50% within 30 days • 30% within 60 days • 15% within 90 days • The balance is written off as irrecoverable. 2. The following discounts are allowed on sales: Budgeted 7. The cash in the bank on 31 October was R44 500. November December R 250 500 400 400 520 000 72 600 22 600 R 368 000 697 000 680 000 72 600 25 700 • 10% on cash sales • 7.5% on credit sales if accounts are settled within 30 days. 3. All salaries, wages and sundry expenses are paid in cash. 4. Sundry expenses include depreciation of R4 200 per month. 5. Seventy-five (75%) of all purchases are on…arrow_forwardThe following information was taken from Concord Corporation cash budget for the month of July: Beginning cash balance $100000 Cash receipts 96000 Cash disbursements 136000 If the company has a policy of maintaining an end of the month cash balance of $100000, the amount the company would have to borrow isarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College