Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 50E

Use the following information for Exercises 9-50 and 9-51:

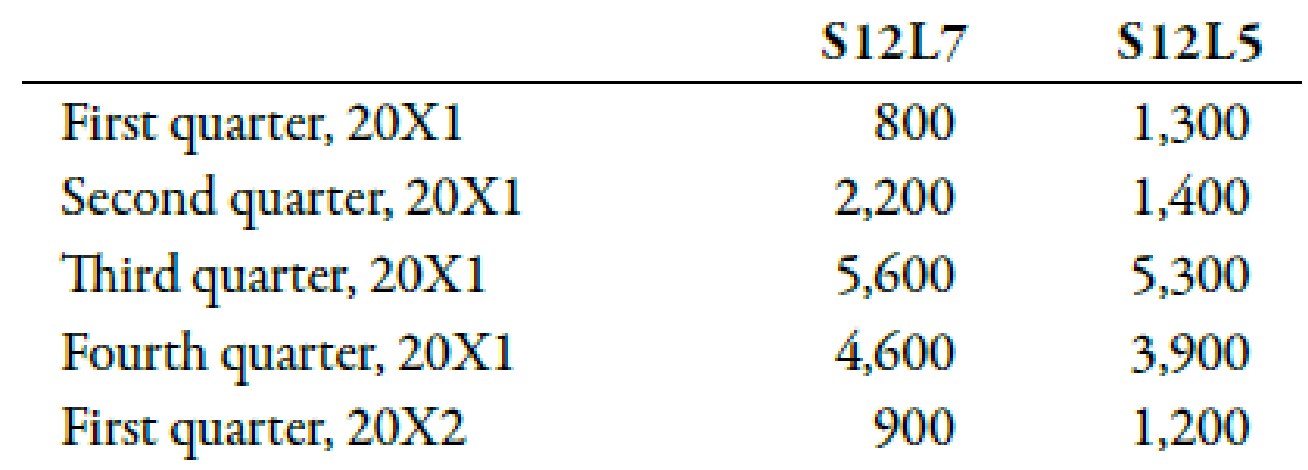

Assume that Stillwater Designs produces two automotive subwoofers: S12L7 and S12L5. The S12L7 sells for $475, and the S12L5 sells for $300. Projected sales (number of speakers) for the coming 5 quarters are as follows:

The vice president of sales believes that the projected sales are realistic and can be achieved by the company.

Exercise 9-50 Sales Budget

Refer to the information regarding Stillwater Designs above.

Required:

- 1. Prepare a sales budget for each quarter of 20X1 and for the year in total. Show sales by product and in total for each time period.

- 2. CONCEPTUAL CONNECTION How will Stillwater Designs use this sales budget?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General accounting

Please solve this financial accounting question

General accounting

Chapter 9 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 9 - Define the term budget. How are budgets used in...Ch. 9 - Prob. 2DQCh. 9 - Explain how both small and large organizations can...Ch. 9 - Prob. 4DQCh. 9 - What is a master budget? An operating budget? A...Ch. 9 - Explain the role of a sales forecast in budgeting....Ch. 9 - All budgets depend on the sales budget. Is this...Ch. 9 - Why is goal congruence important?Ch. 9 - Why is it important for a manager to receive...Ch. 9 - What is participative budgeting? Discuss some of...

Ch. 9 - A budget too easily achieved will lead to...Ch. 9 - Explain why a manager has an incentive to build...Ch. 9 - Discuss the differences between static and...Ch. 9 - Explain why mixed costs must be broken down into...Ch. 9 - What is the purpose of a before-the-fact flexible...Ch. 9 - Prob. 1MCQCh. 9 - Which of the following is part of the control...Ch. 9 - Which of the following is not an advantage of...Ch. 9 - The budget committee a. reviews the budget. b....Ch. 9 - A moving, 12-month budget that is updated monthly...Ch. 9 - Which of the following is not part of the...Ch. 9 - Before a direct materials purchases budget can be...Ch. 9 - The first step in preparing the sales budget is to...Ch. 9 - Which of the following is needed to prepare the...Ch. 9 - A company requires 100 pounds of plastic to meet...Ch. 9 - A company plans to sell 220 units. The selling...Ch. 9 - Select the one budget below that is not an...Ch. 9 - A company has the following collection pattern:...Ch. 9 - The percentage of accounts receivable that is...Ch. 9 - Which of the following is not an advantage of...Ch. 9 - Prob. 16MCQCh. 9 - For performance reporting, it is best to compare...Ch. 9 - To create a meaningful performance report, actual...Ch. 9 - To help assess performance, managers should use a...Ch. 9 - A firm comparing the actual variable costs of...Ch. 9 - Preparing a Sales Budget Patrick Inc. sells...Ch. 9 - Preparing a Production Budget Patrick Inc. makes...Ch. 9 - Preparing a Direct Materials Purchases Budget...Ch. 9 - Preparing a Direct Labor Budget Patrick Inc. makes...Ch. 9 - Preparing an Overhead Budget Patrick Inc. makes...Ch. 9 - Preparing an Ending Finished Goods Inventory...Ch. 9 - Preparing a Cost of Goods Sold Budget Andrews...Ch. 9 - Preparing a Selling and Administrative Expenses...Ch. 9 - Preparing a Budgeted Income Statement Oliver...Ch. 9 - Preparing a Schedule of Cash Collections on...Ch. 9 - Preparing an Accounts Payable Schedule Wight Inc....Ch. 9 - Preparing a Cash Budget La Famiglia Pizzeria...Ch. 9 - Flexible Budget with Different Levels of...Ch. 9 - Performance Report Based on Budgeted and Actual...Ch. 9 - Preparing a Sales Budget Tulum Inc. sells powdered...Ch. 9 - Preparing a Production Budget Tulum Inc. makes a...Ch. 9 - Preparing a Direct Materials Purchases Budget...Ch. 9 - Preparing a Direct Labor Budget Tulum Inc. makes a...Ch. 9 - Preparing an Overhead Budget Tulum Inc. makes a...Ch. 9 - Prob. 40BEBCh. 9 - Preparing a Cost of Goods Sold Budget Lazlo...Ch. 9 - Preparing a Selling and Administrative Expenses...Ch. 9 - Preparing a Budgeted Income Statement Jameson...Ch. 9 - Preparing a Schedule of Cash Collections on...Ch. 9 - Pilsner Inc. purchases raw materials on account...Ch. 9 - Preparing a Cash Budget Olivers Bistro provided...Ch. 9 - Flexible Budget with Different Levels of...Ch. 9 - Performance Report Based on Budgeted and Actual...Ch. 9 - Planning and Control a. Dr. Jones, a dentist,...Ch. 9 - Use the following information for Exercises 9-50...Ch. 9 - Prob. 51ECh. 9 - Production Budget and Direct Materials Purchases...Ch. 9 - Production Budget Aqua-Pro Inc. produces...Ch. 9 - Direct Materials Purchases Budget Langer Company...Ch. 9 - Direct Labor Budget Evans Company produces asphalt...Ch. 9 - Sales Budget Alger Inc. manufactures six models of...Ch. 9 - Production Budget and Direct Materials Purchases...Ch. 9 - Schedule of Cash Collections on Accounts...Ch. 9 - Schedule of Cash Collections on Accounts...Ch. 9 - Cash Payments Schedule Fein Company provided the...Ch. 9 - Cash Budget The owner of a building supply company...Ch. 9 - Flexible Budget for Various Levels of Production...Ch. 9 - Use the following information for Exercises 9-63...Ch. 9 - Use the following information for Exercises 9-63...Ch. 9 - Prob. 65PCh. 9 - Operating Budget, Comprehensive Analysis Allison...Ch. 9 - Use the following information for Problems 9-67...Ch. 9 - Use the following information for Problems 9-67...Ch. 9 - Use the following information for Problems 9-67...Ch. 9 - Ryan Richards, controller for Grange Retailers,...Ch. 9 - Participative Budgeting, Not-for-Profit Setting...Ch. 9 - Cash Budget The controller of Feinberg Company is...Ch. 9 - Optima Company is a high-technology organization...Ch. 9 - Direct Materials and Direct Labor Budgets Willison...Ch. 9 - Prob. 75PCh. 9 - Prob. 76CCh. 9 - Prob. 77CCh. 9 - Budgetary Performance, Rewards, Ethical Behavior...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive income would be?arrow_forwardFor each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to Publication 15-T.arrow_forwardWhat is the total number of equivalent unit for materials during may ?arrow_forward

- Provide answerarrow_forwardWhat is dora industries actual manufacturing overhead for February?arrow_forwardThe following is a December 31, 2024, post-closing trial balance for Almway Corporation. Account Title Cash Investment in equity securities Accounts receivable Inventory Debits $ 49,000 Credits 114,000 62,000 202,000 Prepaid insurance (for the next 9 months) 5,000 Land 94,000 Buildings 422,000 Accumulated depreciation-buildings $ 102,000 Equipment Accumulated depreciation-equipment 112,000 62,000 Patent (net) Accounts payable Notes payable Interest payable Bonds Payable Common stock Retained earnings 12,000 79,000 136,000 22,000 242,000 306,000 123,000 Totals Additional information: $ 1,072,000 $ 1,072,000 1. The investment in equity securities account includes an investment in common stock of another corporation of $32,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $27,000 that the company has not used and is currently listed for sale. 3. The cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License