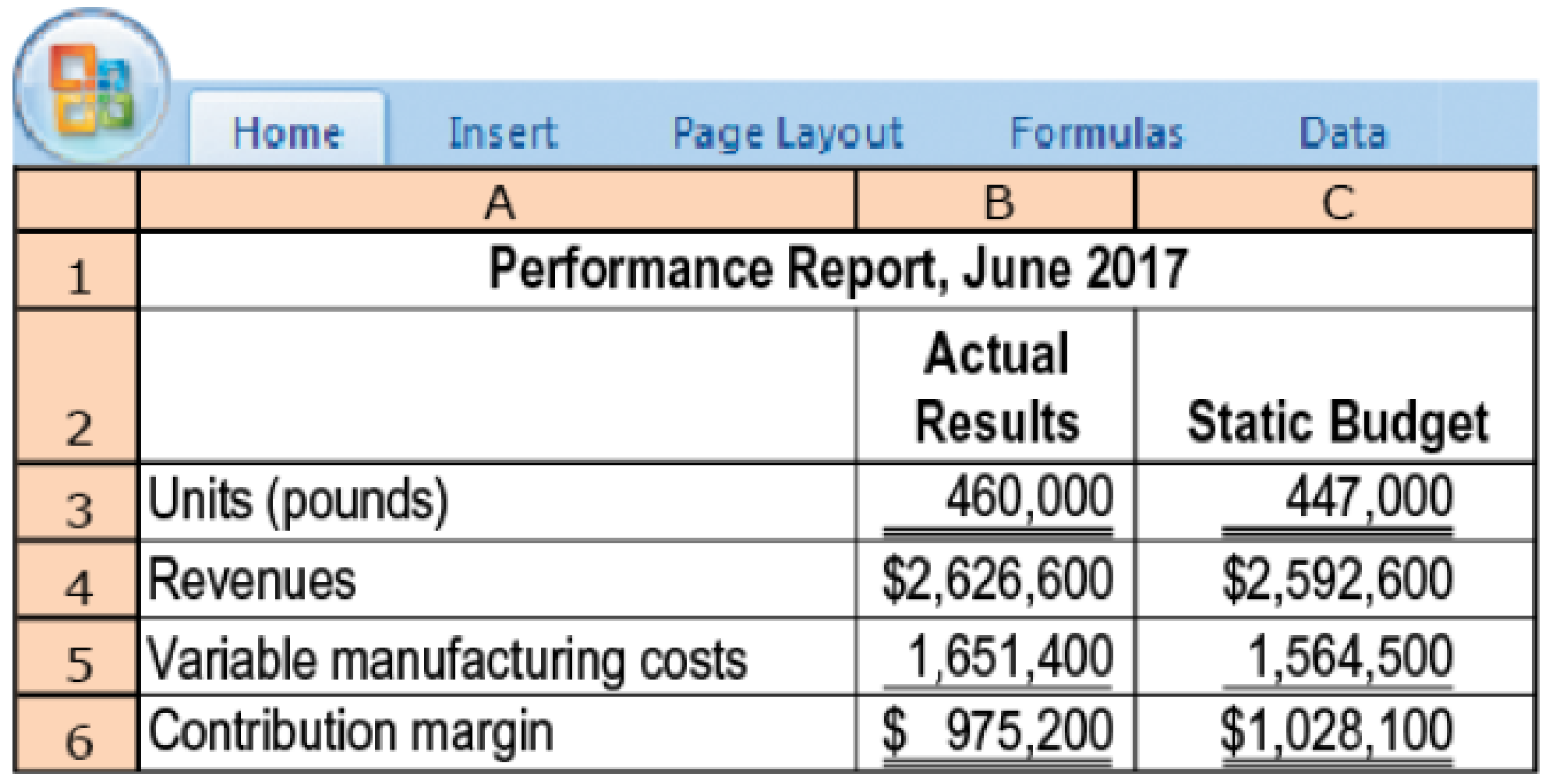

Flexible-budget and sales volume variances. Cascade, Inc., produces the basic fillings used in many popular frozen desserts and treats—vanilla and chocolate ice creams, puddings, meringues, and fudge. Cascade uses

Jeff Geller, the business manager for ice-cream products, is pleased that more pounds of ice cream were sold than budgeted and that revenues were up. Unfortunately, variable

- 1. Calculate the static-

budget variance in units, revenues, variable manufacturing costs, and contribution margin. What percentage is each static-budget variance relative to its static-budget amount? - 2. Break down each static-budget variance into a flexible-budget variance and a sales-volume variance.

- 3. Calculate the selling-price variance.

- 4. Assume the role of

management accountant at Cascade. How would you present the results to Jeff Geller? Should he be more concerned? If so, why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- The salespeople at Larkspur, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large customers. David, the operations supervisor, leaked the $0.80 total unit cost to salespeople, who were thrilled, since that was slightly lower than the previous year's unit cost. Budgets were not yet finalized for the upcoming year, so it was unclear what the target unit cost would be. David knew the current year's operating capacity was two million notebooks, and Larkspur produced and sold just that many. The detailed breakdown of the $0.80 total unit cost is as follows. Direct material Direct labor Variable overhead Fixed overhead Total cost per unit $0.05 0.20 0.15 0.40 $0.80arrow_forwardChandler Packaged Treats (CPT) sells a specialty pet food to pet stores. CPT management prides itself on its scientific management methods. Applying those methods, the controller estimates the following monthly costs based on 10,000 units (produced and sold): Direct material Direct labor Manufacturing overhead Selling, general, and administrative Total Required: a. Compute CPT's unit selling price that will yield a profit of $200,000, given sales of 10,000 units. b. What dollar sales does CPT need to achieve to generate a 15 percent profit on sales, assuming variable costs per unit are 55 percent of the selling price per unit and fixed costs are $188,100. c. Management believes that a selling price of $100.00 per unit is reasonable given current market conditions. How many units must CPT sell to generate the revenues (dollar sales) determined in requirement (b)? Total Annual Costs (10,000 units) $ 128,000 60,000 132,000 100,000 $ 420,000 Complete this question by entering your answers…arrow_forwardRouse manufactures coffee mugs that it sells to other companies for customizing with their own logos. Rouse prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budge volume of 59,700 coffee mugs per month:arrow_forward

- Cosmic Cosmetics (CC) has capacity to produce and sell 200,000 units per month. Costs at this level are provided in the table below. CC currently sells 175,000 units per month, at $1.55 per unit. Pur Skinn has contacted CC about purchasing 15,000 units at $1.05 each. Current sales would not be affected by the special order, and variable marketing costs would not be incurred on the special order. What is CCs' change in net income if the order is accepted? a. $9,375 increase b. $9,375 decrease c. $5,625 increase d. $5,625 decrease Per Unit Costs: Prime Costs Variable manufacturing overhead Variable marketing Total Costs: Fixed manufacturing overhead Fixed marketing $0.350 0.075 0.250 $20,000 $24,000arrow_forwardThe salespeople at Metlock, a notebook manufacturer, commonly pressured operations managers to keep costs down so the company could give bigger discounts to large customers. Richard, the operations supervisor, leaked the $0.65 total unit cost to salespeople, who were thrilled, since that was slightly lower than the previous year's unit cost. Budgets were not yet finalized for the upcoming year, so it was unclear what the target unit cost would be. Richard knew the current year's operating capacity was two million notebooks, and Metlock produced and sold just that many. The detailed breakdown of the $0.65 total unit cost is as follows. Direct material Direct labor Variable overhead Fixed overhead Total cost per unit (a) (b) Total fixed costs Gross margin Your answer is correct. What were Metlock's total fixed costs? If the average selling price was $2.10, how much gross margin did the company generate? $0.15 Fixed costs 0.15 Total cost per unit 0.15 Gross margin 0.20 $0.65 Save for…arrow_forwardData Beginning inventory, January 1 Ending inventory, December 31 Fixed manufacturing overhead Fixed operating costs Variable costs per case: Direct Materials Grapes Bottles, corks, and crates Direct labour Bottling Winemaking Aging 30,000 cases 20,000 cases $4,200,000 $7,856,000 $17.50 per case $11.50 per case $6.50 per case $14.80 per case $1.80 per case On December 31, the unit costs per case for closing inventory are $58.70 for variable costing and $75.70 for absorption costing. Iarrow_forward

- Jet skis and snowmobiles are assembled by Mobile Incorporated. Because both end-items use the same small engine, you can aggregate demand for the engine assembly. Develop an aggregate plan that uses a level production strategy each quarter and the information that follows. What is the total cost? Assume lost sales are backordered and filled during the next quarter. Summarize the plan, its costs, and consequences using manual computations. Initial Inventory Level 1,000 units Regular Time = $15 Lost Sales Cost/Unit = $24 Inventory Carry Cost per unit $3 Beginning Inventory Quarter 1 2 Totals 10,000 15,000 16,000 3,000 44,000 600 Jet Ski Engine Snowmobile Engine Total Engines Average Demand Rate/Quarter Regular Time Production Rate 400 7,000 19,000 19,000 22,000 35,000 22,000 units 9,000 10,000 45,000 13,000 89,000 1,000 22,000 unitsarrow_forwardSolomon Chairs, Incorporated makes two types of chairs. Model Diamond is a high-end product designed for professional offices. Model Gold is an economical product designed for family use. Jane Silva, the president, is worried about cut-throat price competition in the chairs market. Her company suffered a loss last quarter, an unprecedented event in its history. The company's accountant prepared the following cost data for Ms. Silva: Direct Cost per Unit Direct materials Direct labor Category Unit level Batch level Product level Facility level Total Show Transcribed Text Model Diamond (D) $ 20.20 per unit $17.60/hour x 2.00 hours production time Type of Product Estimated Cost $ 255,000 975,000 546,000 644,000 $ 2,420,000 a. Model Diamond a. Model Gold b. Model Diamond b. Model Gold Cost Driver The market price for office chairs comparable to Model Diamond is $119 and to Model Gold is $73. Number of units. Number of setups Number of TV commercials. Number of machine hours. Cost per Unit…arrow_forwardBaird Chairs, Incorporated makes two types of chairs. Model Diamond is a high-end product designed for professional offices. Model Gold is an economical product designed for family use. Jane Silva, the president, is worried about cut-throat price competition in the chairs market. Her company suffered a loss last quarter, an unprecedented event in its history. The company's accountant prepared the following cost data for Ms. Silva: Direct Cost per Unit Direct materials Direct labor Category Unit level Batch level Product level Facility level Total Model Diamond (D) $19.50 per unit $ 19.10/hour x 2.00 hours production time Type of Product Estimated Cost $ 247,500 825,000 704,000 572,000 $ 2,348,500 a. Model Diamond a. Model Gold b. Model Diamond b. Model Gold Cost Driver Number of units. Number of setups Number of TV commercials Number of machine hours The market price for office chairs comparable to Model Diamond is $118 and to Model Gold is $75. Cost per Unit Model Gold (G) $9.90 per…arrow_forward

- Possible causes for price and efficiency variances. You have been invited to interview for an internship with an international food manufacturing company. When you arrive for the interview, you are given the following information related to a ctitious Belgian chocolatier for the month of June. The chocolatier manufactures truffles in 12-piece boxes. The production is labor intensive, and the delicate nature of the chocolate requires a high degree of skill.arrow_forwardDataSpan, Incorporated, implemented Lean Production and would like to redesign its performance measures accordingly. It has provided the following data sets: Percentage of on-time deliveries Total sales (units) Move time per unit Process time per unit Wait time per order before start of production Queue time per unit Inspection time per unit Required 1 Required 2 Month 1 Month 2 Month 3 Month 4 2 85% 80% 2,180 2,087 Required 3 Month Complete this question by entering your answers in the tabs below. Throughput Time days days days days 3 77% 1,980 1-a. Compute the throughput time for each month. 1-b. Compute the delivery cycle time for each month. 1-c. Compute the manufacturing cycle efficiency (MCE) for each month. Note: Round your answers to 1 decimal place. Delivery Cycle Time days days days days 0.6 2.6 31.4 6.8 0.5 Show less Aarrow_forwardBlossom Motors is a division of Blossom Products Corporation. The division manufactures and sells an electric switch used in a wide variety of applications. During the coming year, it expects to sell 180,000 units for $8.00 per unit. Donna Clark is the division manager. She is considering producing either 180,000 or 280,000 units during the period. Other information is as follows: Beginning inventory Expected sales in units Selling price per unit Variable manufacturing cost per unit Fixed manufacturing cost (total) Fixed manufacturing overhead costs per unit Based on 180,000 units Based on 280,000 units Manufacturing cost per unit Based on 180,000 units (a) Based on 280,000 units Variable selling and administrative expenses Fixed selling and administrative expenses (total) - Your answer is partially correct. Units produced Units sold (b) Sales Less Prepare an absorption-costing income statement, with one column showing the results if 180,000 units are produced and one column showing…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning