Concept explainers

Direct materials efficiency, mix, and yield variances. Sandy’s Snacks produces snack mixes for the gourmet and natural foods market. Its most popular product is Tempting Trail Mix, a mixture of peanuts, dried cranberries, and chocolate pieces. For each batch, the budgeted quantities and budgeted prices are as follows:

| Quantity per Batch | Price per Cup | |

| Peanuts | 60 cups | $1 |

| Dried cranberries | 30 cups | $2 |

| Chocolate pieces | 10 cups | $3 |

Small changes to the standard mix of direct materials reflected in the above quantities do not significantly affect the overall end product. In addition, not all ingredients added to production end up in the finished product, as some are rejected during inspection.

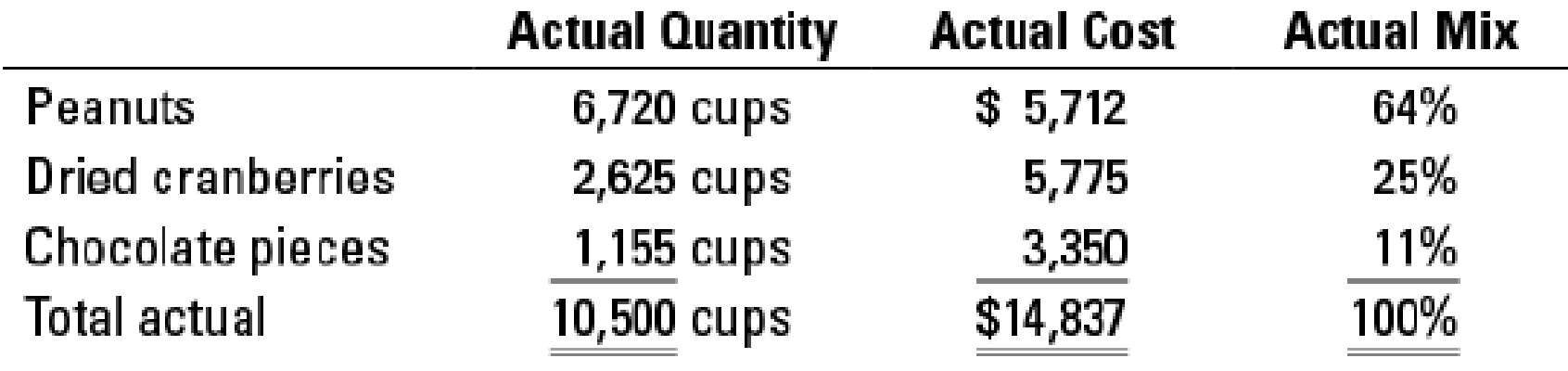

In the current period, Sandy’s Snacks made 100 batches of Tempting Trail Mix with the following actual quantity, cost, and mix of inputs:

- 1. What is the budgeted cost of direct materials for the 100 batches?

Required

- 2. Calculate the total direct materials efficiency variance.

- 3. Calculate the total direct materials mix and yield variances.

- 4. How do the variances calculated in requirement 3 relate to those calculated in requirement 2? What do the variances calculated in requirement 3 tell you about the 100 batches produced this period? Are the variances large enough to investigate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Chypre, Inc., produces a cologne mist using a solvent mix (water and pure alcohol) and aromatic compounds (the scent base) that it sells to other companies for bottling and sale to consumers. Chypre developed the following standard cost sheet: On May 2, Chypre produced a batch of 1,000 gallons with the following actual results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. (Round to the nearest cent.) 3. Calculate the direct materials yield variance. (Round to the nearest cent.) 4. Calculate the direct materials mix variance. (Round to the nearest cent.)arrow_forwardCollege Life produces sweatshirts for college organizations and uses hybrid costing. It reports the following for its fabrication process. Customers choose screen-printed or embroidered logos. Direct materials Conversion Fabrication process costs Customer choices-Logo types Screen-printed Embroidered Required: a. Compute the cost per unit for both the screen-printed and embroidered sweatshirts. b. If the company has a target markup of 30% above cost, compute the selling price for each type of sweatshirt. c. For the current period, the company added direct materials into production that should have produced 5,700 sweatshirts. Actual production was 5,415 (nondefective) sweatshirts. Compute the yield for this period. Express the answer in percent. Required 1 Required 2 Required 3 Per Unit $ 26 13 Complete this question by entering your answers in the tabs below. $39 $ 6 $ 12 Yield For the current period, the company added direct materials into production that should have produced 5,700…arrow_forwardH.J. Heinz Company uses standards to control its materials costs. Assume that a batch of ketchup (2,700 pounds) has the following standards: Ingredient Standard Quantity Standard Price Whole tomatoes 4,500 lbs. $0.37 per lb. Vinegar 250 gal. 2.30 per gal. Corn syrup 22 gal. 8.20 per gal. Salt 100 lbs. 2.10 per lb. The actual materials in a batch may vary from the standard due to tomato characteristics. Assume that the actual quantities of materials for batch 08-99 were as follows: 4,700 lbs. of tomatoes240 gal. of vinegar23 gal. of corn syrup99 lbs. of salt a. Determine the standard unit materials cost per pound for a standard batch. If required, round amounts to the nearest cent. Ingredient Standard Costper Batch Whole tomatoes $fill in the blank 1 Vinegar fill in the blank 2 Corn syrup fill in the blank 3 Salt fill in the blank 4 Total $fill in the blank 5 Standard unit materials cost per pound $fill in the blank 6 b. Determine the direct materials…arrow_forward

- College Life produces sweatshirts for college organizations and uses hybrid costing. It reports the following for its fabrication process. Customers choose screen-printed or embroidered logos. Direct materials Conversion Fabrication process costs Customer choices-Logo types Screen-printed Embroidered Required: a. Compute the cost per unit for both the screen-printed and embroidered sweatshirts. b. If the company has a target markup of 30% above cost, compute the selling price for each type of sweatshirt. c. For the current period, the company added direct materials into production that should have produced 6,700 sweatshirts. Actual production was 6,499 (nondefective) sweatshirts. Compute the yield for this period. Express the answer in percent. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Per Unit $ 46 23 $ 69 $ 6 $ 20 Compute the cost per unit for both the screen-printed and embroidered sweatshirts. Cost per unit $121.00 x $…arrow_forwardSnapware Systems produces commercial strength cleansing supplies. Two of its main products are window cleaner that uses ammonia, and floor cleaner that uses bleach. Information for the most recent period follows: Product Names Window Cleaner (ammonia) Floor Cleaner (bleach) Direct materials information: Standard ounces per unit 16 oz. 24 oz. Standard price per ounce $0.75 ? Actual quantity used per unit 20 oz. 22 oz. Actual price paid for material $1.00 $0.90 Actual quantity purchased and used 1,500 oz. 2,800 oz.. Price variance ? $300 U Quantity variance $1,500 U ? Total direct materials variance ? $678 F Number of units produced 500 600 What is the standard price for bleach? Select one: a. $0.88/oz. b. $1.09/oz. c. $1.14/oz. d. $0.79/oz. e. $0.92/oz.arrow_forwardCalculating the Direct Materials Mix Variance Mangia Pizza Company makes frozen pizzas that are sold through grocery stores. Mangia developed the following standard mix for spreading on premade pizza shells to produce 16 giant-size sausage pizzas.arrow_forward

- Rosehill Co. manufactures two types of toilet paper: Ultra-strong and Ultra-soft. Because of a recent shortage of chlorine-based bleach, a key ingredient needed for the two products, the company has to decide the optimal amount of each product to produce. Information related to the two products that use chlorine-based bleach are shown below: Ultra-strong Ultra-soft Selling price per case $100 $96 Variable cost per case $40 $44 Chlorine-based bleach required per case (in liters) 10 8 Maximum monthly demand (in cases) 500 700 Assume that Rosehill Co. only has 7,200 liters of Chlorine-based bleach available next month. To maximize the company’s contribution margin next month, how many cases of Ultra-strong and how many cases of Ultra-soft the company should produce? Multiple Choice a)300 cases of Ultra-strong and 400 cases of Ultra-soft b)500 cases of Ultra-strong and 275 cases of Ultra-soft c)500 cases of Ultra-strong and 700 cases…arrow_forwardRouse manufactures coffee mugs that it sells to other companies for customizing with their own logos. Rouse prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budge volume of 59,700 coffee mugs per month: Requirement 1. Compute the cost and efficiency variances for direct materials and direct labor. Begin with the cost variances Select the required formulas, compute the cost variances for direct materials and direct labor and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used AC = actualco cost AQ = actual quantity, FOH = fixed overheard; SC = standard cost; SQ= standard quantity.)arrow_forwardRequired information [The following information applies to the questions displayed below.] FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables. The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements. Direct material required per 100 boxes: Paperboard ($0.32 per pound) Corrugating medium ($0.16 per pound) Direct labor required per 100 boxes ($16.00 per hour) Type of Box 50 pounds 90 pounds 40 0.35 pounds hour 50 pounds 0.70 hour The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on a production volume of 440,000 units for each type of box. Production overhead is applied on the basis of direct-labor hours. Indirect material Indirect labor Utilities Property taxes Insurance Depreciation Total $ 13,350 91,650 37,500 25,000 18,000 45,500 $ 231,000 The following selling and administrative expenses are…arrow_forward

- Making product mix decisions StoreAll produces plastic storage bins for household storage needs. The company makes two sizes of bins: large (50 gallon) and regular (35 gallon). Demand for the products is so high that StoreAll can sell as many of each size as it can produce. The company uses the same machinery to produce both sizes. The machinery can be run for only 3,300 hours per period. StoreAll can produce 10 large bins every hour, whereas it can produce 17 regular bins in the same amount of time. Fixed costs amount to $115,000 per period. Sales prices and variable costs are as follows: Requirements Which product should StoreAll emphasize? Why? To maximize profits, how many of each size bin should StoreAll produce? Given this product mix, what will the company’s operating income be?arrow_forwardContainer Solutions produces plastic storage bins for household storage needs. 1(Click the icon to view additional information.) Sales prices and variable costs are as follows: 2(Click the icon to view the costs.) Read the requirements3. Requirement 1. Which product should Container Solutions emphasize? Why? Complete the product mix analysis to determine the contribution margin per machine hour. Container Solutions Product Mix Analysis Regular Large Sales price per unit Variable cost per unit Contribution margin per unit Units per machine hour × × Contribution margin per machine hour Which product should Container Solutions emphasize? Why? Container Solutions should emphasize the production of (1) because this product has the higher (2) Requirement 2. To maximize profits, how many of each size bin…arrow_forwardUse the following standard cost card for 1 gallon of ice cream to answer the questions. Actual direct costs incurred to make 50 gallons of ice cream: 275 quarts of cream at $1.05 per quart 832 ounces of sugar at $0.075 per ounce 165 minutes of labor at $37 per hour All material used was bought during the current period. A. Compute the material and labor variances. B. Comment on the results and possible causes of the variances.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College