Concept explainers

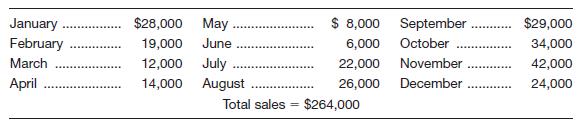

Esquire Products Inc. expects the following monthly sales:

Cash sales are 40 percent in a given month, with the remainder going into accounts receivable. All receivables are collected in the month following the sale. Esquire sells all of its goods for

a. Generate a monthly production and inventory schedule in units. Beginning inventory in January is 12,000 units. (Note: To do part a, you should work in terms of units of production and units of sales.)

b. Determine a cash receipts schedule for January through December. Assume that dollar sales in the prior December were

c. Determine a cash payments schedule for January through December. The production costs (

d. Construct a cash budget for January through December using the cash receipts schedule from part b and the cash payments schedule from part c. The beginning cash balance is

e. Determine total current assets for each month. Include cash, accounts receivable, and inventory. Accounts receivable equal sales minus 40 percent of sales for a given month. Inventory is equal to ending inventory (part a) times the cost of

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Earthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardLens Junction sells lenses for $45 each and is estimating sales of 15,000 units in January and 18,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $18 per hour. Desired inventory levels are: Â Prepare a sales budget, production budget. direct materials budget for silicon and solution, and a direct labor budget.arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forward

- If the sales forecast estimates that 50,000 units of product will be sold during the following year, should the factory plan on manufacturing 50,000 units in the coming year? Explain.arrow_forwardCroy Inc. has the following projected sales for the next five months: Month Sales in Units April 3,850 May 3,875 June 4,260 July 4,135 August 3,590 Croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. Direct materials cost $3.10 per pound, and each unit requires 2 pounds. Direct materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3,865 pounds. Required: 1. Determine budgeted production for April, May, and June.2. Determine budgeted cost of materials purchased for April and May.arrow_forwardCroy Inc. has the following projected sales for the next five months: Month Sales in Units April 3,850 May 3,875 June 4,260 July 4,135 August 3,590 Croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. Direct materials cost $3.10 per pound, and each unit requires 2 pounds. Direct materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3,865 pounds. The beginning finished goods inventory is 2,310 units ending March inventory = 60% of next month; 60%*3,850 - 2,310 Ending March Inventory = Beginning April Inventory Required: 1. Determine budgeted cost of materials purchased for April and May. (round answers to 2 decimal places)arrow_forward

- Ashland Company manufactures and sells a single product. The company's sales and expenses for a recent month are as follows: (a) What is the monthly break-even point in units sold and in sales dollars?(b) How many units would have to be sold each month to earn a minimum target net income of $50,000?arrow_forwardGraham Potato Company has projected sales of $12,000 in September, $15,000 in October, $22,000 in November, and $18,000 in December. Of the company's sales, 30 percent are paid for by cash and 70 percent are sold on credit. Experience shows that 40 percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after. Determine collections for November and December. Also assume Graham's cash payments for November and December are $18,500 and $11,000, respectively. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. Graham Potato Company Cash Receipts Schedule Sales Credit sales Cash sales One month after sale Two months after sale Total cash receipts September October November Decemberarrow_forwardGraham Potato Company has projected sales of $16,200 in September, $18,500 in October, $26,200 in November, and $22,200 in December. Of the company's sales, 25 percent are paid for by cash and 75 percent are sold on credit. Experience shows that 40 percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after. Determine collections for November and December. Also assume Graham's cash payments for November and December are $22,000 and $14,500, respectively. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. Sales Credit sales Cash sales One month after sale Two months after sale Total cash receipts Graham Potato Company Cash Receipts Schedule September October November $ $ December 6,550 $ 19,650 6,550 $ $ 22,200 16,650 5,550 5,550arrow_forward

- Sunland Company estimates its sales at 400000 units in the first quarter and that sales will increase by 15000 units for each subsequent quarter during the year. The company has, and desires, an ending finished goods inventory to 25% of the next quarter's sales. Each unit sells for $25.40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is collected in the quarter following the sale. Cash collections for the third quarter are budgeted at O $10682500. O $8815000. O $6167500. $11314375.arrow_forwardYanimize company sales in December 2018 were $70,000 and they are expected to rise by $4,500 per month for the next 5 months. Of sales, 80 per cent are collected during the month of sale and the rest two months after sales. The cost of sales is 60 per cent of sales and, the company plans to keep an inventory at the end of each month equal to forty per cent of the anticipated sales for the next month’s sales. Suppliers are paid one month after purchases are made. Monthly wages amount to $4,000, rent and heating $700 and depreciation $600. A machine is to be bought in March for $5,000 paid in cash. The purchase of the machine means that the monthly change for depreciation will increase by $40. The inventory held at January 1st is $14,400. Required: Calculate the estimated cash collection from sales for February and March. Calculate the purchases for February and March. Assuming that the cash balance at 31/01/2019 is $8,000; prepare a cash budget for the two months ending March 31,…arrow_forwardCroy Inc. has the following projected sales for the next five months: Month Sales in Units April 3,500 May 3,860 June 4,590 July 4,195 August 3,960 Croy’s finished goods inventory policy is to have 50 percent of the next month’s sales on hand at the end of each month. Direct materials costs $2.70 per pound, and each unit requires 2 pounds. Direct materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3,680 pounds. Required: 1. Determine budgeted production for April, May, and June. I figured out May 4,225 and June 4,393. How do you figure out April without knowing March units?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning