Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 12P

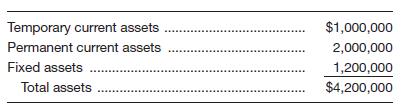

Colter Steel has

Short-term rates are 8 percent. Long-term rates are 13 percent. Earnings before interest and taxes are

If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing, what will earnings after taxes be? For a graphical example of perfectly matched plans, see Figure 6-5.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A financial manager is considering two possible sources of funds necessary to finance a $10,000,000 investment that will yield $1,500,000 before interest and taxes. Alternative one is a short-term commercial bank loan with an interest rate of 8 percent for one year. The alternative is a five-year term loan with an interest rate of 10 percent. The firm's income tax rate is 30 percent.

What are the crucial considerations when selecting between short- and long-term sources of finance?

Financial statements

Net operating revenues

Operating expenses

Operating income

Non-operating items:

Interest expense

Other

Net income

Total assets

Total shareholders' equity

S

2020

33.8

28.9

4.9

(1.2)

(0.6)

3.1

$

$ 200.0

78.0

-

X

The total in rate sensitive assets for a financial institution is $120 million and the total in rate sensitive liabilities is $95 million. What is the cumulative pricing gap (CGAP) and what is the interest rate sensitivity gap ratio if total assets equals $195 million?

What would the projected change to net income be if interest rates rose by 2% on both assets and liabilities? What would the projected change to net income be if interest rates declined by 2% on both assets and liabilities?

What would the projected change to net income be if interest rates rose by 1.8% on assets and 1.5% on liabilities? What would the projected change to net income be if interest rates declined by 1.8% on assets and 1.5% on liabilities?

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A financial manager is considering two possible sources of funds necessary to finance a $10,000,000 investment that will yield $1,500,000 before interest and taxes. Alternative one is a short-term commercial bank loan with an interest rate of 8 percent for one year. The alternative is a five-year term loan with an interest rate of 10 percent. The firm's income tax rate is 30 percent. What will be the firm’s projected earnings under each alternative for the first year? The financial manager expects short-term rates to rise to 11 percent in the second year. At that time long-term rates will have risen to 12%. What will be the firm’s projected earnings under each alternative in the second year? What are the crucial considerations when selecting between short- and long-term sources of finance?arrow_forwardA financial manager is considering two possible sources of funds necessary to finance a $10,000,000 investment that will yield $1,500,000 before interest and taxes. Alternative one is a short-term commercial bank loan with an interest rate of 8 percent for one year. The alternative is a five-year term loan with an interest rate of 10 percent. The firm's income tax rate is 30 percent. What will be the firm's projected earnings under each alternative for the first year?arrow_forward3) Your employer is considering an investment in new manufacturing equipment. The cost of the machinery is RO 180,000 and will provide annual after-tax cash flows of RO 24,500 for 15 years. The equity financing represents three times the percent of debt financing. The risk free rate is 6% and the expected market returns is 11%. The firm's systemic risk is 1.25. The pretax cost of debt is 8%. The flotation costs of debt and equity are 2.5% and 5.5%, respectively. The firm's tax rate is 40%. Assume the project is of approximately the same risk as the firm's existing operations. 3.1. What is the weighted average cost of capital? 3.2 Ignoring flotation costs, what is the NPV of the proposed project? 3.3. After considering flotation costs, what is the NPV of the proposed project? 3.4. What is your recommendation? Why?arrow_forward

- If rate-sensitive assets equal $600 million and rate-sensitive liabilities equals $800 million, what is the expected change in net interest income if rates increase by 1%? a. Net interest income will increase by $2 million. b. Net interest income will fall by $2 million. c. Net interest income will increase by $20 million. d. Net interest income will fall by $20 million. e. Net interest income will be unchanged. its an objective questionarrow_forward) You are asked to estimate the RAROC of a bank's $100 million loan business, 7.5% of which is the economic capital. The average interest rate is 8%. All the loans have the same default probability of 1.5% with a loss given default of 60%. Operating costs are $15 million, and the funding cost of the business is $30 million. The economic capital is invested and earns 6%.arrow_forwardAn insurance company’s projected loss ratio is 79.53 percent, and its loss adjustment expense ratio is 7.51 percent. It estimates that commission payments and dividends to policyholders will add another 13.96 percent. What is the minimum yield on investments required in order to maintain a positive operating ratio? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))arrow_forward

- (Ignore income taxes in this problem.) Your Company is considering an investment proposal in which a working capital investment of $45,000 would be required. The investment would provide cash inflows of $5,000 per year for seven years. The company's discount rate is 8%. What is the investment's net present value? a- $4,115 b- $3,530 c- $7,265 d- $5,645arrow_forwardAssume that Hogan Surgical Instruments Co. has $2,700,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 15 percent, but with a high-liquidity plan, the return will be 11 percent. If the firm goes with a short-term financing plan, the financing costs on the $2,700,000 will be 7 percent, and with a long-term financing plan, the financing costs on the $2,700,000 will be 9 percent. a. Compute the anticipated return after financing costs with the most aggressive asset-financing mix. Anticipated return $ 160,000 b. Compute the anticipated return after financing costs with the most conservative asset-financing mix. Anticipated return $ 40,000 c. Compute the anticipated return after financing costs with the two moderate approaches to the asset-financing mix. Anticipated Return Low liquidity High liquidityarrow_forwardAssume that Hogan Surgical Instruments Company has $2,300,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 16 percent, but with a high-liquidity plan, the return will be 12 percent. If the firm goes with a short-term financing plan, the financing costs on the $2,300,000 will be 8 percent, and with a long-term financing plan, the financing costs on the $2,300,000 will be 10 percent. Compute the anticipated return after financing costs with the most aggressive asset-financing mix. Compute the anticipated return after financing costs with the most conservative asset-financing mix. Compute the anticipated return after financing costs with the two moderate approaches to the asset-financing mix.arrow_forward

- First National Bank is doing some scenario analysis. It believes that its source of funds (the Federal Reserve) will soon increase the cost of loans. In fact, the cost of making loans is expected to change from the current 2 percent interest to either 3 percent or 4 percent interest in the next year. There will be no change in its $2,000,000 income at the 2 percent interest level, but net income will fall to $1,000,000 if interest rates increase to 3 percent and decrease to $100,000 if the interest rates increase to 4 percent . Finally, National predicts a 10 percent probability of a decrease to 2 percent interest rate, a 50 percent probability of a 3 percent interest rate, and a 40 percent probability of an increase to 4 percent interest rate.arrow_forwardAssume that Hogan Surgical Instruments Co. has $3,100,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 14 percent, but with a high-liquidity plan, the return will be 10 percent. If the firm goes with a short-term financing plan, the financing costs on the $3,100,000 will be 6 percent, and with a long-term financing plan, the financing costs on the $3,100,000 will be 8 percent. a. Compute the anticipated return after financing costs with the most aggressive asset-financing mix. b. Compute the anticipated return after financing costs with the most conservative asset-financing mix.arrow_forward(Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.4 million and expects to earn 4.9 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): • Current assets are equal to 19.8 percent of sales, and fixed assets remain at their current level of $0.8 million. • Common equity is currently $0.78 million, and the firm pays out half of its after-tax earnings in dividends. The firm has short-term payables and trade credit that normally equal 11.8 percent of sales, and it has no long-term debt outstanding. What are Beason's financing needs for the coming year? Beason's expected net income for next year is $ (Round to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License