Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

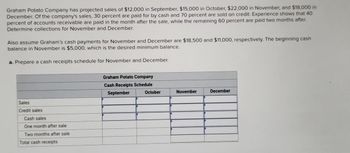

Transcribed Image Text:Graham Potato Company has projected sales of $12,000 in September, $15,000 in October, $22,000 in November, and $18,000 in

December. Of the company's sales, 30 percent are paid for by cash and 70 percent are sold on credit. Experience shows that 40

percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after.

Determine collections for November and December.

Also assume Graham's cash payments for November and December are $18,500 and $11,000, respectively. The beginning cash

balance in November is $5,000, which is the desired minimum balance.

a. Prepare a cash receipts schedule for November and December.

Graham Potato Company

Cash Receipts Schedule

Sales

Credit sales

Cash sales

One month after sale

Two months after sale

Total cash receipts

September

October

November

December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Indarrow_forwardPage Company makes 30% of its sales for cash and 70% on account. 60% of the credit sales are collected in the month of sale, 20% in the month following sale, and 17% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current year: Month Total sales 1 2 $70,000 $90,000 $60,000 $40,000 Total cash receipts in Month 4 will be:arrow_forwardVikrambhaiarrow_forward

- Halifax Shoes has 39% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $61,125 in June, $88,627 in July, and $70,376 in August? Round to the nearest penny, two decimal places.arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $73,000 in June, $63,000 in July, and $95,000 in August?arrow_forwardAssume receivables of $20,000 at the start of the January are all collected during the month; if sales for January and February are $400,000 and $300,000 respectively; the company typically receives payment from 20% of its customers within the same month, 60% the following month, and the remaining 20% by the end of the second following month, how much would accounts receivable be at the end of February?arrow_forward

- Neon Inc.’s forecast sales for July is $72,000. It has $15,000 in accounts receivable at the end of June. 30% of its total sales are expected to be cash sales. Of the remaining 70%, 80% are expected to be collected in the month of the sale and the remaining 20% in the month following the sale. Determine the amount of accounts receivable at the end of July. Group of answer choices $79,200 $61,920 $10,080 $40,320arrow_forwardMillen’s managers have made the following additional assumptions and estimates Estimated sales for July and August are $310,000 and $330,000, respectively. Each month’s sales are 20% cash sales and 80% credit sales. Each month’s credit sales are collected 30% in the month of sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July. Each month’s ending inventory must equal 20% of the cost of next month’s sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July. Monthly selling and administrative expenses are always $70,000. Each month $10,000 of this total amount is depreciation expense and the remaining $60,000 relates to expenses that are paid in the month they are incurred. The company does not plan to buy or sell any plant and equipment…arrow_forwardOffice World Inc. has “cash and carry” customers and credit customers. Office World estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 40% pay their accounts in the month of sale, while the remaining 60% pay their accounts in the month following the month of sale. Projected sales for the next three months are as follows: October $700,000 November 650,000 December 500,000 The Accounts Receivable balance on September 30 was $290,000. Prepare a schedule of cash collections from sales for October, November, and December. Enter all amounts as positive numbers. Office World Inc.Schedule of Collections from SalesFor the Three Months Ending December 31 October November December Receipts from cash sales: Cash sales $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 September sales on account: Collected in October fill in the blank 4 October sales on…arrow_forward

- Prince Charles Island Company has expected sales of $6,000 in September, $10,000 in October, $16,000 in November, and $12,000 in December. Cash sales are 20 percent and credit sales are 80 percent of total sales. Historically, 40 percent of receivables are collected in the month after the sale, and the remaining 60 percent collected two months after. Assume that the company's cash payments for November are $13,000, and December $6,000. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. Sales Credit sales Cash sales Collections in the month after credit sales Collections two months after credit sales Total cash receipts Prince Charles Island Company Cash Receipts Schedule September S Cash receipts Cash payments Net cash flow Prince Charles Island Company Cash Budget November Beginning cash balance Cumulative cash balance. Monthly loan or (repayment). Cumulative loan balance. Ending cash…arrow_forwardValley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or…arrow_forwardManishaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education