Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 18P

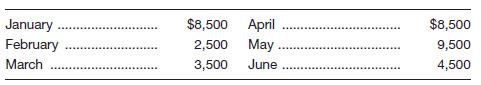

Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows:

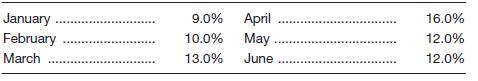

Short-term financing will be utilized for the next six months. Here are the projected annual interest rates:

a. Compute total dollar interest payments for the six months. To convert an annual rate to a monthly rate, divide by 12. Then multiply this value times the monthly balance. To get your answer, add up the monthly interest payments.

b. If long-term financing at 12 percent had been utilized throughout the six months, would the total-dollar interest payments be larger or smaller? Compute the interest owed over the six months and compare your answer to that in part a.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Carmen's Beauty Salon has estimated monthly financing requirements for the next six months as follows:

January

February

March

January

February

March

$8,400 April

2,400 May

3,400

June

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

Interest rate

8%

9

12

April

May

June

$8,400

9,400

4,400

What long-term interest rate would represent a break-even point between using short-term financing and long-term financing? (Round

your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole

cent. Input your answer as a percent rounded to 2 decimal places.)

%

15%

12

12

You plan to purchase a car that costs $42,100. You deposit a down payment of $4,000 and finance the remaining amount over a period of 5 years. Your quoted annual rate is 9.30% compounded monthly Create a single-variable data table in Excel highlighting the monthly payment as a function of the length of the car loan. The table should indicate monthly payment figures for a loan term of a minimum of 2 years and a maximum of 7 years

Carmen's Beauty Salon has estimated monthly financing requirements for the next six months as follows:

April

$ 8,900

January

February

March

May

9,900

4,900

June

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

8% April

January

February

March

$ 8,900

2,900

3,900

Interest rate

9% May

12% June

What long-term interest rate would represent a break-even point between using short-term financing and long-term financing?

Note: Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the

nearest whole cent. Input your answer as a percent rounded to 2 decimal places.

15%

12%

12%

%

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows: January $ 8,100 April $ 8,100 February 2,100 May 9,100 March 3,100 June 4,100 Short-term financing will be utilized for the next six months. Projected annual interest rates are: January 5.0 % April 12.0 % February 6.0 % May 12.0 % March 9.0 % June 12.0 % a. Compute total dollar interest payments for the six months. (Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent.) b-1. Compute the total dollar interest payments if long-term financing at 12 percent had been utilized throughout the six months? (Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent.)arrow_forwardA loan officer is preparing the documents for a commercial term loan. The borrower's risk profile suggests that an annualized return (EAR) of 6.3% is appropriate. The loan will require semi-annual payments, i.e., one payment every six months. What APR (compounded semi-annually) should be used to compute the borrower's future payments? (please show the results in excel spreadsheet also)arrow_forwardA loan officer is preparing the documents for a commercial term loan. The borrower's risk profile suggests that an annualized return ( EAR) of 6.3% is appropriate. The loan will require semi - annual payments, i .e., one payment every six months. What APR (compounded semi - annually) should be used to compute the borrower's future payments? ( please show the results in excel spreadsheet also)arrow_forward

- Jane Doe plans to make twelve end-of-month payments of $18,000 each on a short term investment account. The account earns a monthly interest rate of 2.5%. a. What is the present worth (i.e., Po) of these payments? b. Repeat Part (a) but assuming that they are beginning-of-month payments. a. The present equivalent of the payments is $ nearest dollar.) b. The present equivalent of the payments is $ nearest dollar.) (Round to the (Round to thearrow_forwardCarmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows: January $ 9,000 April $ 9,000 February 3,000 May 10,000 March 4,000 June 5,000 Short-term financing will be utilized for the next six months. Projected annual interest rates are: January 9.0% April 16.0% February 10.0% May 12.0% March 13.0% June 12.0% a. Compute total dollar interest payments for the six months. Note: Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent. b-1. Compute the total dollar interest payments if long-term financing at 12 percent had been utilized throughout the six months? Note: Round your monthly interest rate to 2 decimal places when expressed as a percent. Round your interest payments to the nearest whole cent. b-2. If long-term financing at 12 percent had been utilized throughout the six months, would the total-dollar interest payments be larger or…arrow_forwardSuppose you have a student loan of $45,000 with an APR of 12% for 20 years. Complete parts (a) through (c) below. a. What are your required monthly payments? The required monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

- You finance a $500 car repair completely on credit, you will just pay the minimum payment each month for the next three months. The APR is 18.99% and the minimum payment each month is 4% of the balance. Determine the finance charge, carry-over balance, and minimum payment required for each of the next two months, and the starting balance for month 2 in the table below.arrow_forwardSuppose you have a student loan of $25,000 with an APR of 12% for 20 years. Complete parts (a) through (c) below. a. What are your required monthly payments? The required monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.) b. Suppose you would like to pay the loan off in 10 years instead of 20. What monthly payments will you need to make? The monthly payment required to pay off the loan in 10 years instead of 20 is $ (Do round until the final answer. Then round to the nearest cent as needed.) c. Compare the total amount you'll pay over the loan term if you pay the loan off in 10 years versus 20 years. Total payments for the 20-year loan = $ Total payments for the 10-year loan = $arrow_forward← Consider a student loan of $25,000 at a fixed APR of 9% for 30 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest. a. The monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

- Compute the monthly payment on a car loan of $23,000 for 35 months, if the APR is 8.4%. Formula Excel Functon I need the formula as well as the excel function.arrow_forwardCreate an amortization table for a $60,000 loan. We will assume payments are made monthly over 6 years at an interest rate of 4%. a.) First use a formula cell in your spreadsheet to calculate the monthly payment amount. b.) Create an amortization table for the 72 months. Your columns of your amortization table should include payment number, payment amount, interest paid each month, principle paid that month, amount paid on principal total, and the amount of principal remaining.arrow_forwardSuppose you take out a 36-month installment loan to finance a delivery van for $26,100. The payments are $985 per month, and the total finance charge is $9,360. After 25 months, you decide to pay off the loan. After calculating the finance charge rebate, find your loan payoff (in $) Round to the nearest centarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY