Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 16P

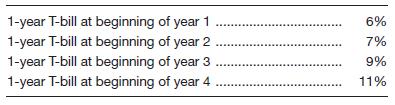

Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Do an analysis similar to that in Table 6-6.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the investment opportunity set and data shown on the excel file attached.

What will be the Weight of Bonds in the Optimum Portfolio, given this investment

opportunity set? Round to two decimals. for example, 0.12

Assume that you are given the following partial covariance and correlation matrices for Securities J,

K and the Market. Also assume that the expected risk-free rate for the coming year is 3.0 percent

and that the expected risk premium on the market is 7.0 percent. Given this information, determine

the required rate of return for Security J for the coming year, using CAPM.

J

Market

Correlation

J

K

Market

Covariance

J

K

Market

Standard

Deviation

O 18.48%

O 20.20%

O 15.48%

O 12.71%

O 15.04%

0.44

0.86

J

0.014400

J

K

0.64

K

CAN

0.016900

K

1.00

Market

0.003600

Market

Show detailed steps to solve the following question.

Consider a portfolio comprised of three securities in the following proportions and with the indicated security beta.

a.) What is the portfolios beta?

b.) Wht is the portfolios expected return?

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Prob. 4DQCh. 6 - “The most appropriate financing pattern would be...Ch. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - What are three theories for describing the shape...Ch. 6 - Since the mid-1960s, corporate liquidity has been...

Ch. 6 - Gary’s Pipe and Steel Company expects sales next...Ch. 6 - Prob. 2PCh. 6 - Tobin Supplies Company expects sales next year to...Ch. 6 - Antivirus Inc. expects its sales next year to be...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Boatler Used Cadillac Co. requires $850,000 in...Ch. 6 - Biochemical Corp. requires $550,000 in financing...Ch. 6 - Sauer Food Company has decided to buy a new...Ch. 6 - Assume that Hogan Surgical Instruments Co. has...Ch. 6 - Assume that Atlas Sporting Goods Inc. has $840,000...Ch. 6 - Colter Steel has $4,200,000 in assets. Short-term...Ch. 6 - Prob. 13PCh. 6 - Guardian Inc. is trying to develop an asset...Ch. 6 - Lear Inc. has $840,000 in current assets, $370,000...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Using the expectations hypothesis theory for the...Ch. 6 - Carmen’s Beauty Salon has estimated monthly...Ch. 6 - Prob. 19PCh. 6 - Eastern Auto Parts Inc. has 15 percent of its...Ch. 6 - Bombs Away Video Games Corporation has forecasted...Ch. 6 - Esquire Products Inc. expects the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to simulate a portfolio of investments over a multiyear period, so for each investment (which could be a particular stock or bond, for example), you need to simulate the change in its value for each of the years. How would you simulate these changes in a realistic way? Would you base it on historical data? What about correlations? Do you think the changes for different investments in a particular year would be correlated? Do you think changes for a particular investment in different years would be correlated? Do you think correlations would play a significant role in your simulation in terms of realism?arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.arrow_forward

- Bond valuation related problems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables If D1 = $1.50 g (which is constant) = 6.5%, Po = $56, what is the stock's expected capital gains yield for the coming year?arrow_forwardFill the parts in the above table that are shaded in yellow. You will notice that there are nineline items. Using the data generated in the previous question (Question 1);a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML?d) If an investment’s expected return (mean return) does not plot on the SML, what doesit show? Identify undervalued/overvalued investments from the graph Please answer A, B, C & Darrow_forwardBond valuation related problems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables If D1 = $1.25, g(which is constant) = 4.7%, and Po= $26.00 what is the stocks expected dividend yield for the coming year?arrow_forward

- An investor wants to determine the safest way to structure a portfolio from several investments, whose annual returns under different scenarios are as follows: Returns Scenario A B. D Probability 1. 0.11 -0.09 0.10 0.07 0.10 -0.11 0.12 0.14 0.06 0.10 3 0.09 0.15 0.11 0.08 0.10 4 0.25 0.18 0.33 0.07 0.30 0.18 0.16 0.1 0.06 0.40 9. Suppose the investor ignores the scenarios have different probabilities. If he has determined his risk aversion value is 0.75, what percentage of his portfolio should be invested in A? percent 2.arrow_forwardSuppose the returns on long-term corporate bonds and T-bills are normally distributed. Assume for a certain time period, long-term corporate bonds had an average return of 6.5 percent and a standard deviation of 8.5 percent. For the same period, T-bills had an average return of 3.3 percent and a standard deviation of 3.1 percent. Use the NORMDIST function in Excel to answer the following questions: a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the probability that in any given year, the return on T-bills will be greater than 10 percent? Less than 0 percent? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. c. In 1979, the return on long-term corporate bonds was -4.18 percent. How…arrow_forwardSuppose that there exist two securities (A and B) with annual expected returns equal to ra = 3% and rg = 5% and standard deviations equal to o4 = 7% and oB = 10% respectively. The correlation coefficient between the returns of these securities is p = -0.5. What is the expected return and the standard deviation of an equally weighted portfolio consisting of the securities A and B? Describe every step of your calculations in detail. What is the expected return and the standard deviation of a portfolio consisting of the securities A and B, if the relevant weights are chosen to minimize the risk of the portfolio? Present the minimisation problem and describe every step of your calculations in detail. How could an investor maximize diversification benefits? Critically discuss and explain in detail.arrow_forward

- You are given the following partial covariance and correlation tables from historical data: Securities J K Market Securities J K Market 1.24 1.11 1.17 1.03 Covariance Matrix K 0.90 J 0.0020480 0.0021600 Also, you have estimated that the market's standard deviation is 4.3 percent. For the coming year, the expected return on the market is 14.0 percent and the risk-free rate is expected to be 4.0 percent. Given this information, determine the beta for Security K for the coming year, assuming CAPM is the correct model for required returns. Correlation Matrix K 0.60 1.00 0.90 1.00 0.60 0.80 Market 0.0020480 0.0021600 Market 0.80 0.90 1.00 Ston sharing Hidel lines Wearrow_forwardConsider the following information about two stocks (D and E) and two common risk factors (factor 1 and factor 2) Stock Risk factor 1 Risk factor 2 Expected return (%) D 1.2 3.4 13.1 2.6 2.6 15.4 a. Assuming that the risk free rate is 5%, determine the risk premium for factors 1 and 2 that are consistent with the expected returns for the two stocks. You expect that in one year the prices of Stock D and E will be $55 and $36 respectively and pay no dividends. What should be the price of each stock today to be consistent with the expected return levels. b. C. Determine how to you identified if Stock D and E are overvalued, fairly valued and undervalued? d. Suppose the risk premium for factor 1 as computed in (a) increases by 0.25 percent, what will be the new expected return for D and E? e. Suppose the risk premium for factor 1 as computed in (a) decreases by 0.25%, what will be the new expected return for D and E? f. Devise how would you develop a Jensen Index using Arbitrage Pricing…arrow_forwardFor the upcoming year, the risk-free rate is 2 percent, and the expected return to the market is 7 percent. You are also given the following covariance matrix for Securities J,K, andL. \table[[Covariance,Security J,Security K,Security L],[Security J,0.0012532,0.0010344,0.0019711],[Security K,0.0010344,0.0023717,0.0013558],[Security L,0.0019711,0.0013558,0.0048442]] Also assume that you form a portfolio by putting 0 percent of your funds in Security J, 40 percent of your funds in Security K, and 60 percent of your funds in Security L. Based on this information, determine the standard deviation of the resulting portfolio. ◻ 6.47% 5.27% 4.98% 5.82% 4.77%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Bond Valuation - A Quick Review; Author: Pat Obi;https://www.youtube.com/watch?v=xDWTPmqcWW4;License: Standard Youtube License