Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

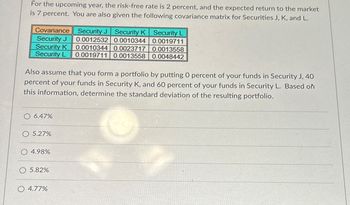

For the upcoming year, the risk-free rate is 2 percent, and the expected return to the market is 7 percent. You are also given the following covariance matrix for Securities J,K, andL. \table[[Covariance,Security J,Security K,Security L],[Security J,0.0012532,0.0010344,0.0019711],[Security K,0.0010344,0.0023717,0.0013558],[Security L,0.0019711,0.0013558,0.0048442]] Also assume that you form a portfolio by putting 0 percent of your funds in Security J, 40 percent of your funds in Security K, and 60 percent of your funds in Security L. Based on this information, determine the standard deviation of the resulting portfolio. ◻ 6.47% 5.27% 4.98% 5.82% 4.77%

Transcribed Image Text:For the upcoming year, the risk-free rate is 2 percent, and the expected return to the market

is 7 percent. You are also given the following covariance matrix for Securities J, K, and L.

Covariance

Security J

Security J

Security K

Security L

0.0012532

0.0010344

0.0019711

0.0023717

0.0013558

Security K 0.0010344

Security L 0.0019711 0.0013558 0.0048442

Also assume that you form a portfolio by putting 0 percent of your funds in Security J, 40

percent of your funds in Security K, and 60 percent of your funds in Security L. Based on

this information, determine the standard deviation of the resulting portfolio.

O 6.47%

5.27%

4.98%

5.82%

O 4.77%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock has an expected return of 0.15, its beta is 0.52, and the expected return on the market is 0.08. What must the risk-free rate be? (Hint: Use CAPM) Enter the answer in 4 decimals e.g. 0.0123.arrow_forward(Expected return and risk) Universal Corporation is planning to invest in a security that has several possible rates of return. Given the probability distribution of returns in the popup window, , what is the expected rate of return on the investment? Also compute the standard deviation of the returns. What do the resulting numbers represent? a. The expected rate of return on the investment is ☐ %. (Round to two decimal places.) b. The standard deviation of the returns is %. (Round to two decimal places.) c. What do the resulting numbers represent? (Select the best choice below.) ○ A. Universal could expect a return of 8.75 percent with a 67 percent possibility that this return would vary up or down by 8.04 percent. B. Universal could expect a return of 8.04 percent with a 67 percent possibility that this return would vary up or down by 8.75 percent. C. Universal could expect a return of 8.75 percent with a 25 percent possibility that this return would vary up or down by 8.04 percent.…arrow_forwardSuppose the market portfolio has an expected return of 9% and a volatility of 18.5%. YMH stock return has a 22% volatility and a correlation with the market return of 0.74. If the risk-free rate is 1% and the CAPM holds, what is the Sharpe ratio of the YMH stock? O 0.32 0.384 O 0.2944 O 0.3648arrow_forward

- Suppose you create a portfolio with two securities: Security Security Weight (%) Security Variance (%) X 70 18 Y 30 22 If the correlation coefficient between the two securities is -0.2, what is the standard deviation of the portfolio?arrow_forwardSyntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return 0.35 13% 0.25 −7% 0.30 17% 0.25 8% 0.35 21% 0.25 15% 0.25 23% (Click on the icon in order to copy its contents into a spreadsheet.) Question content area bottom Part 1 a. Given the information in the table, the expected rate of return for stock A is enter your response here%. (Round to two decimal places.)arrow_forwardThe risk-free rate is 5.6%, the market risk premium is 8.5%, and the stock’s beta is 2.27. What is the required rate of return on the stock, E(Ri)? Use the CAPM equation.arrow_forward

- Given the following excess return index model regression results Ra*= -0.059616 + 0.957478Rm* where; \sigma M = 0.80226720, the return on the market portfolio is 0.085306, and the risk-free rate is 0.018302. Note Ra* and Rm* are excess returns. Calculate the actual return for Stock A. Round to 4 decimals, and present answer as a decimal (.08, not 8%) Answer: 0.0228arrow_forward7-11. SML Assume that the risk free rate is 2%, the market risk premium is 5%, and the beta of two stocks A and B are 1.4 and 0.8, respectively. a. Calculate both stocks' required rates of return. Answer b. What would be the return on an "average" stock? Answer c. Explain the significance of a security with a O beta. What would be this security's required return? d. Assume that the economy worsens and that investors correspondingly revise their attitudes toward stocks, Would this change be better reflected in a shift in the market risk premium to 3.5% or 6.5%? e. Based on your answer to (d), what would be the new required return for stocks A and B? Would you expect stock prices for A and B to fall or rise? Answeh f. Ignoring (d) and (e) above, assume that inflationary expectations were revised upward by 0.5%. What would be the change to required returns for stocks A and B? Would their prices fall or rise? Answer ED ndastandard only answer e) and f)arrow_forwardFinance The risk-free rate is 3.7 percent and the expected return on the market is 12.3 percent. Stock A has a beta of 1.1and an expected return of 13.1 percent. Stock B has a beta of .86 and an expected return of 11.4 percent. Arethese stocks correctly priced? Why or why not? Use E(Ri) = Rf + βi(E(RM) − Rf).arrow_forward

- *Stock A has a beta of 1.3 and an expected return of 10.2. Stock B has a beta of 0.8 and an expected return of 8.7. If these stocks are priced correctly according to the CAPM, what is the risk-free rate? Give your answer in percentage to the nearest basis point.arrow_forwardHelp me pleasearrow_forwardYou are given the following partial covariance and correlation tables from historical data: Securities J K Market Securities J K Market 1.24 1.11 1.17 1.03 Covariance Matrix K 0.90 J 0.0020480 0.0021600 Also, you have estimated that the market's standard deviation is 4.3 percent. For the coming year, the expected return on the market is 14.0 percent and the risk-free rate is expected to be 4.0 percent. Given this information, determine the beta for Security K for the coming year, assuming CAPM is the correct model for required returns. Correlation Matrix K 0.60 1.00 0.90 1.00 0.60 0.80 Market 0.0020480 0.0021600 Market 0.80 0.90 1.00 Ston sharing Hidel lines Wearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education