Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

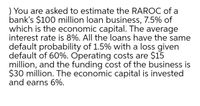

Transcribed Image Text:) You are asked to estimate the RAROC of a

bank's $100 million loan business, 7.5% of

which is the economic capital. The average

interest rate is 8%. All the loans have the same

default probability of 1.5% with a loss given

default of 60%. Operating costs are $15

million, and the funding cost of the business is

$30 million. The economic capital is invested

and earns 6%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- It is December 31. Last year, Galaxy Corporation had sales of $80,000,000, and it forecasts that next year's sales will be $86,400,000. Its fixed costs have been-and are expected to continue to be-$44,000,000, and its variable cost ratio is 10.00 %. Galaxy's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 12%, and 5,000,000 shares of outstanding common equity. The company's profits are taxed at a marginal rate of 35%. The following are the two principal equations that can be used to calculate a firm's DFL value: DFL (at EBIT = $X) = Given this information, complete the following sentences: Percentage Change in EPS Percentage Change in EBIT Consider the following statement about DFL, and indicate whether or not it is correct. 0 0 DFL (at EBITSX) = • The company's percentage change in EBIT is . The percentage change in Galaxy's earnings per share (EPS) is • The degree of financial leverage (DFL) at $86,400,000 is. (Hint: Use the changes in EPS…arrow_forwardNeveready Flashlights Inc. needs $340,000 to take a cash discount of 3/17, net 72. A banker will lend the money for 55 days at an interest cost of $10,400. What is the effective rate on the bank loan? tion in mind. 20.04% 3.06% 4.25% 10% How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 72 days instead of 17 days? 3.0% 97% 6.55% 15% Should the firm borrow the money to take the discount? No Yes I don't know Sometimes If the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $340,000? $10,000 $1,000 $100,000 ○ $425,000 What would be the effective interest rate in part d if the interest charge for 55 days were $13,000? Should the firm borrow with the 20 percent compensating balance? (The firm has no funds to count against the compensating balance requirement.) 3.0% 6.55% 6.0% 5.0%arrow_forwardcO X HAS cASH BALANCE OF $33 AND SHORT TERM LOAN BALANCE OF $200 AT THE BEGINNING OF QTR 1. THE NET CASH INFLOW FOR THE 1ST QTR IS $89 AND THE FOR THE SECOND QTR THERE IS A NET CAHS OUTFLOW OF $44. aLL CASH SHORTFALLS ARE FUNDED WITH SHORT TERM DEBT. THE FIRM PAYS 2% OF ITS PRIOR QUARTERS ENDING LOAN BALANCE AS INTERST EACH QUARTER. THE MINIMUM CASH BALANCE IS $25. wHAT IS THE SHORT TERM LOAN BALANCE AT THE END OF THE YEAR? available anwsers are 107 111 121 128 133arrow_forward

- Company XYZ has annual credit sales of $2,500,000. Collection of the credit sales are evenly spread out over the 250 working days per year. The company’s annual cost of borrowing is 7%. How much would XYZ save each year by improving its receivables process by one day?arrow_forwardok Gladys Bank and Trust has $440 million in consumer loans with an average interest rate of 8.05 percent. The bank also has $320 million in home equity loans with an average interest rate of 5 percent. Finally, the company owns $140 million in government securities with an average rate of 3 percent. Managers at Gladys Bank and Trust estimate that next year its consumer loan portfolio will fall to $400 million and the interest rate will increase to 9.55 percent. They also estimate that its home equity loans will increase to $360 million with an average interest rate of 7 percent, and its government securities portfolio will increase to $155 million with an average rate of 14.50 percent. Required: Estimate the revenues for the coming year for Gladys Bank and Trust. Note: Enter your answer in thousands of dollars. Interest revenue CARRERarrow_forwardAverage account receivables-60 days, Inventories-85 days, Average account payable-55 days Company spends Rs.21, 00,000 annually and can earn 10% on its investments. (i) Find out cash cycle and cash turnover assuming 360 days in a year, (ii) Minimum amount of cash required to meet the payment. Also calculate the above, if inventory age is reduced to 75 days. What will be the savings for the company?arrow_forward

- Dome Metals has credit sales of $450,000 yeariy with credit terms of net 45 days, which is also the average collection perlod. a. Assume the fnrm offers a 2 percent discount for payment in 18 days and every customer takes advantage of the discount. Also assume the firm uses the cash generated from its reduced receivables to reduce its bank loans which cost 12 percent. What will the net gain or loss be to the firm if this discount is offered? (Use a 360-day year.)arrow_forwardABC Co needs to purchase equipment for $2 million. It is estimated that the after- tax cash inflows from the project will be $210,000 annually in perpetuity. ABC Co has a market value debt-to-assets ratio of 60%. The firm's cost of equity is 13%, its pre-tax cost of debt is 8%, and the flotation costs of debt and equity are 2% and 8%, respectively. The tax rate is 34%. Assume the project is of similar risk to the firm's existing operations. What is the dollar flotation cost for the proposed financing? $83,333 $88,000 $92,050 $79,840 $80,000arrow_forwardHoliday Tree Farm has a cash balance of $34 and a short-term loan balance of $180 at the beginning of Qt. The net cash inflow for the first quarter is $36 and for the second quarter there is a net cash outflow of $48. All cash shortfalls are funded with short-term debt. The firm pays 2 percent of its prior quarter's ending loan balance as interest each quarter. The minimum cash balance is $20. What is the short-term loan balance at the end of Q2? Multiple Choice $184.3 $179.2 $138.6 $128.4 $1931arrow_forward

- A new delivery van costs $20,000 and can be financed for 60 months with a $4,000 down payment. I.M.’s bank will finance the van at 5.5 percent compounded monthly, and you calculated his weighted average cost of capital at 8 percent. How do you figure out the monthly payment for the van?arrow_forwardYou are considering investing in Dakota's Security Services. You have been able to locate the following information on the firm: Total assets are $32.6 million, accounts receivable are $4.46 million, ACP is 25 days, net income is $4.83 million, and debt-to-equity is 1.3 times. All sales are on credit. Dakota's is considering loosening its credit policy such that ACP will increase to 30 days. The change is expected to increase credit sales by 6 percent. Any change in accounts receivable will be offset with a change in debt. No other balance sheet changes are expected. Dakota's profit margin will remain unchanged. How will this change in accounts receivable policy affect Dakota's net income, total asset turnover, equity multiplier, ROA, and ROE? Note: Do not round intermediate calculations. Enter your answer in millions of dollars. Round your answers to 2 decimal places. Use 365 days a year. Net income Total asset turnover Equity multiplier ROA ROE million times times % %arrow_forwardSunny Manufacturing is considering extending trade credit to some customers previously considered poor risks. Sales would increase by $220,000 if credit is extended to these new customers. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 5 percent of sales, and production and selling costs will be 70 percent of sales. a. Compute the incremental income before taxes. $ Incremental income before taxes b. What will the firm's incremental return on sales be if these new credit customers are accepted? (Round the final answer to 2 decimal place.) Incremental return on sales % c. If the receivable turnover ratio is 4 to 1, and no other asset buildup is needed to serve the new customers, what will Sunny Manufacturing's incremental return on new average investment be? (Do round intermediate calculations. Round the final answer to the nearest whole percentage.) Incremental return on new average investment %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education