Concept explainers

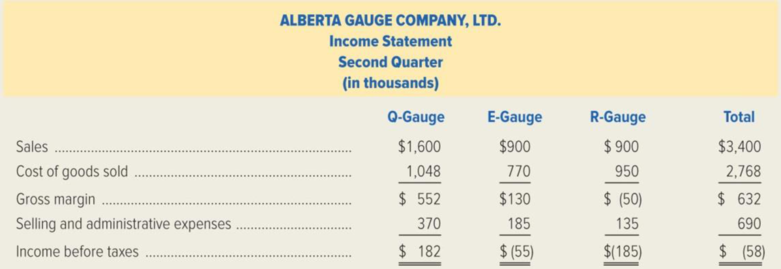

Alberta Gauge Company, Ltd., a small manufacturing company in Calgary, Alberta, manufactures three types of electrical gauges used in a variety of machinery. For many years the company has been profitable and has operated at capacity. However, in the last two years, prices on all gauges were reduced and selling expenses increased to meet competition and keep the plant operating at capacity. Second-quarter results for the current year, which follow, typify recent experience.

Alice Carlo, the company’s president, is concerned about the results of the pricing, selling, and production prices. After reviewing the second-quarter results, she asked her management staff to consider the following three suggestions:

- Discontinue the R-gauge line immediately. R-gauges would not be returned to the product line unless the problems with the gauge can be identified and resolved.

- Increase quarterly sales promotion by $100,000 on the Q-gauge product line in order to increase sales volume by 15 percent.

- Cut production on the E-gauge line by 50 percent, and cut the traceable advertising and promotion for this line to $20,000 each quarter.

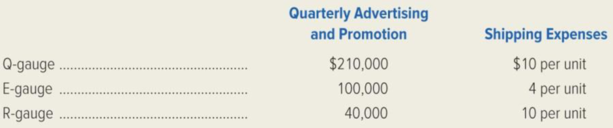

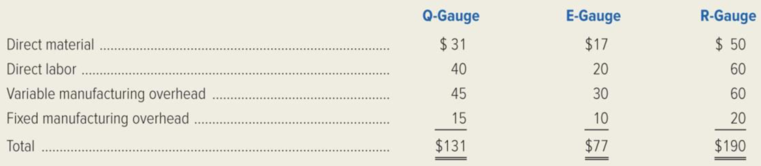

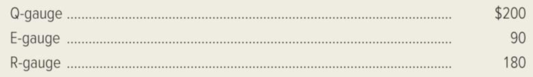

Jason Sperry, the controller, suggested a more careful study of the financial relationships to determine the possible effects on the company’s operating results of the president’s proposed course of action. The president agreed and assigned JoAnn Brower, the assistant controller, to prepare an analysis. Brower has gathered the following information.

- All three gauges are manufactured with common equipment and facilities.

- The selling and administrative expense is allocated to the three gauge lines based on average sales volume over the past three years.

- Special selling expenses (primarily advertising, promotion, and shipping) are incurred for each gauge as follows:

- The unit

manufacturing costs for the three products are as follows:

- The unit sales prices for the three products are as follows:

- The company is manufacturing at capacity and is selling all the gauges it produces.

Required:

- 1. Jo Ann Brower says that Alberta Gauge Company’s product-line income statement for the second quarter is not suitable for analyzing proposals and making decisions such as the ones suggested by Alice Carlo. Write a memo to Alberta Gauge’s president that addresses the following points.

- a. Explain why the product-line income statement as presented is not suitable for analysis and decision making.

- b. Describe an alternative income-statement format that would be more suitable for analysis and decision making, and explain why it is better.

- 2. Use the operating data presented for Alberta Gauge Company and assume that the president’s proposed course of action had been implemented at the beginning of the second quarter. Then evaluate the president’s proposal by specifically responding to the following points.

- a. Are each of the three suggestions cost-effective? Support your discussion with an analysis that shows the net impact on income before taxes for each of the three suggestions.

- b. Was the president correct in proposing that the R-gauge line be eliminated? Explain your answer.

- c. Was the president correct in promoting the Q-gauge line rather than the E-gauge line? Explain your answer.

- d. Does the proposed course of action make effective use of the company’s capacity? Explain your answer.

- 3. Are there any qualitative factors that Alberta Gauge Company’s management should consider before it drops the R-gauge line? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Alberta Gauge Company, LTD., a small manufacturing company in Calgary, Alberta, manufactures three types of electrical gauges used in a variety of machinery. For many years the company has been profitable and has operated at capacity. However, in the last two years, prices on all gauges were reduced and selling expenses increased to meet competition and keep the plant operating at capacity. Second-quarter results for the current year, which follow, typify recent experience. Second Quarter Income Statement: Q-Gauge (in thousands) E-Gauge (in thousands) R-Gauge(in thousands) Total(in thousands) Sales $1,600 $900 $900 $3,400 Cost of Goods sold $1,048 $770 $950 $2768 Gross margin $552 $130 $ (50) $632 Selling and administrative expenses $370 $185 $135 $690 Income before taxes $182 $(55) $(185) $(58) Alice Carlo, the company's president, is concerned about the results of the pricing, selling, and production prices. After reviewing the second-quarter results, she asked…arrow_forwardAlberta Gauge Company, LTD., a small manufacturing company in Calgary, Alberta, manufactures three types of electrical gauges used in a variety of machinery. For many years the company has been profitable and has operated at capacity. However, in the last two years, prices on all gauges were reduced and selling expenses increased to meet competition and keep the plant operating at capacity. Second-quarter results for the current year, which follow, typify recent experience. Second Quarter Income Statement: Q-Gauge (in thousands) E-Gauge (in thousands) R-Gauge(in thousands) Total(in thousands) Sales $1,600 $900 $900 $3,400 Cost of Goods sold $1,048 $770 $950 $2768 Gross margin $552 $130 $ (50) $632 Selling and administrative expenses $370 $185 $135 $690 Income before taxes $182 $(55) $(185) $(58) Alice Carlo, the company's president, is concerned about the results of the pricing, selling, and production prices. After reviewing the second-quarter results, she asked…arrow_forwardVernon Corporation makes and sells state-of-the art electronics products. One of its segments produces the math machine, an in expensive calculator. The company's chief accountant recently prepared the following income statement showing annual revenues and expnses associated with the segment's operating activities. The relevant range for the production and sale of the range for the production and sale of the calculators is between 33,000 and 71,000 units per year. Revenue (47,000 unitsx9.00) $423,000 Unit-level variable costs Materials cost (47,000x$2.00) ($94,000) labor cost (47,000x1.00) ($47,000) manufacturing overhead (47,000x $0.20) ($9,400) shipping and handling (47,000x $0.24) ($11,280) Sales commissions (47,000x$2.00) ($94,000) contribution margin $167,320 Fixed expenses Advertising costs ($30,000) Salary of production supervisor ($66,000) Allocated company-wide facility-level expenses ($82,000) Net loss ($10,680) Required A) A large discount store has approached the…arrow_forward

- A local store, Waterway, has sold out of its signature item, the classic rocking chair, for the past five years straight. Waterway has capitalized on a product that appeals to nostalgic consumers of all ages. To evaluate its performance for the year just ended, where 3,400 units were produced compared to the 3,100 planned units, the accounting team gathered the following information. . . . . . (a) Actual board feet purchased, 186,700; actual board feet used. 168,300; budgeted board feet per unit, 50. Actual price per board foot, $1.18; budgeted price per board foot, $1.20. Actual DL hours used, 6,700; budgeted DL hours per unit, 2. Actual DL rate per hour, $20.10; budgeted DL rate per hour, $20. Actual variable-MOH cost, $23,450; budgeted variable-MOH rate. $3.60 per DL hour. Actual fixed-MOH cost, $52,595; budgeted fixed-MOH rate, $8.50 per DL hour. Prepare a standard cost card for each product cost, and conduct a variance analysis for each. Specifically, determine the amount and sign…arrow_forwardMAG Petroleum is an SME specialising in the sale of lubricants for industrial use. The company, which is owned and operated by Angelina, has just completed its third year operation. During this time, Angelina has sought to establish a reputation for the company as a supplier of high quality lubricants. The efforts made by Angelina and her staff have proved successful, and her company has become one of the best and fastest growing privately owned company in Zambia.Angelina has concluded that in order to plan better for the growth of the company in the future, it is necessary to develop assistance that will enable her to forecast lubricant sales by month for up to one year in advance. Angelina has available data on the total lubricant sales that were realized during the previous three years of operation. These data are provided in Table Q2.(a) What forecasting method would you recommend to Angelina? Justify your choicearrow_forwardJordan manufacturing co. produces and sells specialized equipment used in the petroleum industry. The company is organized into three separate operating branches. Division A, which manufactures and sells heavy equipment, Division B, which manufactures and sells hand tools, and divisions, which makes and sells electric motors. Each division is housed in a separate building. In recent years, Division B has been operating at a net loss and is expected to continue to do so. Income statements for the three divisions for year 2 follow. Sales Less cost of goods sold Division Sales Division A Division B Division C less : cost of goods sold $4,000,000 $1,150,000 $4,500,000 unit level manufacturing cost $(2,500,000) (800,000) $(2,780,000) rent on manufacturing facility $(510,000) $(260,000) $(500,000) Gross margin…arrow_forward

- Swain Athletic Gear (SAG) operates six retall outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city. Management at SAG is concerned about declining sales and profitability of the Cornwall store and believes that outlet has been a drag on profits in recent years. The most recent Income statement for the Cornwall store follows. SWAIN ATHLETIC GEAR Cornwall Street Store Income Statement For the Year Ending February 28 Sales revenue Costs Cost of goods sold Advertising Store administrative salaries Sales commissions Leases and utilities Allocated corporate support Total costs Net loss before tax benefit Tax benefit at 25% Net loss The CFO at SAG has asked for your advice on closing the Cornwall Street store. If the Cornwall Street store is closed, neither total corporate support costs nor operations or costs of the other stores are expected to change. Required: a. Using the worksheet below,…arrow_forwardSuppose that Kicker had the following sales and cost experience (in thousands of dollars) for May of the current year and for May of the prior year: In May of the prior year, Kicker started an intensive quality program designed to enable it to build original equipment manufacture (OEM) speaker systems for a major automobile company. The program was housed in research and development. In the beginning of the current year, Kickers accounting department exercised tighter control over sales commissions, ensuring that no dubious (e.g., double) payments were made. The increased sales in the current year required additional warehouse space that Kicker rented in town. (Round ratios to four decimal places. Round sales dollars computations to the nearest dollar.) Required: 1. Calculate the contribution margin ratio for May of both years. 2. Calculate the break-even point in sales dollars for both years. 3. Calculate the margin of safety in sales dollars for both years. 4. CONCEPTUAL CONNECTION Analyze the differences shown by your calculations in Requirements 1, 2, and 3.arrow_forwardRichard is the operating manager of Sheridan, a company that manufactures three different types of all-terrain vehicles: four- wheelers, personal watercraft, and snowmobiles. Naturally, Richard has the opportunity to test all of these products for quality- control purposes. At the end of the year, Richard needs to perform a profitability analysis for each product line to better evaluate the company's pricing strategy. He has a gut feeling that the company has room to increase selling prices in the snowmobile category, but he wants to see what the financials look like before he makes a case to the CEO. He has gathered the following information. The costs for the three support departments, Payroll, Maintenance, and IT, are allocated to the product lines according to number of employees, maintenance hours used, and IT hours used, respectively. Sales Four-Wheelers IT hours $1,132,000 Costs Number of employees Maintenance hours Personal Watercraft Payroll $94,000 2 100 150 $1,399,000…arrow_forward

- Tesselek Technology, Inc., is a relatively new company and has been operating for only the past five years. It was set up by two leading scientists Mr. Tess and Mr. Lek. The company is involved in the development of high speed electric cars which are in high demand. The company has enjoyed very rapid growth and equally high profitability. Although the company has employed an excellent group of well competent employees, its overall future development plans were highly dependent on the two senior scientists. On November 3, 2020, the two scientists had an accident in a race to test their new car model. Both were killed in that accident and now, the company's future plans have come to a near dead stop. The stock market answered badly to this news, the company stock price had dropped nearly by 70% and the remaining members of the Board of Directors have instructed the CFO to account for this loss of market value estimated at between $350M-$500M ( probability is equally distributed) as a…arrow_forwardTesselek Technology, Inc., is a relatively new company and has been operating for only the past five years. It was set up by two leading scientists Mr. Tess and Mr. Lek. The company is involved in the development of high speed electric cars which are in high demand. The company has enjoyed very rapid growth and equally high profitability. Although the company has employed an excellent group of well competent employees, its overall future development plans were highly dependent on the two senior scientists. On November 3, 2020, the two scientists had an accident in a race to test their new car model. Both were killed in that accident and now, the company's future plans have come to a near dead stop. The stock market answered badly to this news, the company stock price had dropped nearly by 70% and the remaining members of the Board of Directors have instructed the CFO to account for this loss of market value estimated at between $350M-$500M ( probability is equally distributed) as a…arrow_forwardThe new chief executive officer (CEO) of Richard Manufacturing has asked for a variety of information about the operations of the firm from last year. The CEO is given the following information, but with some data missing: (Click the icon to view the variety of operations information.) Read the requirements, Requirement 1. Find (a) total sales revenue, (b) selling price, (c) rate of return on investment, and (d) markup percentage on full cost for this product. (a) The total sales revenue is (Round your answer to the nearest cent.) (b) The selling price per unit is (Round the retum on investment to the nearest whole percent, X%.) (c) The rate of return on investment is (d) Calculate the markup percentage on full cost for this product. (Round your intermediary calculations to the nearest cent and the markup to the nearest hundredth percent XXX%) The markup percentage on full cost for this product is Requirement 2. The new CEO has a plan to reduce fixed costs by $200,000 and variable…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub