Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 47P

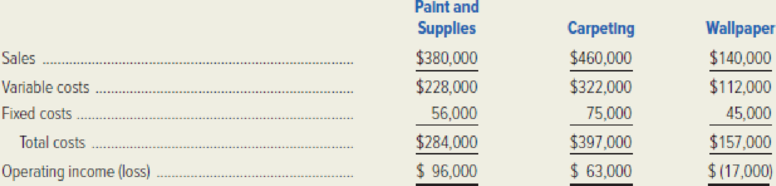

Tipton One-Stop Decorating sells paint and paint supplies, carpet, and wallpaper at a single-store location in suburban Des Moines. Although the company has been very profitable over the years, management has seen a significant decline in wallpaper sales and earnings. Much of this decline is attributable to the Internet and to companies that advertise deeply discounted prices in magazines and offer customers free shipping and toll-free telephone numbers. Recent figures follow.

Tipton is studying whether to drop wallpaper because of the changing market and accompanying loss. If the line is dropped, the following changes are expected to occur:

- The vacated space will be remodeled at a cost of $12,400 and will be devoted to an expanded line of high-end carpet. Sales of carpet are expected to increase by $120,000, and the line’s overall contribution margin ratio will rise by five percentage points.

- Tipton can cut wallpaper’s fixed costs by 40 percent. Remaining fixed costs will continue to be incurred.

- Customers who purchased wallpaper often bought paint and paint supplies. Sales of paint and paint supplies are expected to fall by 20 percent.

- The firm will increase advertising expenditures by $25,000 to promote the expanded carpet line.

Required:

- 1. Should Tipton close its wallpaper operation? Show computations to support your answer.

- 2. Assume that Tipton’s wallpaper inventory at the time of the closure decision amounted to $23,700. How would you have treated this additional information in making the decision?

- 3. What advantages might Internet- and magazine-based firms have over Tipton that would allow these organizations to offer deeply discounted prices—prices far below what Tipton can offer?

- 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirement (1) above. Show how the solution will change if the following information changes: sales were $400,000, $450,000, and $130,000, for paint and supplies, carpeting, and wallpaper, respectively.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

HASF & company sells paint and paint supplies carpet and wallpaper at a single store location in suburban Baltiomore Although the company has been very profitable over the year management has seen very profitable over the year management has seen a significant decline in wallpaper sales and earnings Much of this decline is attributable to the internet and to companies that advertise deeply discounted prices in magazines and offer customer free shipping and toll free telephone number recent figures follow :

Paint Supplies Carpeting Walpaper Total

Sales 250,000 230,000 70,000 550,000

Fixed cost 170,000 161,000 56,000 387,000

Less variable cost 40,000 40,000 40,000 120,000

Total cost 210,000 201,000 96,000 507,000

Operating…

HASF & company sells paint and paint supplies carpet and wallpaper at a single store location in suburban Baltiomore Although the company has been very profitable over the year management has seen very profitable over the year management has seen a significant decline in wallpaper sales and earnings Much of this decline is attributable to the internet and to companies that advertise deeply discounted prices in magazines and offer customer free shipping and toll free telephone number recent figures follow

Paint and supplies

Carpeting

wallpaper

Total

sales

250,000

230,000

70,000

550,000

less variable cost

170,000

161,000

56,000

387,000

fixed costs

40,000

40,000

40,000

120,000

total cost

210,000

201,000

96,000

507,000

operating income

40,000

29,000

-26,000

43,000

Other information:

Management is studying whether to drop wallpaper because of the changing market and accompanying loss if the line is dropped the following changes are expected to occur…

HASF & company sells paint and paint supplies carpet and wallpaper at a single store location in suburban Baltiomore Although the company has been very profitable over the year management has seen very profitable over the year management has seen a significant decline in wallpaper sales and earnings Much of this decline is attributable to the internet and to companies that advertise deeply discounted prices in magazines and offer customer free shipping and toll free telephone number recent figures follow

Paint and supplies

Carpeting

wallpaper

Total

sales

250,000

230,000

70,000

550,000

less variable cost

170,000

161,000

56,000

387,000

fixed costs

40,000

40,000

40,000

120,000

total cost

210,000

201,000

96,000

507,000

operating income

40,000

29,000

-26,000

43,000

Other information:

Management is studying whether to drop wallpaper because of the changing market and accompanying loss if the line is dropped the following changes are expected to occur…

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 14 - Prob. 1RQCh. 14 - Describe the managerial accountants role in the...Ch. 14 - Distinguish between qualitative and quantitative...Ch. 14 - Prob. 4RQCh. 14 - A quantitative analysis enables a decision maker...Ch. 14 - Prob. 6RQCh. 14 - Prob. 7RQCh. 14 - Prob. 8RQCh. 14 - Is the book value of inventory on hand a relevant...Ch. 14 - Why might a manager exhibit a behavioral tendency...

Ch. 14 - Prob. 11RQCh. 14 - Prob. 12RQCh. 14 - Prob. 13RQCh. 14 - Prob. 14RQCh. 14 - Prob. 15RQCh. 14 - Briefly describe the proper approach for making a...Ch. 14 - Prob. 17RQCh. 14 - Are allocated joint processing costs relevant when...Ch. 14 - Briefly describe the proper approach to making a...Ch. 14 - What is meant by the term contribution margin per...Ch. 14 - How is sensitivity analysis used to cope with...Ch. 14 - There is an important link between decision making...Ch. 14 - List four potential pitfalls in decision making,...Ch. 14 - Why can unitized fixed costs cause errors in...Ch. 14 - Prob. 25RQCh. 14 - Prob. 26RQCh. 14 - Are the concepts underlying a relevant-cost...Ch. 14 - Prob. 28RQCh. 14 - Redo Exhibit 144 without the irrelevant data.Ch. 14 - Valley Pizzas owner bought his current pizza oven...Ch. 14 - Lamont Industries produces chemicals for the...Ch. 14 - Day Street Delis owner is disturbed by the poor...Ch. 14 - Prob. 35ECh. 14 - Intercontinental Chemical Company, located in...Ch. 14 - Intercontinentals special order also requires...Ch. 14 - Fusion Metals Company is considering the...Ch. 14 - Prob. 39ECh. 14 - Zytel Corporation produces cleaning compounds and...Ch. 14 - Duo Company manufactures two products, Uno and...Ch. 14 - Refer to the data given in the preceding exercise...Ch. 14 - Southern California Chemical Company manufactures...Ch. 14 - Kitchen Magician, Inc. has assembled the following...Ch. 14 - Prob. 45PCh. 14 - Prob. 46PCh. 14 - Tipton One-Stop Decorating sells paint and paint...Ch. 14 - Carpenters Mate, Inc. manufactures electric...Ch. 14 - Casting Technology Resources (CTR) has purchased...Ch. 14 - The Midwest Division of the Paibec Corporation...Ch. 14 - Prob. 51PCh. 14 - Prob. 52PCh. 14 - Upstate Mechanical, Inc. has been producing two...Ch. 14 - Chenango Industries uses 10 units of part JR63...Ch. 14 - Miami Industries received an order for a piece of...Ch. 14 - Prob. 56PCh. 14 - Ozark Industries manufactures and sells three...Ch. 14 - Prob. 58PCh. 14 - Deru Chocolate Company manufactures two popular...Ch. 14 - Prob. 60PCh. 14 - Prob. 61PCh. 14 - Bo Vonderweidt, the production manager for...Ch. 14 - Alberta Gauge Company, Ltd., a small manufacturing...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PLEASE ANSWER FAST!!! HASF & company sells paint and paint supplies carpet and wallpaper at a single store location in suburban Baltiomore Although the company has been very profitable over the year management has seen very profitable over the year management has seen a significant decline in wallpaper sales and earnings Much of this decline is attributable to the internet and to companies that advertise deeply discounted prices in magazines and offer customer free shipping and toll free telephone number recent figures follow : Paint Supplies Carpeting Walpaper Total Sales 250,000 230,000 70,000 550,000 Fixed cost 170,000 161,000 56,000 387,000 Less variable cost 40,000 40,000 40,000 120,000 Total cost 210,000 201,000 96,000 507,000…arrow_forwardPosavek is a wholesale supplier of building supplies building contractors, hardware stores, and home-improvement centers in the Boston metropolitan area. Over the years, Posavek has expanded its operations to serve customers across the nation and now employs over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently, Posavek has experienced fierce competition from the large online discount stores. In addition, the company is suffering from operational inefficiencies related to its archaic information system. Posavek revenue cycle procedures are described in the following paragraphs. Revenue Cycle Posaveks sales department representatives receive orders via traditional mail, e-mail, telephone, and the occasional walk-in customer. Because Posavek is a wholesaler, the vast majority of its business is conducted on a credit basis. The process begins in the sales department, where the sales clerk enters the customers order into the centralized computer sales order system. The computer and file server are housed in Posaveks small data processing department. If the customer has done business with Posavek in the past, his or her data are already on file. If the customer is a first-time buyer, however, the clerk creates a new record in the customer account file. The system then creates a record of the transaction in the open sales order file. When the order is entered, an electronic copy of it is sent to the customers e-mail address as confirmation. A clerk in the warehouse department periodically reviews the open sales order file from a terminal and prints two copies of a stock release document for each new sale, which he uses to pick the items sold from the shelves. The warehouse clerk sends one copy of the stock release to the sales department and the second copy, along with the goods, to the shipping department. The warehouse clerk then updates the inventory subsidiary file to reflect the items and quantities shipped. Upon receipt of the stock release document, the sales clerk accesses the open sales order file from a terminal, closes the sales order, and files the stock release document in the sales department. The sales order system automatically posts these transactions to the sales, inventory control, and cost-of-goods-sold accounts in the general ledger file. Upon receipt of the goods and the stock release, the shipping department clerk prepares the goods for shipment to the customer. The clerk prepares three copies of the bill of lading. Two of these go with the goods to the carrier and the third, along with the stock release document, is filed in the shipping department. The billing department clerk reviews the closed sales orders from a terminal and prepares two copies of the sales invoice. One copy is mailed to the customer, and the other is filed in the billing department. The clerk then creates a new record in the accounts receivable subsidiary file. The sales order system automatically updates the accounts receivable control account in the general ledger file. CASH RECEIPTS PROCEDURES Mail room clerks open customer cash receipts, reviews the check and remittance advices for completeness, and prepares two copies of a remittance list. One copy is sent with the checks to the cash receipts department. The second copy of the remittance advices are sent to the billing department. When the cash receipts clerk receives the checks and remittance list, he verifies the checks received against those on the remittance list and signs the checks For Deposit Only. Once the checks are endorsed, he records the receipts in the cash receipts journal from his terminal. The clerk then fills out a deposit slip and deposits the checks in the bank. Upon receipt of the remittances, the billing department clerk records the amounts in the accounts receivable subsidiary ledger from the department terminal. The system automatically updates the AR control account in the general ledger Posavek has hired your public accounting firm to review its sales order procedures for internal control compliance and to make recommendations for changes. Required a. Create a data flow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the physical internal control weaknesses in the system. d. (Optional) Prepare a system flowchart of a redesigned computer-based system that resolves the control weaknesses that you identified. Explain your solution.arrow_forwardContemporary Trends sells paint and paint supplies carpet and wallpaper at a single store location in suburban Baltimore Although the company has been very profitable over the year management has seen very profitable over the year management has seen a significant decline in wallpaper sales and earnings Much of this decline is attributable to the internet and to companies that advertise deeply discounted prices in magazines and offer customer free shipping and toll free telephone number recent figures follow: Paint and supplies Carpeting wallpaper Sales 190,000 230,000 70,000 Less variable cost 114,000 161,000 56,000 Fixed costs 28,000 37,500 22,000 Total cost 142,000 198,500 78,000 operating income 48,000 31,500 -8,000 Management is studying whether to drop wallpaper because of the changing market and accompanying loss if the line is dropped the following changes are expected to occur The vacated space…arrow_forward

- Haglund Department Store is located in the downtown area of a small city. While the store had been profitable for many years, it is facing increasing competition from large national chains that have set up storeson the outskirts of the city. Recently the downtown area has been undergoing revitalization, and the ownersof Haglund Department Store are somewhat optimistic that profitability can be restored.In an attempt to accelerate the return to profitability, management of Haglund Department Store is inthe process of designing a balanced scorecard for the company. Management believes the company shouldfocus on two key problems. First, customers are taking longer and longer to pay the bills they incur usingthe department store’s charge card, and the company has far more bad debts than are normal for the industry. If this problem were solved, the company would have more cash to make much needed renovations.Investigation has revealed that much of the problem with late payments and unpaid…arrow_forwardExeter Group is a large retail company that has brick-and-mortar outlets throughout the Southeast. They have been in business for many years, but two years ago started an online sales channel to offset slowing in-store sales. The human resources (HR) department at Exeter handles tasks for the two divisions that make up Exeter: Retail and Online. Retail Division manages the company’s traditional business line. This business, although still profitable, is currently not growing and may be shrinking slightly. Online Division, on the other hand, has experienced double-digit growth from the beginning. The cost allocation system at Exeter allocates all corporate costs to the divisions based on a variety of cost allocation bases. HR costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the HR Department. The first is employee maintenance (payroll administration, benefits, and so on), which is an ongoing activity and requires the…arrow_forwardExeter Group is a large retail company that has brick-and-mortar outlets throughout the Southeast. They have been in business for many years, but two years ago started an online sales channel to offset slowing in-store sales. The human resources (HR) department at Exeter handles tasks for the two divisions that make up Exeter: Retail and Online. Retail Division manages the company's traditional business line. This business, although still profitable, is currently not growing and may be shrinking slightly. Online Division, on the other hand, has experienced double-digit growth from the beginning. The cost allocation system at Exeter allocates all corporate costs to the divisions based on a variety of cost allocation bases. HR costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the HR Department. The first is employee maintenance (payroll administration, benefits, and so on), which is an ongoing activity and requires the…arrow_forward

- Contemporary Trends sells paint and paint supplies carpet and wallpaper at a single store location in suburban Baltimore Although the company has been very profitable over the year management has seen very profitable over the year management has seen a significant decline in wallpaper sales and earnings Much of this decline is attributable to the internet and to companies that advertise deeply discounted prices in magazines and offer customer free shipping and toll free telephone number recent figures follow: Paint and supplies Carpeting wallpaper |Sales Less variable cost Fixed costs Total cost | operating income 190,000 114,000 28,000 142,000 48.000 230,000 161,000 37,500 198,500 31,500 70,000 56,000 22,000 78,000 -8,000 Management is studying whether to drop wallpaper because of the changing market and accompanying loss if the line is dropped the following changes are expected to occur a. The vacated space will be remodeled at a cost of 15,000 and will be devoted to an expanded line…arrow_forwardSwain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city. Management at SAG is concerned about declining sales and profitability of the Cornwall store and believes that outlet has been a drag on profits in recent years. The most recent income statement for the Cornwall store follows. SWAIN ATHLETIC GEAR Cornwall Street Store Income Statement For the Year Ending February 28 Sales revenue $ 12,300,000 Costs Cost of goods sold $ 5,289,000 Advertising 1,421,000 Store administrative salaries 975,000 Sales commissions 1,056,000 Leases and utilities 2,100,000 Allocated corporate support 1,622,000 Total costs $ 12,463,000 Net loss before tax benefit $ (163,000) Tax benefit at 25% (40,750) Net loss $ (122,250) The CFO at SAG has asked for your advice on closing the Cornwall Street store. If the Cornwall Street store is…arrow_forwardSwain Athletic Gear (SAG) operates six retall outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city. Management at SAG is concerned about declining sales and profitability of the Cornwall store and believes that outlet has been a drag on profits in recent years. The most recent Income statement for the Cornwall store follows. SWAIN ATHLETIC GEAR Cornwall Street Store Income Statement For the Year Ending February 28 Sales revenue Costs Cost of goods sold Advertising Store administrative salaries Sales commissions Leases and utilities Allocated corporate support Total costs Net loss before tax benefit Tax benefit at 25% Net loss The CFO at SAG has asked for your advice on closing the Cornwall Street store. If the Cornwall Street store is closed, neither total corporate support costs nor operations or costs of the other stores are expected to change. Required: a. Using the worksheet below,…arrow_forward

- A payday loan company has decided to open several new locations in a city and hires consultants to decide where to open these locations. The consultants are paid per store that is opened, and at the end of the quarter, the company notices a many of the new stores' sales volume fail to meet expectations. To incentivize the consultants to instead focus on opening profitable stores, the company decided to alter the compensation to a percentage of the profit earned per new store. This puts the consultants_ and the payday loan company should expect to compensate for this change. to Group of answer choices 1. In a less risky position; pay the consultants more than they would in the per- store scheme 2. A more risky position; pay the consultants less than they would in the per- store scheme 3. In a less risky position; pay the consultants less than they would in the per- store scheme 4. A more risky position; pay the consultants more than they would in the per- store schemearrow_forwardFordson Bank operates a branch in a relatively small rural community. Fordson has a strong customer service focus and knows that branch visits can be important in fostering a reputation for good customer service. However, as internet banking increases in popularity, the financial staff at Fordson question whether the costs of the branch are worth it. As part of looking at the question, a financial analyst has collected monthly data on the number of customer visits to the branch and the operating cost of the branch over the last fiscal year. The data follow: Month Customer Visits 1 2 3 4 5 6 7 8 10 12 962 1,378 1,170 1,014 1,586 1,222 1,144 1,248 1,430 1,040 1,092 1,066 Branch Cost $ 71,534 90,046 80,790 73,848 99,302 83,104 79,633 84,261 Branch cost= 92,360 75,005 77,319 76,162 Required: a. Estimate the monthly fixed costs and the unit variable cost per customer visit using the high-low estimation method. Note: Round variable cost per unit to 2 decimal places. per visit Customer visitsarrow_forwardNunez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2014 is as follows: (Click to view the operating income for the stores.) The equipment has a zero disposal value. In a senior management meeting, Maria Lopez, the management accountant at Nunez Corporation, makes the following comment, "Nunez can increase its profitability by closing down the Rhode Island store." Is Maria Lopez Correct? Read the requirements. Requirement 1. By closing down the Rhode Island store, Nunez can reduce overall corporate overhead costs by $45,000. Calculate Nunez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. Begin by calculating Nunez's operating income if it closes the Rhode Island store. (Enter losses in revenues as a negative amount. Enter a "0" if the cost is Data Table (Loss in Revenues) Savings in Costs Revenues Connecticut…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License