Miami Industries received an order for a piece of special machinery from Jay Company. Just as Miami completed the machine, Jay Company declared bankruptcy, defaulted on the order, and forfeited the 10 percent deposit paid on the selling price of $72,500.

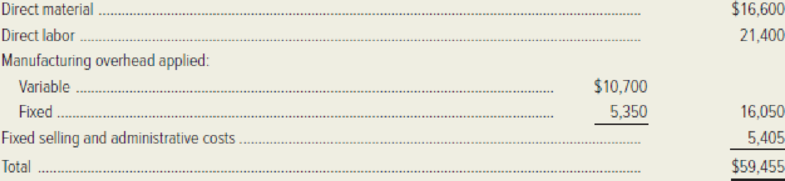

Miami’s manufacturing manager identified the costs already incurred in the production of the special machinery for Jay Company as follows:

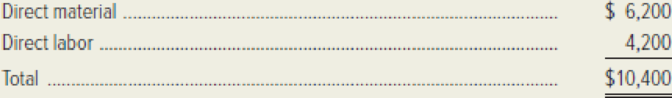

Another company, Kaytell Corporation, will buy the special machinery if it is reworked to Kaytell’s specifications. Miami Industries offered to sell the reworked machinery to Kaytell as a special order for $68,400. Kaytell agreed to pay the price when it takes delivery in two months. The additional identifiable costs to rework the machinery to Kaytell’s specifications are as follows:

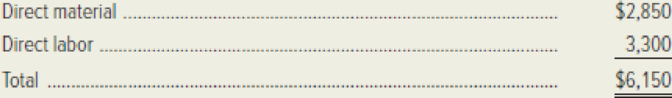

A second alternative available to Miami’s management is to convert the special machinery to the standard model, which sells for $62,500. The additional identifiable costs for this conversion are as follows:

A third alternative for Miami Industries is to sell the machine as is for a price of $52,000. However, the potential buyer of the unmodified machine does not want it for 60 days. This buyer has offered a $7,000 down payment, with the remainder due upon delivery.

The following additional information is available regarding Miami’s operations.

- The sales commission rate on sales of standard models is 2 percent, while the rate on special orders is 3 percent.

- Normal credit terms for sales of standard models are 2/10, net/30. This means that a customer receives a 2 percent discount if payment is made within 10 days, and payment is due no later than 30 days after billing. Most customers take the 2 percent discount. Credit terms for a special order are negotiated with the customer.

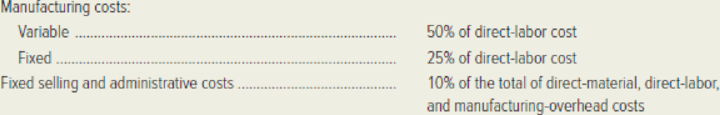

- The allocation rates for manufacturing

overhead and fixed selling and administrative costs are as follows:

- Normal time required for rework is one month.

Required:

- Determine the dollar contribution each of the three alternatives will add to Miami Industries’ before-tax profit.

- If Kaytell makes Miami Industries a counteroffer, what is the lowest price Miami should accept for the reworked machinery from Kaytell? Explain your answer.

- Discuss the influence fixed

manufacturing-overhead cost should have on the sales price quoted by Miami Industries for special orders.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Wildhorse Inc. recently replaced a piece of automatic equipment at a net price of $5,360, f.o.b. factory. The replacement was necessary because one of Wildhorse’s employees had accidentally backed his truck into Wildhorse’s original equipment and made it inoperable. Because of the accident, the equipment had no resale value to anyone and had to be scrapped. Wildhorse’s insurance policy provided for a replacement of its equipment and paid the price of the new equipment directly to the new equipment manufacturer, minus the deductible amount paid to the manufacturer by Wildhorse. The $5,360 that Wildhorse paid was the amount of the deductible that it has to pay on any single claim on its insurance policy. The new equipment represents the same value in use to Wildhorse. The used equipment had originally cost $64,800. It had a book value of $48,000 at the time of the accident and a second-hand market value of $55,020 before the accident, based on recent transactions involving similar…arrow_forwardLaco Company acquired its factory building about 20 years ago. For several years, the company has rented out a small, unused part of the building. The renter's lease will expire soon. Rather than renewing the lease, Laco Company is considering using the space itself to manufacture a new product. Under this option, the unused space will continue to be depreciated on a straight-line basis, as in past years. Direct materials and direct labour cost for the new product would be $50 per unit. In order to have a place to store finished units of the new product, the company would have to rent a small warehouse nearby. The rental cost would be $2,000 per month. It would cost the company an additional $4,000 each month to advertise the new product. A new production supervisor would be hired to oversee production of the new product who would be paid $3,000 per month. The company would pay a sales commission of $10 for each unit of product that is sold. Classify each cost by marking an "X" in the…arrow_forwardCari Heat (CH) Ltd. is currently faced with a critical decision regarding its production equipment. Cari Heat (CH) is evaluating two options for its production equipment: upgrading or replacing. The company manufactures and sells 7,500 heaters every year, each priced at $920. The current production equipment, which was acquired at a cost of $2,150,000, has been in use for just two years and is subject to straight-line depreciation over a five-year useful life. Furthermore, it possesses no terminal disposal value, but it can be currently sold for $650,000. The following table presents data for the two alternatives: ABC 1 Choice Upgrade Replace 2 One-time equipment costs $3,500,0003 Variable manufacturing cost per Heater $180 $90 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipment 0 0 Required 1. Prepare a schedule, for the remaining 3 years, reflecting whether CH should upgrade its production line or replace it?arrow_forward

- Several years ago Velvet Company purchased a small building adjacent to its manufacturing plant in order to have room for expansion when needed. Since the company had no immediate need for the extra space, the building was rented out to another company for rental revenue of $40,000 per year. The renter’s lease will expire next month, and rather than renewing the lease, Velvet Company has decided to use the building itself to manufacture a new product. Direct materials cost for the new product will total $40 per unit. It will be necessary to hire a supervisor to oversee production. Her salary will be $2,500 per month. Workers will be hired to manufacture the new product, with direct labor cost amounting to $18 per unit. Manufacturing operations will occupy all of the building space, so it will be necessary to rent space in a warehouse nearby in order to store finished units of product. The rental cost will be $1,000 per month. In addition, the company will need to rent equipment for use…arrow_forwardAble Plastics, an injection-molding firm, has negotiated a contract with a national chain of department stores. Plastic pencil boxes are to be produced for a 2-year period. If the firm invests $62,000 for special removal equipment to unload the completed pencil boxes from the molding machine, one machine operator can be eliminated saving $32,000 per year. The removal equipment has no salvage value and is not expected to be used after the 2-year production contract is completed. The equipment would be serviceable for about 15 years. What is the payback period? Should Able Plastics buy the removal equipment?arrow_forwardDue to increased demand for local deliveries in Western Sydney, Metro Deliveries Ltd leased a truck from a truck dealer, Parramatta Trucks Ltd. Parramatta Trucks Lid acquired the truck at the cost of $181,000. The truck will be painted with Metro Deliveries Ltd's logo and advertising, and the cost of repainting the truck to make suitable for another owner four years later is estimated to be $41,000. Metro Deliveries has not made any commitment to the lessor to purchase it, but they plan to keep the truck after the lease. The terms of the lease are as follows: . Date of entering lease: 1 July 2023. . Duration of lease: 4 years. . Life of leased asset: 5 years, after which it will have no residual value. • Lease payments: $101,000 at the end of each year. . The interest rate implicit in the lease: 10 per cent. . Unguaranteed residual: $51,000. . Fair Value of truck at the inception of the lease: $354,993. REQUIRED 1. Prepare the journal entries to account for the lease transaction in the…arrow_forward

- Tony Hawk (TH) Ltd. is currently faced with a critical decision regarding its production equipment. Tony Hawk (TH) is evaluating two options for its production equipment: upgrading or replacing. The company manufactures and sells 7,500 heaters every year, each priced at $920. The current production equipment, which was acquired at a cost of $2,150,000, has been in use for just two years and is subject to straight-line depreciation over a five-year useful life. Furthermore, it possesses no terminal disposal value, but it can be currently sold for $650,000. The following table presents data for the two alternatives: A B C Choice: Upgrade Replace One-time equipment costs: $3,500,000 $5,200,000 Variable manufacturing cost per Heater $180 $90 Remaining useful life of equipment (years) 3 3 Terminal disposal value of equipment 0 0 Required: 3. Assume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercise, but that…arrow_forwardHelp mearrow_forwardHybachi Company is trying to decide whether it should purchase new equipment and continue to make its subassemblies internally or if production should be discontinued and the subassembly purchased from an outside supplier. Either way production cannot continue using the current equipment. New equipment for producing the subassemblies can be purchased at a cost of $400,000. The equipment would have a five-year useful life (the company uses straight-line depreciation) and a $50,000 salvage value. Alternatively, the subassemblies could be purchased from an outside supplier. The supplier has offered to provide the subassemblies for $9 each under a five-year contract. Hybachi Company's present costs per unit of producing the subassemblies internally (with the old equipment) are given below. The costs are based on a current activity level of 40,000 subassemblies per year: Direct Materials $ 3.00…arrow_forward

- Citation Builders, Incorporated, builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10-20 homes and are typically sold during construction or soon after. To secure the home upon completion, buyers must pay a deposit of 10% of the price of the home with the remaining balance due upon completion of the house and transfer of title. Failure to pay the full amount results in forfeiture of the down payment. Occasionally, homes remain unsold for as long as three months after construction. In these situations, sales price reductions are used to promote the sale. During 2024, Citation began construction of an office building for Altamont Corporation. The total contract price is $10 million. Costs incurred, estimated costs to complete at year-end, billings, and cash collections for the life of the contract are as follows: Costs incurred during the year Estimated costs…arrow_forwardCitation Builders, Incorporated, builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10−20 homes and are typically sold during construction or soon after. To secure the home upon completion, buyers must pay a deposit of 10% of the price of the home with the remaining balance due upon completion of the house and transfer of title. Failure to pay the full amount results in forfeiture of the down payment. Occasionally, homes remain unsold for as long as three months after construction. In these situations, sales price reductions are used to promote the sale. During 2024, Citation began construction of an office building for Altamont Corporation. The total contract price is $23 million. Costs incurred, estimated costs to complete at year-end, billings, and cash collections for the life of the contract are as follows: 2024 2025 2026 Costs incurred during…arrow_forwardCitation Builders, Incorporated, builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10-20 homes and are typically sold during construction or soon after. To secure the home upon completion, buyers must pay a deposit of 10% of the price of the home with the remaining balance due upon completion of the house and transfer of title. Failure to pay the full amount results in forfeiture of the down payment. Occasionally, homes remain unsold for as long as three months after construction. In these situations, sales price reductions are used to promote the sale. During 2024, Citation began construction of an office building for Altamont Corporation. The total contract price is $18 million. Costs incurred, estimated costs to complete at year-end, billings, and cash collections for the life of the contract are as follows: Costs incurred during the year Estimated costs…arrow_forward

- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage